High Options Trading Activity in Starbucks, Chevron, and Trump Media

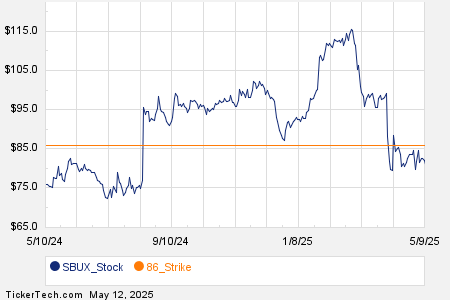

Among the components of the Russell 3000 index, significant options trading volume has emerged today. Notably, **Starbucks Corp. (Symbol: SBUX)** is leading with **60,631 contracts** traded, which corresponds to around **6.1 million underlying shares**. This figure represents approximately **51.1%** of SBUX’s average daily trading volume of **11.9 million shares** over the past month. The $86 strike call option set to expire on **May 16, 2025**, experienced particularly high interest, with **2,932 contracts trading today**, representing roughly **293,200 underlying shares**. Below is a chart that outlines SBUX’s trailing twelve-month trading history, highlighting the $86 strike in orange:

Next, **Chevron Corporation (Symbol: CVX)** has seen an options trading volume of **47,424 contracts**, equivalent to about **4.7 million underlying shares**. This accounts for roughly **50.2%** of CVX’s average daily trading volume of **9.4 million shares** over the same period. The $145 strike call option expiring on **May 16, 2025**, garnered considerable attention today, with **6,071 contracts trading**, representing about **607,100 underlying shares**. Below is a trading history chart for CVX, with the $145 strike highlighted in orange:

Additionally, **Trump Media & Technology Group Corp (Symbol: DJT)** recorded a trading volume of **25,532 contracts**, representing approximately **2.6 million underlying shares**. This number reflects about **49.2%** of DJT’s average daily trading volume of **5.2 million shares** over the past month. The $36 strike call option, expiring on **May 23, 2025**, saw **1,761 contracts** exchanged today, corresponding to approximately **176,100 underlying shares**. Below is a chart depicting DJT’s trailing twelve-month trading history, with the $36 strike highlighted in orange:

For further details on various available expirations for SBUX, CVX, or DJT options, please visit StockOptionsChannel.com.

![]() Today’s Most Active Call & Put Options of the S&P 500 »

Today’s Most Active Call & Put Options of the S&P 500 »

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.