Hess Corporation Reports Strong Q1 2025 Earnings Despite Revenue Decline

Hess Corporation (HES) reported first-quarter 2025 adjusted earnings per share (EPS) of $1.81, exceeding the Zacks Consensus Estimate of $1.77. However, this marks a decline from the prior year’s EPS of $3.16.

Total quarterly revenues dropped to $2,938 million, down from $3,341 million a year ago. Nevertheless, this revenue figure surpassed the Zacks Consensus Estimate of $2,901 million.

The stronger-than-expected earnings were primarily driven by consistent crude oil production and increased natural gas liquids (NGL) output. However, these positives were somewhat countered by lower crude oil price realizations and rising overall costs and expenses.

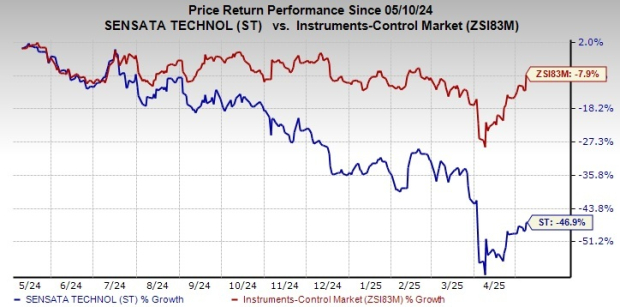

Hess Corporation Price, Consensus, and EPS Surprise

Hess Corporation price-consensus-eps-surprise-chart | Hess Corporation Quote

Exploration & Production Segment

The exploration and production segment posted adjusted earnings of $563 million, a significant decrease from $997 million year-over-year. This decline was largely due to lower realized crude oil prices.

Quarterly hydrocarbon production remained stable at 476 thousand barrels of oil equivalent per day (MBoe/d), surpassing estimates of 470.7 MBoe/d.

Crude oil production was recorded at 304 thousand barrels per day (MBbls/d), slightly down from 305 MBbls/d in the first quarter of 2024. This figure, however, exceeded our estimate of 299.1 MBbls/d.

Natural gas liquids production increased to 76 MBbls/d, compared to 71 MBbls/d last year, also beating our estimate of 72.7 MBbls/d.

Conversely, natural gas production dropped to 574 thousand cubic feet per day (Mcf/d), down from 599 Mcf/d a year ago, falling short of our estimate of 593.2 Mcf/d.

The average worldwide crude oil price realization per barrel decreased to $71.22, down from $80.06 a year earlier, while global natural gas prices rose to $4.89 per Mcf, up from $4.62. The average global NGL selling price increased to $24.08 per barrel, compared to $22.97 last year.

Mid-Stream Operations

In the mid-stream sector, adjusted net earnings reached $70 million, slightly up from $67 million a year ago.

Operating Expenses

Operating expenses in the first quarter totaled $470 million, a rise compared to $412 million a year earlier. This exceeded our forecast of $425.2 million.

Exploration expenses rose to $76 million from $42 million in the prior year, while marketing costs fell to $578 million from $622 million last year.

Overall costs and expenses increased to $2,157 million, up from $1,926 million in the previous year.

Financial Overview

Net cash provided by operating activities was $1,401 million, while Hess’ capital expenditure for exploration and production reached $1,085 million.

As of March 31, 2025, the company held $1,324 million in cash and cash equivalents, with long-term debt standing at $8,654 million.

Future Outlook

Looking ahead to the second quarter of 2025, Hess projects net production in its exploration and production segment to be between 480-490 thousand barrels of oil equivalent per day. The company also announced that the fourth oil development in the Starbroek Block, Yellowtail, is expected to commence in the third quarter of 2025, with a total exploration and production capital and exploratory expenditure forecast of $4.5 billion for the entire year.

Hess’ Zacks Rank

Hess currently holds a Zacks Rank of #3 (Hold).

# Strong Gains for Traders in 2024: Breaking Down Stock Performances

In 2024, traders have reported 256 positions that generated substantial gains, including both double- and triple-digit returns. This trend highlights the potential for significant investment opportunities, particularly in stocks under $10 and in innovative technology sectors.

The marked performance can signal an evolving market landscape. Amid ongoing changes in economic conditions and technological advancements, these stocks have demonstrated remarkable resilience and growth potential.

### Company Highlights

Below are several key companies that have garnered attention for their performance:

Hess Corporation (HES) : Free Stock Analysis Report

Kinder Morgan, Inc. (KMI) : Free Stock Analysis Report

Archrock, Inc. (AROC) : Free Stock Analysis Report

Nine Energy Service, Inc. (NINE) : Free Stock Analysis Report

This analysis follows recent earnings reports, including Hess’s Q1 results, which exceeded expectations despite flat hydrocarbon production over the year. This highlights the competitive environment and the necessity for ongoing innovation in the sector.

The insights provided reflect the author’s perspectives and do not necessarily represent the views of Nasdaq, Inc.