Investing Opportunities in Undervalued AI Stocks: Alphabet, AMD, Qualcomm

In recent years, stocks in the artificial intelligence (AI) sector have soared to impressive valuations. Nvidia has thrived due to strong demand for AI accelerators, while Palantir‘s valuation has also surged, driven by significant productivity improvements offered by its software.

However, not all AI stocks have experienced this growth, leaving several undervalued options for investors. This presents potential investment opportunities in companies that may have been overlooked, which could potentially yield substantial returns for investors focused on AI. Specifically, investors may want to assess Alphabet (NASDAQ: GOOGL) (NASDAQ: GOOG), Advanced Micro Devices (NASDAQ: AMD), and Qualcomm (NASDAQ: QCOM).

Alphabet’s Strong Position in AI

Surprisingly, Alphabet currently trades at a P/E ratio of 19. This company, a pioneer in AI dating back to 2001, is notably cash-rich, generating $75 billion in free cash flow over the last year and holding $95 billion in liquidity.

Despite this strong financial position, concerns linger. Alphabet’s lucrative search business, which has traditionally fueled much of its revenue, faces growing competition. For the first time in years, ChatGPT has pushed Alphabet’s market share below 90%, as reported by Oberlo.

Aiming to reduce its reliance on search, Alphabet’s advertising revenue accounted for 74% of total revenue in Q1 2025, down from 77% the previous year. Conversely, Google Cloud’s revenue share increased to 14%, up from 12% during the same period.

Moreover, Alphabet owns several businesses that may become significant revenue contributors, including Waymo, its autonomous vehicle subsidiary. Recently, investors valued Waymo at $45 billion during a funding round. Given Alphabet’s financial strength and business diversification, a 19 P/E ratio remains a relatively low price.

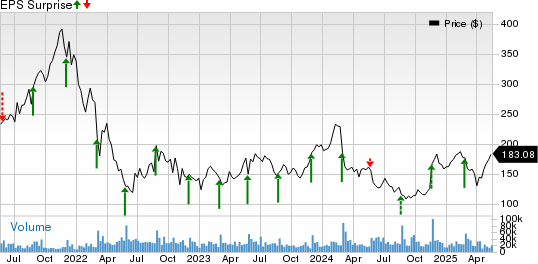

AMD’s Potential Recovery

Another potentially overlooked stock is Advanced Micro Devices (AMD). It has positioned itself as a leading CPU manufacturer, surpassing longtime competitor Intel. Although it currently trails Nvidia in the AI accelerator sector, AMD is emerging as a competitive player in this market.

Recent months have seen a sell-off in AMD shares, primarily due to declines in its gaming and embedded segments. Presently, AMD trades at about a 50% discount from its all-time high seen in early 2024.

Nevertheless, long-term investors in AMD may soon observe promising indicators. In Q1 2025, the company reported $7.4 billion in revenue—an increase of 36% year-over-year, which far exceeds the previous year’s growth of just 2%.

Both the data center and client segments showed robust performance, with revenue growth of 57% and 68%, respectively. Furthermore, the embedded segment has begun to stabilize, with an annual decline reduced to 3%. The previous 30% decrease in gaming revenue shows signs of improvement, suggesting a potential end to the downturn in these sectors.

Even though its trailing P/E ratio stands at 86, a forward P/E of 29 may indicate an undervalued position, especially given the company’s upswing in revenue growth. This upward trajectory suggests that AMD’s recent stock price rise has room to continue.

Qualcomm’s Growth Amid Challenges

Qualcomm also faces negative sentiment in the market, affected by its strong exposure to China and Apple’s decision to in-source chipset development. However, its current stock price may already reflect these challenges.

With a P/E ratio of only 16 and a forward P/E of 13, Qualcomm’s stock appears to anticipate ongoing profit growth.

Recent advancements, such as DeepSeek’s technology, promise to lower the cost of AI, making it more accessible. This could positively influence Qualcomm’s chipset business, which saw a notable 17% annual increase to $11 billion in revenue for the second quarter of fiscal 2025.

Additionally, Qualcomm’s Internet of Things and automotive sectors are also showing promise, with yearly revenue growth of 27% and 59%, respectively. This diversification suggests that Qualcomm is preparing for a time when smartphones may play a less critical role in consumer technology.

In summary, while Qualcomm faces challenges, its low P/E ratio combined with strong growth in other areas makes it an appealing investment opportunity.

Conclusion: Evaluating Investment Options

Before investing in Alphabet, consider other factors currently affecting its valuation. Fortune favors those who approach investments with diligence, particularly in an evolving sector like AI.

While Alphabet may not currently be listed among the “10 best stocks” recommended by analyst teams, it remains a considerable force in the AI landscape alongside other potential investments such as AMD and Qualcomm.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.