Hologic HOLX has been making significant strides with its new product offerings in Diagnostics and Breast Health. Despite facing macroeconomic challenges and unfavorable currency exchange rate fluctuations, the company has managed to hold its ground. Currently holding a Zacks Rank #3 (Hold), Hologic’s resilience shines through.

The Driving Forces Behind HOLX’s Stock Growth

Hologic’s success can be attributed to its innovative diagnostic products, with molecular diagnostic assays taking center stage. The company has seen consistent growth, especially in the Molecular Diagnostics business, which has maintained high-single to double-digit gains in 13 out of the last 15 quarters. The expansion of product offerings in Breast Health, covering various aspects of breast cancer care, has also contributed significantly to the company’s growth.

International sales have been a key driver for Hologic, with robust growth in markets worldwide. The company’s strategic initiatives to streamline operations and enhance competitiveness have proven to be fruitful, reflected in increased brand awareness and market share gains.

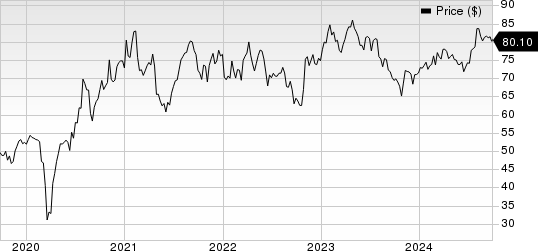

Charting the Success of Hologic

The stock has witnessed a commendable 12.2% increase year to date, outperforming the industry. With a clear focus on expanding its diagnostic assay and breast health offerings globally, Hologic is poised for further growth in the days ahead.

Challenges and Roadblocks Faced by HOLX

Despite its successes, Hologic isn’t immune to challenges. Global economic uncertainties and currency exchange rate fluctuations have impacted the company’s performance. The recent increase in the cost of revenues and administration expenses presents a hurdle for the company.

The ongoing impact of COVID-19 on the healthcare sector remains a concern, with declining assay revenues affecting key performance metrics. Additionally, the adverse foreign currency impact has been a persistent challenge for Hologic, affecting its overall performance.

Exploring Potential Investments

For investors eyeing the medical space, stocks like TransMedics Group TMDX, AxoGen AXGN, and OrthoPediatrics KIDS offer promising opportunities. With each carrying a favorable Zacks Rank, these stocks present potential growth prospects for investors.

TransMedics has shown impressive performance, with earnings surpassing estimates consistently. AxoGen and OrthoPediatrics also exhibit strong growth potential within the medical sector. Investors looking for solid investment options can consider these promising stocks.

As Hologic navigates through challenges and continues its growth trajectory, the company’s resilience and strategic approach remain key pillars of its success amidst a dynamic market environment.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.