Dreams of financial independence often lead investors down the path of dividends, those golden eggs laid by successful companies for their shareholders. But not all dividend payers are equal. In the quest for a reliable payout, one must navigate a minefield to avoid yield traps — enticing stocks that could ultimately deplete your wealth.

Enter a shining example: a high-yielding stock that has managed to evade the yield trap curse. Offering a near 10% yield, this stock promises a steady income flow that won’t keep you up at night. With an investment of $102,750, this gem could put a cool $10,000 in your pocket annually.

Introducing the Ever-Reliable British American Tobacco

British American Tobacco (NYSE: BTI) boasts a global presence in the tobacco market, peddling traditional and smokeless products like vapes and heated devices. From iconic cigarette brands such as Camel and Newport to newer sensations like Vuse and Glo, this British behemoth raked in a hefty $34 billion in revenue in 2023. Not to mention, a strategic investment in India’s ITC worth $15 billion indicates a diverse portfolio.

However, the real star quality of British American Tobacco lies in its dividends. With quarterly payouts totaling $2.92 per share in 2023, yielding a tantalizing 9.75% at current prices, this stock is a dividend darling.

The Trust Factor: Why British American Tobacco’s Dividends Are Bulletproof

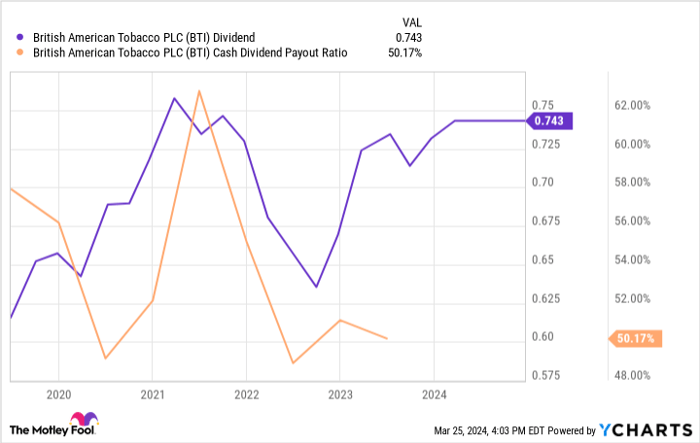

High dividend yields can signal danger, especially for U.S. investors eyeing foreign firms like British American Tobacco. Yet, trust in this company’s dividends is well-founded. Firstly, its financials are solid, with a consistent payout ratio between 50% and 60%. This stability, paired with the addictive nature of tobacco products, ensures a steady revenue stream.

Moreover, even in a hypothetical cash flow crisis, British American Tobacco’s $15 billion ITC stake could serve as a financial lifeboat. Secondly, the culture of tobacco companies places dividends at a sacred pedestal. Shareholders who rely on these generous payouts can rest assured that management will fight tooth and nail to maintain them through thick and thin.

A Blueprint to $10,000 in Dividend Income

Dipping your toes in the dividend pool with British American Tobacco doesn’t mean plunging all your funds into one basket. Even a modest investment will net you that juicy 9.75% yield. Imagine, needing 3,425 shares to generate a handsome $10,000 in annual dividend income, translating to a $102,750 investment. The best part? It’s a self-sustaining cash machine, affording you the flexibility to reinvest or savor the spoils.

Could this be your ticket to financial freedom? That decision rests with you. But remember, in the rollercoaster world of investing, a golden goose like British American Tobacco could be the key to unlocking lasting wealth.

Should you invest $1,000 in British American Tobacco right now?

Consider this: The Motley Fool Stock Advisor analysts have unveiled their top 10 stock picks, each poised for impressive returns. While British American Tobacco may not make the list, these chosen few could pave the way for stellar growth in the years ahead.

Stock Advisor offers a roadmap to success, guiding investors on portfolio construction and delivering two new stock picks monthly. Since 2002, the service has outperformed the S&P 500 by a significant margin*.

Explore the 10 handpicked stocks

*Stock Advisor returns as of March 25, 2024

Justin Pope has no position in any of the stocks mentioned. The Motley Fool recommends British American Tobacco P.l.c. and recommends the following options: long January 2026 $40 calls on British American Tobacco and short January 2026 $40 puts on British American Tobacco. The Motley Fool has a disclosure policy.

The views and opinions expressed are solely those of the author and do not reflect the opinions of Nasdaq, Inc.