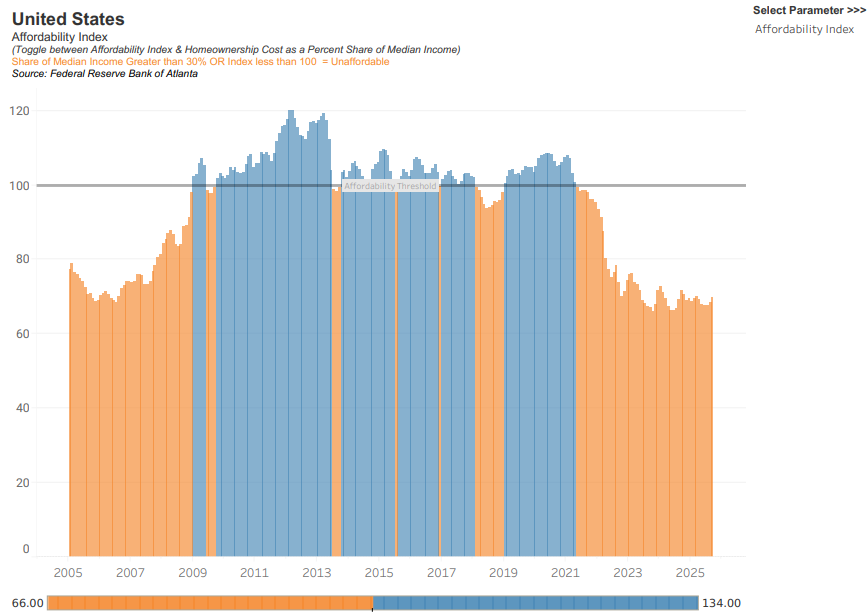

Americans have lost over $100,000 in home-buying power since early 2020 due to the rise in mortgage rates, with current rates around 6.25% compared to 3.5% in March 2020. For a typical household aiming to pay $1,700 per month, this means they can now support only a $275,000 loan versus the previously attainable $400,000-$420,000, while typical U.S. home values sit between $360,000 and $370,000. As a result, households are spending over 35% of their annual income on mortgage payments, far exceeding the “affordable” threshold of 30%.

In response to this ongoing housing crisis, Treasury Secretary Scott Bessent indicated that the White House might declare a National Housing Emergency. This declaration could trigger policies aimed at alleviating the affordability crisis, including tariff relief for building materials, financial assistance for first-time buyers, regulatory streamlining for housing projects, and the use of federal land for development.

Data reveals that the U.S. housing market has seen a drastic shift since 2022, with mortgage rates surging by 400 basis points—the steepest increase on record. Coupled with stagnant wages and low housing supply, this has created an untenable situation for many potential buyers, ultimately making effective governmental intervention more crucial than ever.