Enbridge Inc. (ENB) has announced a robust growth strategy, backed by over C$30 billion in secured capital projects in areas like liquid pipelines, gas transmissions, and renewables. The new projects are expected to enhance cash flows, supporting a consistent dividend strategy that has seen increases for 31 consecutive years. Currently, ENB boasts a dividend yield of 5.9%, surpassing the industry average of 5.36%.

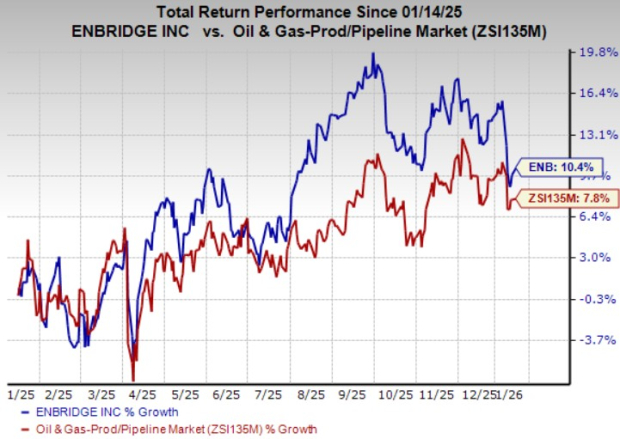

In terms of performance, ENB shares have increased by 10.4% over the past year, compared to a 7.8% industry improvement. The company trades at a trailing EV/EBITDA of 14.76X, slightly above the industry average of 13.63X. Notably, the Zacks Consensus Estimate for ENB’s 2025 earnings has remained stable over the past 30 days.

In comparison, competitor companies Kinder Morgan Inc. (KMI) and Williams (WMB) have lower dividend yields of 4.35% and 3.36%, respectively, highlighting ENB’s competitive financial positioning within the midstream energy sector.