W.W. Grainger’s Mixed Performance Signals Caution for Investors

W.W. Grainger, Inc. (GWW) boasts a market capitalization of $47.3 billion, positioning it as a significant player in the maintenance, repair, and operating (MRO) product distribution sector. Based in Lake Forest, Illinois, the company operates primarily through two segments: High-Touch Solutions North America and Endless Assortment.

As a member of the “large-cap” stocks category, which includes companies valued at $10 billion or more, W.W. Grainger represents a prominent figure in the American Fortune 500 industrial supply market. The company’s offerings are distinguished by innovative technology and strong customer relationships.

Active Investor: FREE newsletter going behind the headlines on the hottest stocks to uncover new trade ideas.

Recent Performance Declines

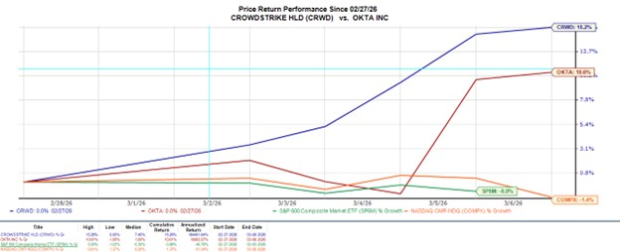

Recent trading activity reflects challenges for W.W. Grainger, with its stock falling 20.1% from a 52-week high of $1,227.66. Over the past three months, the company’s shares dipped by 15.1%, which is underwhelming compared to the S&P 500 Index’s ($SPX) decrease of 8.4%.

On a year-to-date (YTD) basis, GWW’s decline stands at 6.9%, while the S&P 500 has experienced a smaller drop of 5.3%. However, examining a broader 52-week timeframe, W.W. Grainger’s shares have risen by 1.8%, lagging behind the S&P 500’s gains of nearly 8.9%.

Technical Indicators and Decreasing Sales Outlook

Although GWW traded above its 200-day moving average previously, it has recently slipped below this benchmark. Currently, the stock also trades under its 50-day moving average.

Concerns are growing following a 5.6% drop in GWW shares on January 31 after the company reported disappointing Q4 2024 results. The adjusted earnings per share (EPS) of $9.71 fell short of analysts’ expectations. While quarterly net sales matched consensus estimates at $4.2 billion, the 2025 EPS forecast of $39 to $41.50 was below Wall Street’s projections. Additionally, GWW’s sales guidance of $17.6 billion to $18.1 billion points to continued soft demand in the industrial and construction sectors.

Comparative Market Positioning

In comparison, rival Global Industrial Company (GIC) has also struggled, showing a significant decline of 48.9% in share value over the past 52 weeks and a 7.3% decrease YTD. This underperformance raises caution among analysts regarding GWW’s future potential, leading to a consensus rating of “Hold” from the 16 analysts monitoring the stock.

At present, W.W. Grainger is trading below the average price target of $1,112.70. Investors may want to proceed with caution as the company’s financial indicators and market conditions suggest a period of uncertainty.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy

here.

More news from Barchart

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.