Alphabet Prepares for a Pivotal 2025: What Investors Need to Know

Alphabet (NASDAQ: GOOGL) (NASDAQ: GOOG) has stirred interest as it approaches 2025, with its CEO urging employees to brace for a year filled with challenges yet potential growth for the stock. Let’s examine the insights shared by CEO Sundar Pichai and the implications for investors.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. See the 10 stocks »

CEO Sundar Pichai: A Crucial Time for Alphabet

During a recent meeting at headquarters in Mountain View, California, Pichai emphasized the critical nature of 2025 for Alphabet, particularly in the realm of artificial intelligence (AI). He stressed the need for the company to accelerate its pace and leverage AI to address real-world challenges.

With regulatory pressures mounting, Pichai acknowledged the hurdles ahead. In 2024, Alphabet faced an antitrust ruling from the U.S. Department of Justice (DOJ), declaring it had a search monopoly. The DOJ has proposed remedies that could force Alphabet to divest its Chrome browser and possibly its Android operating system, in addition to sharing data with users and advertisers. A recent case against the company concerning its control of online ad technology is ongoing, alongside objections raised by the U.K. regarding Alphabet’s advertising practices.

Nonetheless, Pichai maintained that these challenges are part of being a major player in the industry. The focus remains firmly on advancing AI capabilities. He presented a chart showing that Alphabet’s Gemini 1.5 large language model (LLM) is currently outperforming its competitors, including ChatGPT, although he predicted a competitive landscape with ongoing shifts in the market.

Alphabet seems to excel in video AI, evidenced by the success of the Veo 2 AI video generator. Praised for its performance, Veo 2 has surpassed OpenAI’s Sora video generator, which was released shortly before it. Remarkably, Veo 2’s training on Alphabet’s YouTube platform likely contributes to its superior capabilities.

Looking ahead, Gemini 2.0, Alphabet’s latest AI LLM, is set to be integrated into the company’s range of products in 2025. Further, Alphabet is gearing up to enhance its Gemini app, which currently faces stiff competition from ChatGPT. Despite recent momentum, Alphabet must work to catch up to the household name that ChatGPT has become. Pichai aptly noted, “Scaling Gemini on the consumer side will be our biggest focus next year.”

Image source: Getty Images.

Is Now the Right Time to Buy Alphabet Stock?

Critics have sometimes described Alphabet as complacent, relying on its past successes. However, the rise of AI has sparked a renewed sense of urgency within the company. Pichai’s call for a “scrappy” approach reflects a necessary shift in mindset. While competition typically poses a risk, it can also serve as a catalyst for improvement.

This revitalization is evident in Alphabet’s advances in quantum computing and the performance of Veo 2. As rivals strive to outpace one another, the competitive atmosphere seems to be driving Alphabet to innovate. The substantial amount of search data accumulated by Google over the decades may prove valuable in future AI search initiatives.

Moreover, Alphabet’s ventures into AI Search Overviews and the Gemini App could create new advertising revenue streams. With Google currently monetizing only about 20% of its searches, the expansion of AI queries might significantly boost its revenue growth down the line.

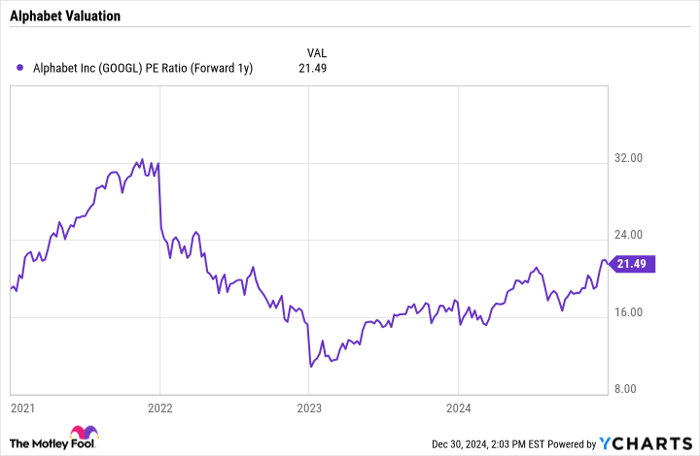

In terms of valuation, Alphabet remains one of the more attractively priced mega-cap tech stocks involved in AI, trading at a forward price-to-earnings ratio of approximately 21.5, based on projections for 2025.

GOOGL PE Ratio (Forward 1y) data by YCharts

With a clear focus and a strategy in place for navigating the hurdles of 2025, an investment in Alphabet stock at its current price seems promising. The company is showcasing its innovative capabilities, likely increasing its appeal to investors while maintaining a solid valuation that leaves room for growth in its P/E multiple.

Thinking of Investing $1,000 in Alphabet?

Before diving into an investment in Alphabet, consider this:

The Motley Fool Stock Advisor analyst team has identified what they believe are the 10 best stocks to buy now—and Alphabet is not among them. The selected stocks may hold significant return potential in the coming years.

Take for example, when Nvidia made the list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $823,000!*

Stock Advisor offers investors a straightforward blueprint for success, including portfolio-building guidance, frequent analyst updates, and two new stock recommendations each month. Since 2002, the Stock Advisor service has more than quadrupled the return rate of the S&P 500.

See the 10 stocks »

*Stock Advisor returns as of December 30, 2024

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Geoffrey Seiler has positions in Alphabet. The Motley Fool has positions in and recommends Alphabet. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.