Air Products and Chemicals Shows Strong Performance Amid Market Challenges

Allentown, Pennsylvania-based Air Products and Chemicals, Inc. (APD) stands out as a prominent industrial gases company. Its offerings include atmospheric gases, specialty gases, equipment, and related services. With a market capitalization of $70.4 billion, APD operates across the Americas, Indo-Pacific, Europe, and the Middle East.

Classified as a “large-cap stock,” APD is considered to be among companies valued at $10 billion or more. The company’s extensive operations and leadership in the materials sector make its valuation unsurprising.

Active Investor: FREE newsletter providing insights on hot stocks and new trade ideas.

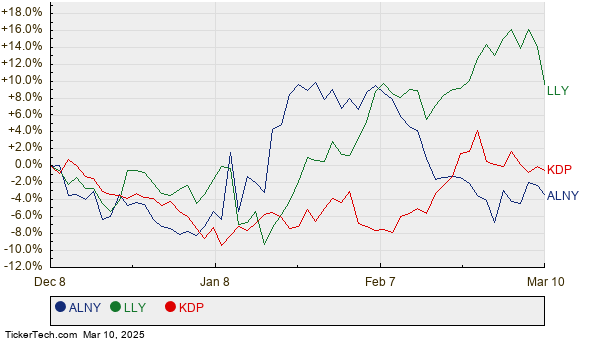

APD reached its all-time high of $341.14 on February 4 and is currently trading 7.2% below this peak. Over the past three months, APD has dipped 1.2%, slightly outperforming the iShares U.S. Basic Materials ETF (IYM), which saw a decline of 3.8% in the same period.

Looking at a longer time frame, APD’s performance appears more favorable. Over the past six months, the stock has risen 17.8%, and it has surged 29.1% in the last 52 weeks. In contrast, IYM experienced only a 38 basis point dip over the past six months and a 3.2% decline over the year.

To reinforce this positive trend, APD has consistently traded above its 200-day moving average since late July 2024 and maintained levels above its 50-day moving average since mid-January, despite some fluctuations along the way.

After releasing mixed Q1 results on February 6, Air Products and Chemicals’ stock saw a decline of 1.5%. Although higher prices positively impacted revenue, this was offset by decreased volumes and foreign exchange losses. The company’s overall sales for the quarter fell 2.2% year-over-year to $2.9 billion, which missed analysts’ expectations. However, APD’s adjusted earnings per share (EPS) increased 1.4% year-over-year to $2.86, aligning with consensus estimates.

Furthermore, APD has outperformed its peer, DuPont de Nemours, Inc. (DD), which reported a 1.3% decline over the last six months and 9.8% growth over the past year.

Among the 22 analysts following APD, the consensus rating is a “Moderate Buy,” with a mean price target of $353.35. This indicates an upside potential of 11.7% from current price levels.

On the date of publication, Aditya Sarawgi did not hold (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article are for informational purposes only. For more information, please view the Barchart Disclosure Policy here.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.