Market Volatility: Understanding Recent Trends in the S&P 500

For over a century, the stock market has consistently enriched patient investors. However, the price of admission to financial opportunities on Wall Street involves facing volatility.

After more than two years of persistent optimism, major indices like the Dow Jones Industrial Average (DJINDICES: ^DJI), the widely monitored S&P 500 (SNPINDEX: ^GSPC), and the growth-oriented Nasdaq Composite (NASDAQINDEX: ^IXIC) have recently taken a downturn. As of the market close on April 17, the S&P 500 reached a 12.3%, 14%, and 18.8% decline respectively from their all-time highs on February 19.

Currently, both the Dow and the S&P 500 are categorized as in correction territory, while the Nasdaq Composite’s dip as of April 8 has marked its first bear market since 2022.

Image source: Getty Images.

The S&P 500’s performance this year has been particularly disappointing. As of April 18, the index experienced its fifth-worst start through 73 trading days since 1928, with a drop of 10.2%.

Amid the fear and uncertainty that often accompanies such volatile periods, historical patterns suggest that previous double-digit downturns in the S&P 500 at the start of the year have often predicted the following directional trend for stocks with complete accuracy.

Current Economic Factors Driving Volatility

Before examining the historical correlation between early-year declines and future recoveries, it’s essential to identify the key factors currently pressuring equities. These headwinds are likely to persist in the near term.

One of the most significant challenges is posed by former President Donald Trump’s recent tariff announcements. On April 2, termed “Liberation Day,” Trump introduced a global tariff of 10%, coupled with increased “reciprocal tariffs” on select countries that maintain trade deficits with the U.S.

Trump maintains that these tariffs will generate U.S. revenue, promote domestic production, and enable American goods to compete more effectively against imports.

Nevertheless, uncertainties surrounding this tariff policy include potential deterioration in international trade relations, a possible increase in inflation rates, and the prospect of decelerated economic growth.

A study conducted by four economists from the New York Fed at Liberty Street Economics found that businesses negatively impacted by Trump’s China tariffs from 2018 to 2019 experienced declines in profits, sales, employment, and labor productivity from 2019 to 2021.

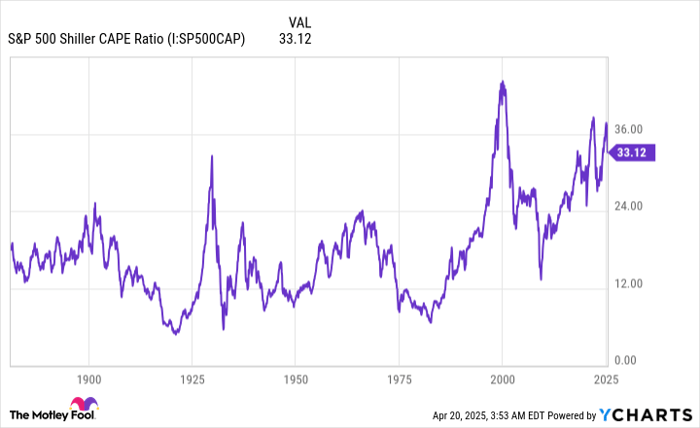

In addition to tariff concerns, the stock market began 2025 at one of its highest valuations on record.

S&P 500 Shiller CAPE Ratio data by YCharts.

The Shiller price-to-earnings (P/E) ratio, also known as the cyclically adjusted P/E Ratio (CAPE Ratio), indicates that stocks are historically overpriced. In December 2024, this ratio neared 39, marking one of its highest levels during a bull market in 154 years. Historically, similar scenarios preceded the collapse during the dot-com era in 1999 and the bear market beginning in January 2022.

When stocks hold such elevated valuations, adjustments are required. Typically, either corporate valuations must decline, or corporate earnings must rise to render valuations more appealing. Historically, Shiller P/E ratios exceeding 30 have led to declines of 20% or more in the major indices.

Other catalysts contributing to the prevailing fear and volatility include forecasts from the Atlanta Federal Reserve predicting a contraction in U.S. GDP for the first quarter, and rising Treasury bond yields, signaling potentially higher borrowing costs.

Image source: Getty Images.

Historical Recovery Patterns Post Poor Market Starts

While history doesn’t guarantee future results, examining how the S&P 500 typically reacts after a rough start may offer some insight. Despite the current 10.2% drop, looking back at the index’s previous 20 worst starts reveals a notable recovery pattern.

As noted by Charlie Bilello, Chief Market Strategist at Creative Planning, those 20 worst beginnings resulted in declines ranging from 4.7% to 24.6%. Excluding the current downturn, there was an increase in S&P 500 value 58% of the time from day 74 through to year-end following these poor performances.

Of particular interest, only five of the past 98 years recorded a loss of 10% or more through the first 73 trading days (1932, 1939, 2020, 1942, and 2025). In these instances, the S&P 500 finished the year higher 100% of the time. While the index has historically averaged a 10% return per year, these four poor-start years yielded an average return of 22.8% for the remainder of the year.

Market Insights: Investing During a Rough Start to 2025

As trading day 74 approaches the end of the year, history shows that challenging beginnings often provide unique buying opportunities for investors. Currently, the S&P 500 has seen a decline of 10% during the first 73 trading days of 2025, marking the fifth-worst start to a year in the history of the index.

The S&P 500 is down 10% in the first 73 trading days of 2025, the 5th worst start to a year in history. $SPX

Video: https://t.co/bOI6drdCEz pic.twitter.com/rpWFyQ206y

— Charlie Bilello (@charliebilello) April 19, 2025

While this data examines a brief timeframe, it aligns with broader analyses revealing that downturns in the S&P 500 often lead to eventual recoveries. Research from Bespoke Investment Group analyzed the duration of bear and bull markets from September 1929 to June 2023. They reported a significant disparity between bear and bull market lifespans: bear markets, characterized by a decline of 20% or more, averaged 286 calendar days (around 9.5 months), whereas bull markets persisted for an average of 1,011 days, approximately two years and nine months. This data supports the notion that optimism has historically yielded better investment outcomes.

Additionally, analysts at Crestmont Research provided further insight. They calculated the rolling 20-year total returns—accounting for dividends—of the S&P 500, covering periods from the early 20th century through today. Their findings indicated that all 106 analyzed 20-year stretches posted positive annualized total returns. This pattern suggests that whether investors entered the market at peaks or troughs, during periods of war, recession, or pandemic, they would hypothetically profit if they maintained their investments for two decades. Patience appears to be a key factor in wealth creation based on historical data.

Evaluating a $1,000 Investment in the S&P 500 Index

Before deciding to invest in the S&P 500 Index, consider the following insights:

The Motley Fool’s analyst team recently highlighted what they believe are the 10 best stocks for investors at this moment—remarkably, the S&P 500 Index was not included on this list. Analysts suggest that the selected stocks may yield substantial returns in the coming years.

Consider this example: when Netflix was recommended on December 17, 2004, an investment of $1,000 would have grown to $561,046. Similarly, an investment of $1,000 in Nvidia after its recommendation on April 15, 2005, would have risen to $606,106.

It is essential to note that the overall average return for Stock Advisor stands at an impressive 811%, significantly outpacing the 153% return of the S&P 500 during the same period. For those considering the latest recommendations, joining Stock Advisor may provide valuable insights.

*Return data for Stock Advisor as of April 21, 2025

Sean Williams has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool adheres to a strict disclosure policy.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.