Escalating EU Tariffs Challenge Harley-Davidson’s Market Position

The ongoing trade war between the United States and the European Union (EU) is intensifying. The EU has recently declared €26 billion in retaliatory tariffs on American products, shortly after the U.S. enforced 25% tariffs on steel and aluminum imports from the EU. This time, the U.S. has not provided exemptions for items that are unavailable domestically, marking a significant change from past practices.

Impact of Tariffs on American Exports

The EU’s countermeasures will roll out in two phases, starting on April 1 and April 13. They will primarily target key American exports such as bourbon whiskey, jeans, and motorcycles, projecting total tariffs of around €18 billion. Harley-Davidson (HOG) is facing a substantial blow, with a staggering 56% tariff now imposed on its motorcycles shipped to the EU. This development contrasts sharply with the trade environment of 2018, which forced the company to relocate part of its production overseas to mitigate rising costs.

Recent Stock Performance

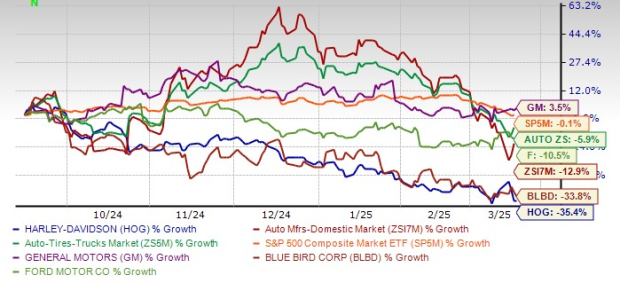

Over the last six months, HOG shares have dropped by 35.4%, significantly underperforming the Zacks Auto, Tires and Trucks sector, which saw a decline of 5.9%, and the Zacks Automotive – Domestic industry decline of 12.9%. Meanwhile, the S&P 500 index reported a slight loss of 0.1% during the same period. Harley-Davidson has been grappling with sluggish wholesale and retail demand, coupled with reduced revenues from its HDMC segment, stemming from lower shipment volumes. Concerns surrounding its highly leveraged balance sheet have also shaken investor confidence.

In comparison, HOG’s stock performance has not fared well against industry rivals like General Motors (GM), Ford Motor (F), and Blue Bird (BLBD). While GM’s stock has risen 3.5%, Ford’s and Blue Bird’s shares have decreased by 10.5% and 33.8%, respectively, in the same timeframe.

Image Source: Zacks Investment Research

Challenges Ahead

The elevated tariffs pose a serious threat to Harley-Davidson’s European sales. Increased production costs from tariffs on raw materials are likely to squeeze the company’s profit margins further. In 2018, Harley-Davidson estimated that a 31% tariff would result in annual costs between $90 million and $100 million. Given the current tariffs exceed this rate, the company’s cost management will be crucial, especially as relocating production abroad becomes less feasible due to broader trade restrictions encompassing various components and materials.

Strategic Responses

To navigate these challenges, Harley-Davidson might consider alternative strategies, such as fostering local production partnerships within Europe. Additionally, the company aims to diversify its revenue by venturing into the electric motorcycle market through its LiveWire brand. Although this segment accounted for only 0.5% of the company’s revenues in 2024, it achieved impressive year-over-year growth of 46%, maintaining a dominant market share of 65% in the U.S. 50+ horsepower on-road EV segment.

Currently, Harley-Davidson’s LiveWire lineup features two models: the LiveWire One and the Del Mar. The expansion of its electric offerings could help compensate for the anticipated revenue declines in the European market.

Financial Outlook

The Zacks Consensus Estimate for Harley-Davidson’s first quarter of 2025 revenues stands at $1.13 billion, indicating a year-over-year decline of 23.54%. The consensus for first-quarter earnings per share (EPS) is currently set at 90 cents, reflecting a drop of 9.1% over the past month and a concerning decline of 47.67% compared to the same quarter last year.

For the full year 2025, analysts predict HOG’s revenues at $4.07 billion, suggesting a year-over-year decrease of about 2%. The expected EPS for 2025 is pegged at $3.29, down 4.4% over the past 30 days and suggesting a decline of 4.36% year-over-year.

Conclusion

Looking forward, the future of Harley-Davidson hinges on its ability to effectively manage trade tensions, adapt to shifting market conditions, and continue its advancement in the electric motorcycle sector. Successfully controlling costs while maintaining global demand could position the company for a recovery. However, in the short term, the ongoing trade war poses significant challenges to its growth trajectory.

Currently, HOG holds a Zacks Rank #5 (Strong Sell), signaling that investors may want to avoid the stock for now. For further insights, click here to view today’s Zacks #1 Rank (Strong Buy) stocks.

7 Best Stocks for the Next 30 Days

Recently released: Experts have identified 7 elite stocks from a pool of 220 Zacks Rank #1 Strong Buys. These stocks are anticipated to be “Most Likely for Early Price Pops.”

Since 1988, this selected list has outperformed the market by more than double, averaging a gain of +24.3% per year. Don’t miss out on these promising stocks.

Stay updated with the latest recommendations from Zacks Investment Research. Today, you can download the report on 7 Best Stocks for the Next 30 Days. Click here for your free copy.

Ford Motor Company (F): Free Stock Analysis report

Harley-Davidson, Inc. (HOG): Free Stock Analysis report

General Motors Company (GM): Free Stock Analysis report

Blue Bird Corporation (BLBD): Free Stock Analysis report

This article was first published on Zacks Investment Research (zacks.com).

Zacks Investment Research

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.