For valid reasons, high volume trading over the past 20 days indicates that it’s time to consider investing in a few top-rated Zacks stocks.

High trading volume is desirable for investors as it usually accompanies reduced volatility and may offer a sign of more buyers in the market. This can propel stocks higher, and here are three options to contemplate at the moment given this scenario.

Amazon

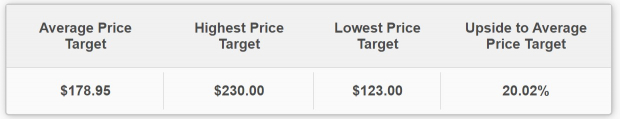

Bullish price targets have caused a surge in Amazon shares over the past week with an average trading volume of over 42 million shares exchanged in the last 20 days. Notably, Amazon’s stock currently has a Zacks Rank #1 (Strong Buy) and an Average Zacks Price Target of $178.95 a share, indicating 20% potential upside from current levels.

BMO Capital’s recent price target of $200 a share boosted Amazon’s stock by over 1% in today’s trading session, with the analyst pointing to strong growth prospects, diversified revenue streams, and competitive advantages for the outperform rating. Amazon’s stock has ascended by +17% in the last three months and is now up by +68% over the last year.

Image Source: Zacks Investment Research

AGNC Investment

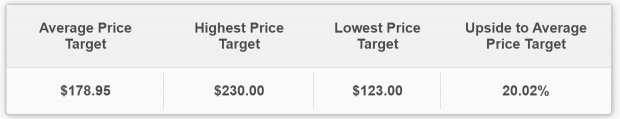

Also holding a Zacks Rank #1 (Strong Buy) is AGNC Investment, with an average volume of over 13 million shares being traded daily. Despite trading below $10 a share, AGNC’s stock has surged by 9% over the last three months, attracting investor attention with a current dividend yield of 14.46%.

Furthermore, AGNC is well-leveraged with a low long-term debt/equity ratio of 1.3% and a high trailing twelve-month return on equity (ROE) of 28.72%.

Image Source: Zacks Investment Research

Citigroup

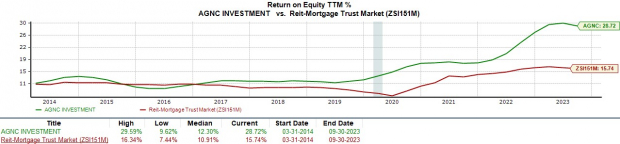

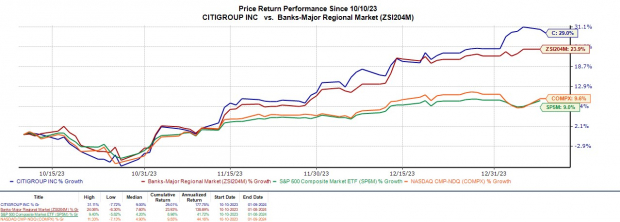

Citigroup holds a Zacks Rank #2 (Buy) and is a major bank generating significant interest ahead of its fourth-quarter earnings report on Friday, January 12. With an average trading volume of over 18 million, Citigroup’s stock recently reached 52-week highs of $54.75 a share last Thursday.

Having surged by +29% in the last three months, Citigroup’s stock still maintains a reasonable forward earnings multiple of 9.1X and offers a 3.93% annual dividend yield, which may continue to attract investors, especially if Q4 results and guidance are favorable.

Image Source: Zacks Investment Research

Final Thoughts

Higher trading volume certainly indicates that the market may hold more upside potential for Amazon, AGNC Investment, and Citigroup’s stock. There might still be time to join in on the rising trend, and the likelihood of more buyers in the market makes these stocks ideal “buy-the-dip” candidates on a pullback.

5 Stocks Set to Double

Each was handpicked by a Zacks expert as the #1 favorite stock to gain +100% or more in 2023. Previous recommendations have skyrocketed by +143.0%, +175.9%, +498.3%, and +673.0%.

Most of the stocks in this report are flying under Wall Street radar, presenting a great opportunity to get in at the ground level.

Today, See These 5 Potential Home Runs >>

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.