Roku Shows Promising Growth After Strong Q4 Earnings

Earnings season always brings winners and losers, and streaming company Roku (NASDAQ: ROKU) is currently in the winner’s circle. The stock surged approximately 14% in one day following an impressive fourth-quarter performance. Although Roku has since experienced some pullback, it remains up by around 15% since the beginning of 2025.

Investors may question whether the stock is still a good buy after such a rally. Fortunately, the streaming giant is positioned for substantial growth potential for those willing to hold onto their investments. Here is why Roku’s prospects appear optimistic.

Where to invest $1,000 right now? Our analyst team has identified the 10 best stocks to buy currently. Learn More »

Roku’s Recovery Path

Despite its recent gains, Roku has lagged behind the market over the last three years due to several significant challenges, including slowing revenue growth and consistent net losses. Part of this downturn was influenced by broader economic factors, notably reduced advertising budgets among companies—advertising constitutes Roku’s primary revenue source—due to a challenging marketplace.

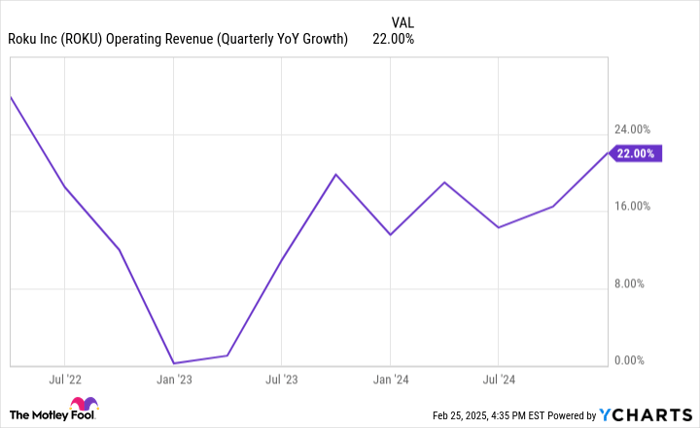

In response to inflationary pressures, Roku opted to absorb many of the costs related to its streaming devices, rather than passing them on to consumers. However, as the advertising market began to rebound, Roku’s performance remained relatively stagnant until the fourth quarter. In this period, Roku experienced a 22% year-over-year revenue increase, reaching $1.2 billion—the best growth this company has showcased in quite some time.

Source: YCharts.

Roku also made improvements in its average revenue per user (ARPU), which increased by 4% year-over-year, reaching $41.49. This marks a change after several quarters of stagnant growth in this metric. Additionally, the company’s ecosystem expanded significantly, ending the year with 89.8 million households, reflecting a 12% year-over-year rise. During Q4, Roku recorded 34.1 billion streaming hours, an 18% increase compared to the same period last year.

While Roku is still unprofitable, it is demonstrating progress in this area as well. The Q4 net loss of $0.24 per share was an improvement over the $0.55 net loss per share reported in the same quarter the previous year.

Long-Term Growth Potential

As a leading connected TV (CTV) provider in key markets such as the U.S., Canada, and Mexico, Roku still has considerable growth opportunities, particularly in international markets. One reason its ARPU has faced challenges recently is its focus on expanding its global presence, prioritizing streaming households while deferring monetization efforts.

During the Q4 earnings conference call, CEO Anthony Wood stated, “Internationally, in most markets, except for maybe Canada, we’re primarily focused on scaling streaming households rather than monetization. However, that will follow.” This strategic focus has vital implications for Roku’s future.

Firstly, there remains substantial room for growth as Roku continues to expand its streaming households; the company aims to reach 100 million households within the next 18 months. Secondly, an increasing share of these households will be located in markets where monetization processes are just beginning. When Roku begins to monetize in these regions, both sales growth and profit margins could significantly improve.

The platform segment, which encompasses revenue from advertising and other services, generates higher profits compared to the devices segment, which relies heavily on device sales. Once the company pivots from expansion to monetization, revenues from its platform are likely to spike. Roku is following a template it successfully implemented in the U.S. There is still substantial opportunity available as the company continues to innovate its services, such as the Content Row—an AI-driven recommendation service on its home screen that is currently performing well.

In January, streaming represented nearly 43% of TV viewing time in the U.S., a figure that is comparatively smaller in many international markets. With its established leadership and network effects in the streaming sector, Roku stands to be a substantial beneficiary as streaming continues to eclipse cable and traditional entertainment forms. Thus, even in light of its post-earnings surge, Roku remains a viable option for potential investors interested in the stock.

Should You Invest $1,000 in Roku Now?

Before making any investment in Roku, consider the following:

The Motley Fool Stock Advisor analyst team recently highlighted what they believe are the 10 best stocks to purchase at this time, which notably did not include Roku. The stocks selected have strong potential for significant returns in the years to come.

For instance, when Nvidia was included on this list on April 15, 2005, an investment of $1,000 would have grown to $765,576!*

Stock Advisor offers investors a clear, actionable strategy for success, including guidance on building a diverse portfolio, regular updates from their analysts, and two new stock recommendations each month. Since its inception, the Stock Advisor service has quadrupled the returns of the S&P 500 since 2002*. Don’t miss out on the latest top 10 list available to new members of Stock Advisor.

See the 10 stocks »

*As of February 28, 2025, Stock Advisor returns reflect this data.

Prosper Junior Bakiny has no position in any of the stocks mentioned. The Motley Fool recommends and has positions in Roku. The Motley Fool maintains a disclosure policy.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.