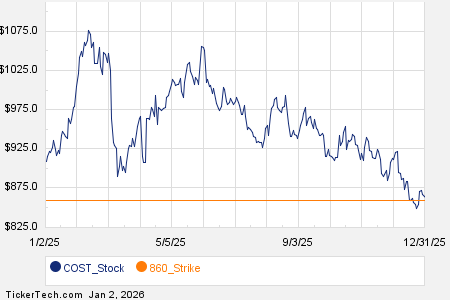

Among the Russell 3000 index components, notable options trading volume was observed today. Costco Wholesale Corp (COST) reported a total of 40,826 contracts traded, equating to approximately 4.1 million underlying shares, which is 137.4% of its average daily trading volume of 3.0 million shares over the past month. The $860 strike call option expiring on January 2, 2026 saw particularly high activity, with 3,199 contracts traded.

Robinhood Markets Inc (HOOD) experienced an even higher volume with 285,438 contracts, representing about 28.5 million underlying shares, or 128.3% of its recent average daily volume of 22.2 million shares. Noteworthy was the $110 strike put option expiring on February 20, 2026, with 15,001 contracts traded.

Meanwhile, Howard Hughes Holdings Inc (HHH) recorded 4,892 contracts, amounting to approximately 489,200 underlying shares, or 122.1% of its average daily trading volume of 400,760 shares. The $70 strike put option expiring on January 16, 2026 had a substantial volume of 2,642 contracts traded.