Investing in Communications: A Look at Vanguard’s Winning ETF

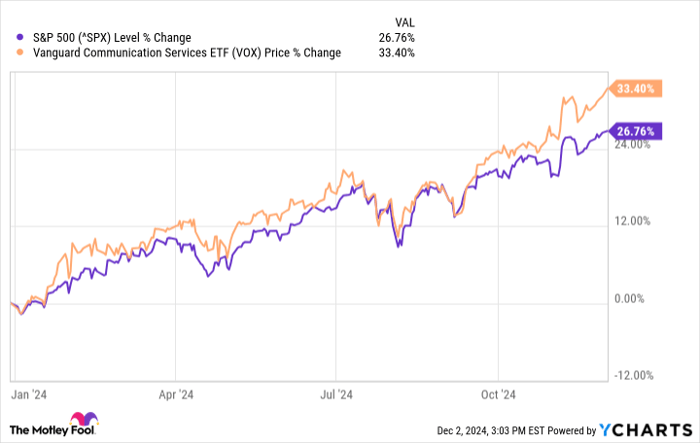

The S&P 500 (SNPINDEX: ^GSPC) has seen a notable increase of 26.8% as of December 2, 2024, with certain sectors like Communication Services outpacing it at 34.2% growth this year.

Vanguard offers an exchange-traded fund (ETF) that tracks the S&P 500’s communications sector. The Vanguard Communications ETF (NYSEMKT: VOX) is currently up 33.4%. This fund continues to attract investors interested in major communications stocks, including Google’s parent company Alphabet (NASDAQ: GOOGL), (NASDAQ: GOOG) along with Meta Platforms (NASDAQ: META), Netflix (NASDAQ: NFLX), and Walt Disney (NYSE: DIS).

With an expense ratio of just 0.1% and a minimum investment requirement of $1, let’s explore why the Vanguard Communications ETF is a compelling option for investors at all levels.

Image source: Getty Images.

Understanding the Communications Sector

Among the 11 stock market sectors, communications stands out. It includes traditional media companies like Comcast and Disney, video game developers such as Take-Two Interactive, Electronic Arts, and Roblox, social media firms like Meta Platforms, Pinterest, and Snap, as well as telecom giants such as Verizon Communications, AT&T, and T-Mobile.

This sector is crucial for the infrastructure and distribution of entertainment and media, blending legacy and new companies. While it’s diverse, the top holdings have significant voting power; Alphabet and Meta Platforms alone account for 44.1% of the fund. Netflix follows at 4.6%, outperforming Comcast’s 4.2% and Disney’s 3.8% shares.

Despite these concentrations, the valuations are surprisingly reasonable. For instance, Meta has a price-to-earnings (P/E) ratio of 27.1, while Alphabet’s is just 22.4, in contrast to the S&P 500’s P/E ratio of 30.9.

The Challenge of Volatility

Some investors may hesitate to buy Meta and Alphabet stocks due to concerns about their growth sustainability. Meta has improved its profitability, especially through Instagram, which has become a popular platform for targeted advertising. However, it is also pouring billions into its Reality Labs division, where the results remain uncertain. If competition heats up or advertising trends shift, the market might reevaluate Meta’s value.

Alphabet faces challenges too. Although YouTube is a major player, Google Cloud lags behind directly competing with Amazon Web Services and Microsoft Cloud. Legal pressures, including a potential forced divestiture of its Chrome browser and Android operating system, add further complexity to its growth story.

Data by YCharts.

Netflix has surged 82% this year, leading to its higher P/E ratio. It recently transformed its business model from buying content to creating it, which offers long-term benefits but introduces volatility based on viewership success.

Disney’s model is also cyclical and requires substantial capital. It boasts a forward P/E of just 21.6 but only recently achieved profitability with Disney+. Recent box office successes have improved Disney’s outlook, although it has yet to return to pre-pandemic levels. Its parks continue to yield revenue but demand continual investment and can be impacted by economic conditions.

Growth Versus Value in Investing

Investing in a diversified ETF like the Vanguard Communications ETF can mitigate some of the sector’s inherent volatility. By acquiring this ETF, investors can benefit from the combined growth of companies like Netflix and Disney without depending on just one stock’s performance.

The ETF’s P/E ratio stands at a reasonable 25.7 with a yield of 1%, which is comparable to Vanguard Utilities ETF’s ratio of 25.5, but with greater growth potential. In contrast, the Vanguard Information Technology ETF, which includes Apple, Microsoft, and Nvidia, has a much higher P/E ratio of 46.2.

For investors seeking exposure to leading growth stocks without the inflated prices typically observed in the S&P 500, the Vanguard Communications ETF represents a valuable opportunity.

Is Now the Right Time to Invest $1,000 in Vanguard Communications ETF?

Before purchasing shares in Vanguard’s ETF, consider the following:

The Motley Fool Stock Advisor team recently identified the 10 best stocks to buy, and Vanguard Communications ETF was not among them. Their recommended stocks may yield significant returns in the coming years.

For context, if you had invested $1,000 in Nvidia back on April 15, 2005, when it was recommended, you would now have $847,211!*

Stock Advisor provides a clear path for investors, with regular updates and two new stock picks monthly. Since 2002, its returns have surpassed the S&P 500’s by over four times.*

See the 10 stocks »

*Stock Advisor returns as of December 2, 2024

John Mackey, former CEO of Whole Foods Market, now an Amazon subsidiary, and members of The Motley Fool board have ties to various related businesses. The Motley Fool recommends M such as Alphabet, Amazon, Apple, Meta Platforms, Microsoft, Netflix, Nvidia, and others, and has also recommended options in relation to these holdings. Please refer to their disclosure policy for more details.

The views and opinions expressed herein belong to the author and do not necessarily reflect those of Nasdaq, Inc.