“`html

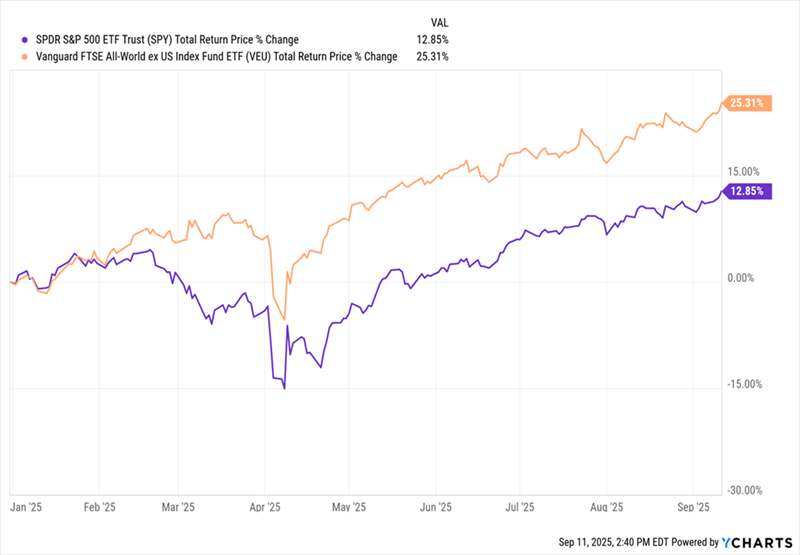

Global stocks are outperforming American stocks in 2025, despite US stocks reaching all-time highs, with American stock investors comprising 55% of the population. According to data, the SPDR S&P 500 ETF (SPY) has been relatively stagnant compared to the Vanguard FTSE All-World Ex-US Index Fund (VEU), indicating a shift in investor interest towards international markets.

American investors are increasingly drawn to international stocks, attracted by higher dividend yields; for instance, major Canadian stocks yield 2.6%, compared to the S&P 500’s 1.2%. However, the VEU fund has demonstrated long-term underperformance, prompting the recommendation of high-yield closed-end funds (CEFs) that can provide 8%+ dividends while avoiding underperforming assets.

The recommended funds include the Calamos Global Dynamic Income Fund (CHW) with an 8.1% yield, the LMP Capital & Income Fund (SCD) at 9.3%, and the Virtus NFJ Dividend Value Fund (NFJ), also yielding 9.3%. These funds are actively managed and have the ability to adapt to market volatility while offering attractive long-term income prospects.

“`