Anthony Scaramucci Reflects on Long-Term Gains from Microsoft Investment

Former White House Communications Director and current investor, Anthony Scaramucci, shared a compelling story about his early investment in Microsoft Corporation MSFT. This investment, made for his newborn son, AJ, underscores the benefits of long-term investing.

Investment Background

During a recent appearance on The Julia La Roche Show, Scaramucci revealed that he purchased $1,200 worth of Microsoft Stock shortly after AJ was born on September 23, 1992.

At that time, he made the decision to reinvest dividends, despite Microsoft not issuing any dividends initially.

“I had an account for my son AJ,” Scaramucci recalled. “On Oct. 1, I bought him $1,200 of Microsoft.”

Discovery After Decades

Scaramucci faced challenges early on, including moving several times, which led to his brokerage, Goldman Sachs, losing track of his address. Consequently, the account remained untouched for nearly 30 years.

“We found the account, it was 26–27 years later,” Scaramucci noted. He initially thought the investment had increased by $88,000 but later learned it had grown by $288,000.

In a previous podcast, he had incorrectly stated the investment rose by about $72,000.

Market Context

Additionally, Scaramucci mentioned that during Microsoft’s stagnant phase under former CEO Steve Ballmer, he might have considered selling the Stock had he known it was still in his portfolio.

“There was a period when Steve Ballmer was running that company… they were flatlining at Microsoft for about eight or nine years,” he explained. “I would have sold that Stock but didn’t know I owned it, and it turned out to be a big win.”

Growth of Microsoft Stock

Microsoft went public on March 13, 1986, at an initial offering price of $21, closing its first day at $27.75 with over 2.5 million shares traded. Since then, the company has undergone multiple Stock splits, including significant splits in 1987 and 1990, and a series of additional splits through 2003.

Taking these splits into account, Scaramucci’s original $1,200 investment would have purchased approximately 784.313 shares. Presently, these shares are valued at approximately $306,792.15 based on Microsoft’s current share price.

Current Stock Performance

Presently, Microsoft shares have dipped 6.55% year-to-date and 2.76% over the past 12 months. However, the company has seen substantial growth, with shares rising 124.07% over the last five years. As of Monday, shares closed at $391.16, a slight decline of 0.18%, according to Benzinga Pro.

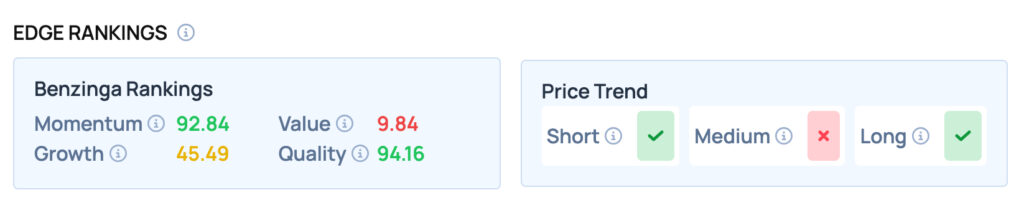

As per Benzinga Edge Stock Rankings, Microsoft holds a growth score of 64.68% and a momentum rating of 41.89.

Currently, the consensus price target for Microsoft stands at $494.57, based on assessments from 33 analysts. Truist Securities projects the highest target at $600 as of October 28. Recent ratings from Goldman Sachs, Piper Sandler, and Barclays indicate an average target of $438.33, suggesting a potential upside of 12.11%.

Photo Courtesy: Al Teich On Shutterstock.com

Disclaimer

This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.