HgCapital Trust Receives a Boosted Price Target of 505.92

Investors in HgCapital Trust (LSE:HGT) have been greeted with a pleasant surprise as the one-year price target for the company has been upped to a staggering 505.92 per share. This significant hike of 16.43% from the earlier estimate of 434.52 (as of January 16, 2024) marks a profound shift in market sentiment towards the company.

The revised price target, compiled from various analyst forecasts, ranges from a low of 500.96 to a high of 520.80 per share. This notable increase of 17.11% from the latest closing price of 432.00 per share showcases a strong bullish sentiment surrounding HgCapital Trust.

HgCapital Trust’s Strong Dividend Yield of 1.50%

HgCapital Trust continues to demonstrate resilience in its dividend yield, standing at a healthy 1.50% at the latest price. Moreover, with a commendable 3-Year dividend growth rate of 0.35%, the company showcases its commitment to rewarding shareholders over time.

Fund Sentiment and Shareholder Activities

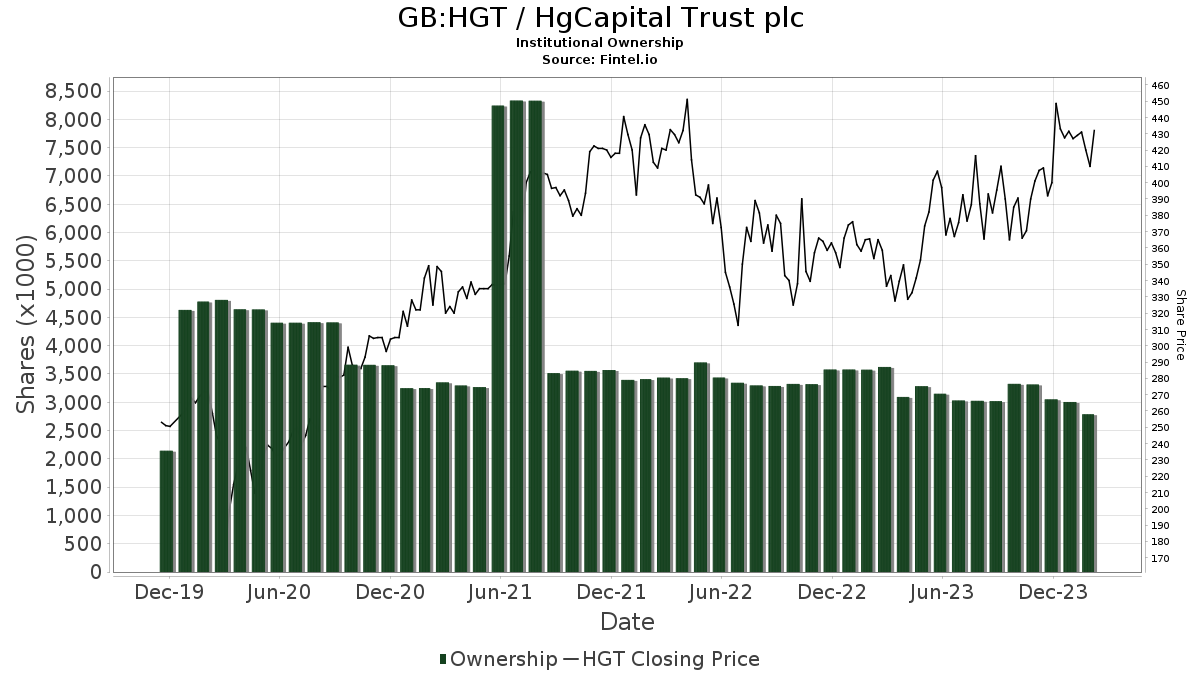

Currently, there are 6 funds or institutions reporting positions in HgCapital Trust, a figure that has remained constant over the last quarter. The average portfolio weight dedicated to HGT by all funds stands at 2.74%, reflecting a modest increase of 0.04%. However, total shares owned by institutions have seen a decrease of 15.90% in the last three months, amounting to 2,789K shares.

Partners Group Private Equity holds 1,143K shares, signifying a notable decrease of 22.07% from its previous ownership of 1,395K shares. On the other hand, PSP – Invesco Global Listed Private Equity ETF has 915K shares, displaying a decrease of 22.95% from its prior ownership of 1,124K shares. Interestingly, LPEFX – ALPS holds 447K shares, with AVPEX – ALPS owning 186K shares, and PEX – ProShares Global Listed Private Equity ETF holding 56K shares, each showcasing varying levels of activity and sentiment towards HgCapital Trust.

Empowering Investors with Fintel Insights

In the dynamic world of investing, Fintel stands out as one of the most comprehensive research platforms available to individual investors, traders, financial advisors, and small hedge funds. Offering data that covers the global landscape, Fintel provides a plethora of fundamental metrics, analyst reports, ownership data, fund sentiment insights, options sentiment, and more. Moreover, their exclusive stock picks powered by advanced quantitative models promise enhanced profits to users.

For those keen on delving deeper into the world of investing and unlocking the power of insightful data, Fintel presents a gateway to unparalleled research and analysis.

Discover more about the exciting realm of financial data and insights by exploring Fintel’s offerings today.

This story originally appeared on Fintel.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.