“`html

The Bullish Outlook on Market Trends and AI Demand

Market Anticipation and Key Economic Developments

As I write near lunch, the market is on edge, awaiting the Federal Reserve’s policy announcement and comments from Chairman Jerome Powell scheduled for tomorrow.

The direction of the market in the near term will heavily depend on Powell’s statements.

We will report on the outcome in tomorrow’s Digest; however, our analysts are already outlining a bullish outlook as summer approaches.

Let’s delve into insights from our hypergrowth expert, Luke Lango, from his recent Daily Notes in Early Stage Investor:

We believe the recent market rally is just beginning.

Our forecast includes several bullish catalysts expected to unfold over the coming months:

- In May: Anticipate trade agreements with key allies such as India, Japan, South Korea, and Vietnam.

- In June: Expect a dovish shift from the Fed, driven by trade deals alleviating inflation concerns, potentially leading to a rate cut in their June meeting.

- Late June to Early July: Developments on a U.S.-China trade agreement.

- Early July: Passage of a significant tax cut package in Washington, D.C.

- July to August: An exceptional earnings season, as Q2 results benefit from improved macroeconomic clarity (trade deals, rate cuts, tax cuts, etc.).

Such a series of positive developments could create a favorable environment for market growth.

If these factors align—and we believe they will—they could fuel a multi-month stock market rally.

However, concerns remain about the tariff war and potential increases in consumer prices, which might impact earnings and corporate employment. Are recession risks substantiated?

Luke argues these risks are exaggerated. He references last week’s payroll report, highlighting that the U.S. economy added 177,000 jobs in April, surpassing the expected 138,000. More encouraging, according to Luke, is the wage growth.

Back to Luke:

Wages rose 3.8% in April, while the Cleveland Fed reported inflation at only 2.3% for that month.

This yields real wage growth of 1.5%—historically, when wages outpace inflation, recessions tend not to occur.

As for the Fed, while Luke does not foresee a rate cut at tomorrow’s FOMC meeting, he thinks the conditions may be ripe for a cut in June. Should that happen, a market rally could ensue.

Moreover, he is optimistic about an impending tax cut initiative, potentially extending the 2017 Tax Cuts and Jobs Act, possibly as soon as July.

Back to Luke:

This tax package could include full expensing, reduced corporate tax rates, and additional incentives for domestic growth.

Similar to 2017, such a move could trigger a strong market rally.

Considering these elements, Luke maintains a bullish position.

Regarding his current investments in anticipation of a summer rally, he favors leading AI stocks—specifically, those in “physical AI.”

Last week, Luke conducted a live briefing detailing current buying opportunities in robotics and cutting-edge AI. For those who missed it, a free replay is available here.

The recent winning streak in the market is more than just a bounce; it could signal the early stage of a historic summer rally, and the clock is ticking.

AI Demand Remains Strong Amid Market Fluctuations

How does AI power its operations?

As noted frequently in the Digest, AI consumes substantial energy. This demand is poised to rise, especially as AI continues to integrate into daily life. Investors are encouraged to explore the broader AI datacenter ecosystem supporting this demand.

Some analysts have recently suggested a decline in datacenter demand. They argue expectations had become overly optimistic. However, the evidence suggests otherwise. According to CNBC,

Demand for data centers is stable in northern Virginia, the world’s largest market, as stated by executives at Dominion Energy.

Dominion, which supplies electricity to Loudoun County—known as “Data Center Alley”—has observed significant investments from Big Tech firms that are allocating billions to datacenter projects for AI model training.

“We have seen no evidence of declining demand from data center customers across our service area,” said Dominion’s CFO, Steven Ridge, during the company’s first-quarter earnings call.

Data center customers are still actively investing in new projects, and there are no signs of concern regarding economic challenges, according to Dominion CEO Robert Blue.

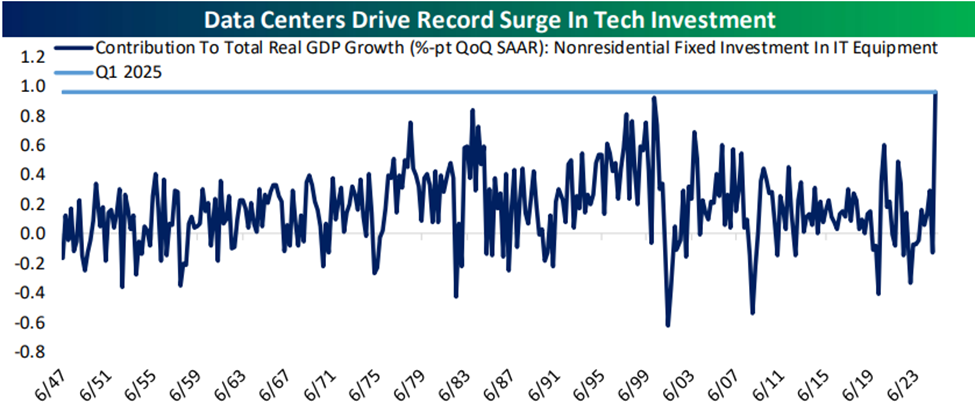

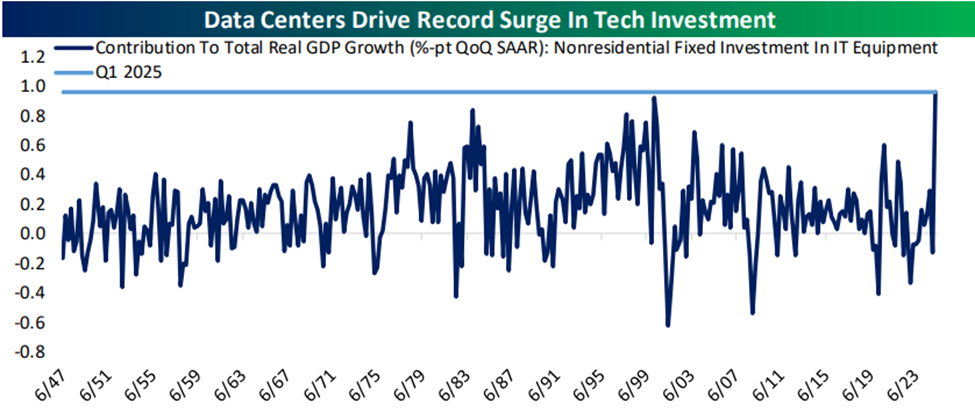

Furthermore, research firm Bespoke reported last week on X:

Investment in data centers contributed a full percentage point to GDP in Q1, marking a record.

Source: Bespoke

In addition, Jonathan Gray, CEO of Blackstone, recently stated his belief that there is robust demand ahead for AI datacenters.

From Gray:

This trend is powerful and is expected to continue.

Overall, we are witnessing a significant shift in the market landscape.

“`

Microsoft’s AI Investments and Oil Market Challenges: A Current Overview

Recent developments highlight significant trends in the tech and oil markets. Microsoft has unveiled its formidable commitment to AI, revealing plans that promise to reshape the sector. Meanwhile, the oil market faces serious challenges, pushing prices to their lowest levels in four years.

Microsoft’s Commitment to AI

Microsoft continues to invest heavily in AI infrastructure this quarter. During the recent earnings call, CEO Satya Nadella announced that the company has opened data centers in ten countries across four continents. This expansion underscores Microsoft’s strategy in the AI realm.

Earlier this year, Nadella assessed that the company plans to allocate $80 billion in fiscal 2025 for constructing data centers specifically designed to handle AI workloads. The persistent growth in AI indicates that demand for such infrastructure will remain robust, creating potential investment opportunities.

Declining Oil Prices

In the oil sector, the price of West Texas Intermediate Crude dipped below $56.00, while Brent crude also fell into the $50s. Overall, oil prices have decreased by approximately 20% this year. This decline can be attributed to two main factors:

- Concerns over a global economic slowdown, leading to reduced demand.

- OPEC+ taking action against countries that have exceeded their production quotas.

According to a report from Bloomberg, Saudi Arabia’s recent decision to increase oil output is indicative of a strategic shift. After a decade of limiting production to stabilize prices, they are now opting to lower them to penalize non-compliant members. The rising output could heighten concerns of a price war among OPEC+ members.

Saudi Arabia’s primary targets for this increased production are Kazakhstan and Iraq. Notably, Kazakhstan has openly defied OPEC+ restrictions, emphasizing the necessity of oil revenues for its population. However, recent reports suggest that Kazakhstan may consider complying with OPEC+ production cuts to avert further price declines.

In a warning from Russia, a co-leader of OPEC+, members were reminded of their substantial unused production capacity and the importance of adhering to established quotas.

Investment Strategies Amid Market Volatility

For those invested in oil stocks, fluctuations in prices are expected. Despite a recent about-turn with oil prices rising nearly 4%, caution is advised, particularly as lower prices remain a possibility. Investor Louis Navellier has advised his subscribers to sell their positions in Exxon (XOM), citing the need to pivot towards emerging opportunities in AI instead.

For investors not holding oil stocks, now may be the right time to prepare for potential entry. Prices have recently reached four-year lows, suggesting continued pressure on stock prices. This dynamic can present attractive long-term opportunities for patient investors.

Linking this back to AI’s rapid growth, Jonathan Gray, CEO of Blackstone, pointed out the importance of evaluating all power sources, including renewable energy and natural gas, as companies expand their data centers. He emphasized the pressing need for electrical capacity to support this technological growth.

Looking Ahead: Federal Reserve Meeting

As we approach tomorrow’s Federal Reserve meeting, all eyes will be on Federal Reserve Chairman Jerome Powell. While no rate cuts are anticipated, market participants will be attentive to Powell’s comments, especially regarding potential actions in June. A dovish stance could spark significant market reactions.

We will continue to monitor these developments.

Best,

Jeff Remsburg