Trading Activity Peaks for Akamai, Standard and Poors Global, and Duolingo

Options Volume Highlights Significant Market Moves

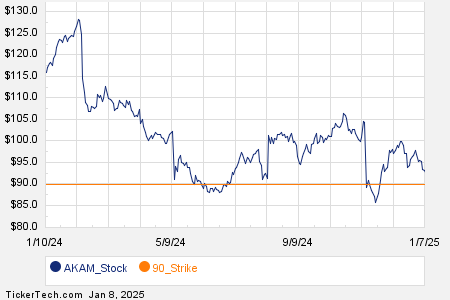

Among the components of the Russell 3000 index, Akamai Technologies Inc (Symbol: AKAM) grabbed attention today with a substantial options trading volume. So far, 6,307 contracts have been traded, equivalent to approximately 630,700 underlying shares. This figure represents about 44.8% of AKAM’s average daily trading volume, which stands at 1.4 million shares over the past month. A particularly notable segment is the $90 strike put option expiring on May 16, 2025, which saw 1,600 contracts traded so far today, amounting to roughly 160,000 underlying shares. The chart below illustrates AKAM’s trading history over the past twelve months, with the $90 strike highlighted in orange:

Standard and Poors Global Shows Robust Trading Activity

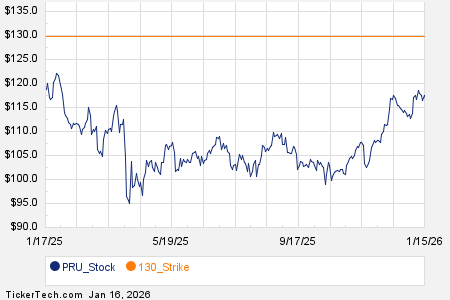

Standard and Poors Global Inc (Symbol: SPGI) also experienced significant options trading, with a total of 5,374 contracts, representing about 537,400 underlying shares. This volume corresponds to approximately 44.5% of SPGI’s average daily trading volume of 1.2 million shares over the past month. The $500 strike call option expiring on January 17, 2025, accounted for a significant portion of today’s activity, with 878 contracts traded, equating to around 87,800 underlying shares. The accompanying chart outlines SPGI’s trading history for the past year, with the $500 strike highlighted in orange:

Duolingo Sees Increased Options Trading Volume

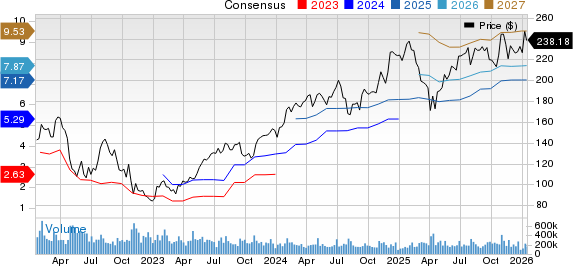

Duolingo Inc (Symbol: DUOL) reported an options trading volume of 2,366 contracts today, amounting to about 236,600 underlying shares. This represents a notable 44.5% of DUOL’s average daily trading volume, which is approximately 531,955 shares. The $330 strike put option set to expire on January 17, 2025, saw the heaviest trading, with 462 contracts changing hands, representing roughly 46,200 underlying shares. Below is the chart detailing DUOL’s trading history over the past twelve months, showcasing the $330 strike in orange:

Explore More Options Trading Opportunities

For those interested in viewing various available expirations for AKAM, SPGI, or DUOL options, please visit StockOptionsChannel.com.

![]() Today’s Most Active Call & Put Options of the S&P 500 »

Today’s Most Active Call & Put Options of the S&P 500 »

Also see:

• Top 10 Hedge Funds Holding Air Products and Chemicals

• Institutional Holders of RMGN

• ZN shares outstanding history

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.