Microchip Technology Inc. Sees Uneven Path as Earnings Approaches

Microchip Technology Inc. MCHP is an important player in the semiconductor industry, especially in supporting AI technologies despite not being fully tied to it.

Headquartered in Chandler, Arizona, the company focuses on microcontrollers, analog chips, and field-programmable gate arrays (FPGAs), which are vital for embedded AI applications across industries like automation, automotive, and the Internet of Things (IoT).

However, investors have remained cautious. Over the last year, Microchip’s stock has dropped more than 38%, reflecting various challenges the company faces. For instance, management revealed restructuring plans last year that included shutting down its wafer fabrication facility in Tempe, Arizona, and lowered revenue expectations for the December 2024 quarter.

In contrast, Palantir Technologies Inc. PLTR has shown how tough market conditions don’t always mean disaster. After China’s DeepSeek R1 rattled markets, many AI stocks faltered. Yet, Palantir’s impressive fourth-quarter results signaled that the AI narrative still has momentum.

This context suggests that as interest in AI applications continues to rise, Microchip could find itself ideally positioned once again. The company is set to release its earnings report on February 6 after the market closes, which adds to the cautious anticipation surrounding its stock.

Statistical Trends Ignite Speculative Interest

Visually, Microchip’s stock performance over the past six months has not shown promise, with a more than 28% drop indicating a worrying trend. Yet, some statistical trends might hint at a speculative opportunity.

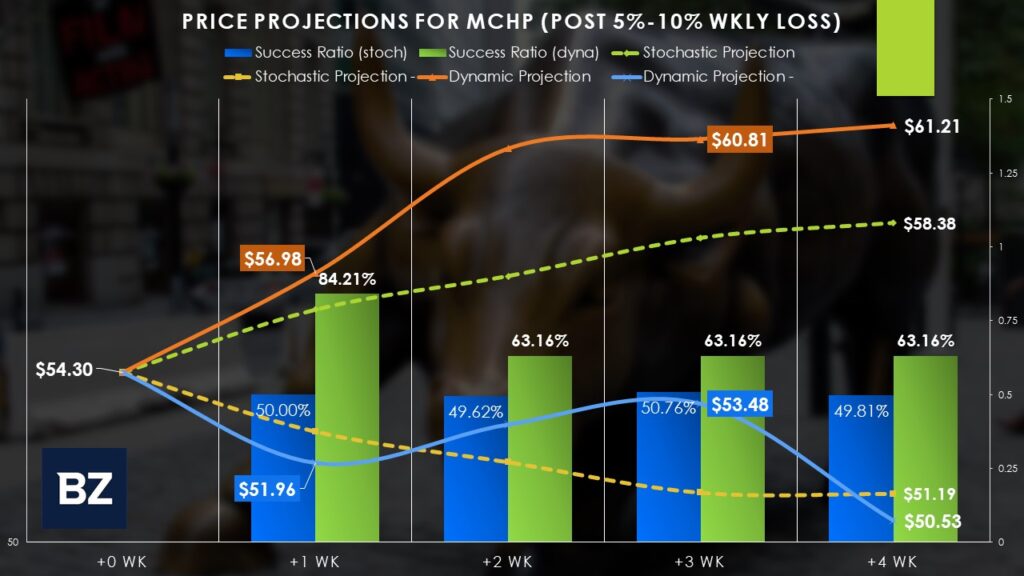

It’s crucial to recognize that investing in Microchip carries high risk, given its current trajectory. Analyzing past pricing trends over the last five years reveals a neutral to slightly negative bias. For instance, entering a position at the beginning of the week yields a 50% chance of a price increase by week’s end. This drops slightly to 49.81% over a four-week timeframe, where median gains can reach 7.52% against median losses of 5.73%.

Market sentiment greatly influences stock behavior, and sudden price dips can trigger notable reactions. For instance, the recent 6.06% decline in Microchip’s stock was significantly worse than the median loss observed during less volatile weeks. Historical data shows an 84% probability that a decline of 5% to 10% in one week will be followed by a positive week.

While these conclusions should be taken with caution, it appears that investor behavior often leads to a buying trend following sharp drops, with a more than 63% likelihood of gains in the subsequent weeks.

Navigating an Uncertain Road Ahead of Earnings

Leading up to Microchip’s earnings announcement, the implied volatility surrounding the stock is notably high, signaling that significant movement may be anticipated. Normally, a long iron condor strategy could be wise, but current market expectations render such options less attractive.

This scenario is akin to a quarterback revealing their play before the snap: the market knows something big may happen.

For those feeling bullish, aggressive speculators might explore options like bull call spreads set to expire this Friday. A particularly intriguing option is the 52/54 bull spread, which consists of purchasing the $52 call and selling the $54 call. This strategy requires an initial investment of $105, potentially yielding a maximum payoff of $95, translating to a strong return of 90.48%. Additionally, the breakeven point only requires the stock price to rise to $53.05.

For a longer-term view, traders could consider the 52.50/56.50 bull spread with options expiring on February 21, taking into account the expected rise in volatility based on the current trends following significant sell-offs.

Now Read:

Image: Shutterstock

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.