Investing in Cannabis: Opportunity Amid Market Uncertainty

Market concerns are growing regarding the impact of tariffs on growth stocks such as Nvidia and Apple. Investors worry about whether tariffs will affect their earnings. However, one sector may remain relatively unaffected: cannabis. Investing in this industry could be promising today, but it requires a degree of risk tolerance, patience, and a long-term outlook.

Why Cannabis May Be Resilient Against Tariffs

While cannabis remains illegal federally in the United States, many states have legalized its use for recreational and medicinal purposes. This unique legal landscape means that cannabis companies can operate legally within states but must navigate restrictions preventing interstate commerce. As a result, companies cultivate and sell their products locally.

Canadian cannabis firms face similar challenges. Tariffs on American products do not extend to cannabis, which is illegal for cross-border shipment. Recently, Tilray Brands, a Canadian company, reported earnings stating that tariffs are unlikely to impact its sales.

The industry could feel some indirect effects if economic conditions deteriorate, leading to reduced consumer spending. A broader economic downturn could affect all consumer-driven sectors, including cannabis.

Risks Associated with Cannabis Investments

Despite the limited direct impact of tariffs, cannabis companies face significant challenges. The current federal prohibition complicates their ability to leverage economies of scale and access essential banking services needed for growth and expansion.

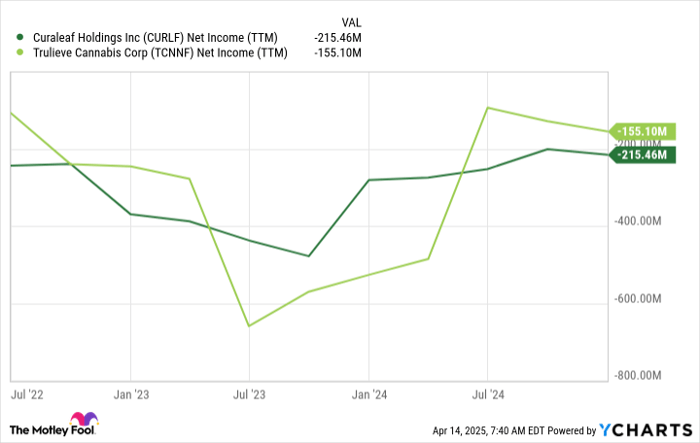

Curaleaf Holdings (OTC: CURLF) and Trulieve Cannabis (OTC: TCNNF) are prominent players in the U.S. market, yet both struggle with profitability. They often focus on adjusted earnings to present a more favorable financial picture, yet achieving consistent net income remains a future challenge.

CURLF Net Income (TTM) data by YCharts

On a positive note, these companies generate positive cash flow from their operations, indicating short-term sustainability. They are not in immediate danger of bankruptcy despite industry challenges.

Nevertheless, investor sentiment has soured on cannabis stocks as growth has stagnated, with national legalization still not in sight. Optimism often leads to stock rallies, but during the past five years, the AdvisorShares Pure US Cannabis ETF has plummeted over 90%, reflecting widespread market pessimism.

Will Cannabis Investments Lead to Significant Gains?

Investing in cannabis stocks is risky. Current circumstances suggest pot stocks won’t gain traction until legalization prospects improve significantly. Progress seems unlikely under the present administration, potentially prolonging uncertainty for years. Thus, if you’re not prepared to hold for five years or longer, cannabis investments may not suit you.

However, given the considerable reduction in valuations, investing in companies like Curaleaf or Trulieve may be an option to consider. These stocks are affordable, and if you can maintain a long-term position, the potential upside could be significant. Should marijuana legalization occur, these stocks could experience substantial gains. It’s a high-risk proposition but allocating a small portion of your portfolio might be worthwhile for the patient investor.

Should You Invest $1,000 in Curaleaf?

Before investing in Stock in Curaleaf, take this into account:

The Motley Fool Stock Advisor team has discovered what they see as the 10 best stocks available now, and Curaleaf does not currently rank among them. The selected stocks have the potential for substantial rewards in the coming years.

For context, when Netflix was recommended on December 17, 2004, a $1,000 investment would now be worth $502,231!*

Similarly, if you had invested in Nvidia on April 15, 2005, you would see a return of $678,552!*

Additionally, it’s significant to note that Stock Advisor has achieved an average return of 800 % over the years, which exceeds 156 for the S&P 500. Don’t miss their latest top 10 list, available when you join Stock Advisor.

view the 10 stocks »

*Stock Advisor returns as of April 14, 2025

David Jagielski has no positions in any of the stocks discussed. The Motley Fool has recommended Apple, Nvidia, and Tilray Brands. The Motley Fool maintains a disclosure policy.

The opinions and perspectives presented herein are those of the author and do not necessarily represent those of Nasdaq, Inc.