Apple (NASDAQ: AAPL) has been the reigning monarch of the stock market for ages, boasting as Berkshire Hathaway‘s crown jewel and once the all-time most valuable company. However, a recent shift in power has seen it relinquish its throne to Microsoft, with whispers in the wind hinting that it may soon bow down to the likes of Nvidia, should its blazing valuation continue to surge.

The Unyielding Grip of Underperformance

In the ongoing saga of 2024, Apple has trailed behind, with a woeful 5.3% drop compared to the Nasdaq Composite‘s respectable 5.1% climb. Over the past year, Apple’s meager 18.6% rise pales in comparison to Nasdaq’s towering 33.1% leap. While Microsoft, Nvidia, Amazon, Alphabet, and Meta Platforms basked in the glory of outperforming the Nasdaq, Apple languished in the shadows of its former self.

Such somber developments have cast a pall over Apple on Wall Street, triggering fears and uncertainties among investors about its future prospects.

Image source: Getty Images.

The Tale of Slowing Growth

Amidst the chaos, the crux of Apple’s downfall lies within its core business of selling gadgets and gizmos. While its services segment continues to break records, the product sales, which constitute over 80% of revenue, face stagnation.

Apple’s struggle to revitalize its product business is evident as each new iPhone or MacBook launch fails to stir the same frenzy as before. The company finds itself trapped in a cycle of diminishing returns, a victim of its own triumphs.

Despite these trials and tribulations, Apple’s prowess in blending hardware and software remains unparalleled, a testament to its unmatched ability to add value for consumers amidst a sea of competitors that pale in comparison.

A Glimmer of Hope in the New Landscape

Apple’s stronghold lies in its vertically integrated model, fostering lifelong customer loyalty. While challenges persist in generating substantial product sales, a silver lining appears on the horizon.

The surge in Apple’s sales during 2020 and 2021, driven by a shift towards physical goods purchases, resulted in a lull that is now haunting its future performance.

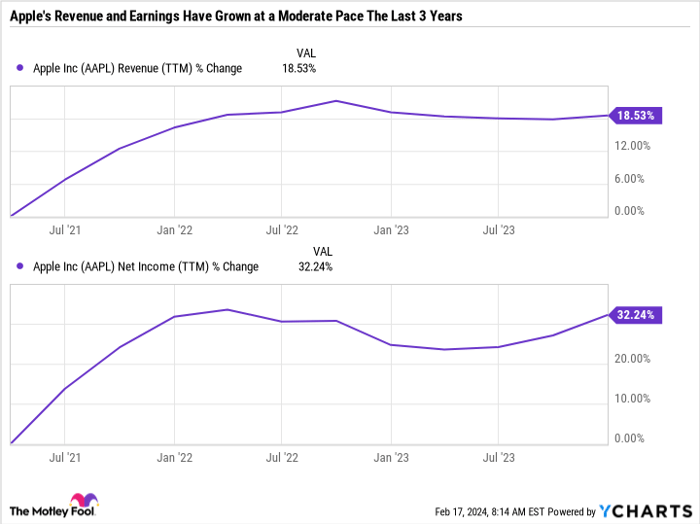

AAPL Revenue (TTM) data by YCharts

The repercussions of this artificial boost in sales illuminate Apple’s struggle to break free from the shackles of a cyclical downturn. Yet, the company’s unique business model, centered around consumer engagement and ecosystem-building, remains a beacon of hope.

Weathering the Storm of Headwinds

Apple’s dependence on iPhone and Mac sales reveals the crux of its troubles. Despite the allure of services and potential, the heart of the matter lies in selling new gadgets, a fundamental mandate for the company’s survival.

A dark cloud looms over China, Apple’s second-largest market, as sales plummet amidst economic uncertainties and intense competition. The setback in China has prompted a shift in focus towards emerging markets, offering a ray of light amidst the gathering storm.

As Tim Cook, Apple’s CEO, aptly stated, “We are, in essence, taking what we learned in China years ago and applying that to India,” hinting at a potential renaissance in regions beyond China’s borders.

The Balance of Pros and Cons

While skepticism shrouds Apple’s future, it would be remiss to overlook the herculean strengths that underpin its legacy. Apple’s journey, fraught with challenges, is a testament to resilience and adaptability, paving the way for a potential renaissance in the stock market.

The Long-Term Potential of Apple Stock

Apple’s Resilience and Potential

Despite concerns about innovation in its iconic products such as the iPhone and Mac, Apple stands strong as a beacon of brand power, industry leadership, vertical integration, customer loyalty, high margins, strong cash flow, and a rock-solid balance sheet. While these qualities may lead to overvaluation in the short term, they position Apple as a steady and potentially lucrative investment over the long haul.

A Sleeping Giant in the Tech Industry

Apple may seem lackluster at the moment, but beneath the surface lies a sleeping giant with the resources to drive significant growth for years to come. With ample cash reserves, Apple remains poised for a potential game-changing acquisition in fields like artificial intelligence. The company’s yet-to-be-tapped potential in emerging technologies positions it as a force to be reckoned with in the tech sector.

The Path to Nasdaq Outperformance

For Apple to reclaim its position as a frontrunner within the Nasdaq, it must demonstrate to investors that it can sustain growth patterns that justify its premium valuation. While the stock’s current price to earnings ratio of 28.3 may seem lofty, the intrinsic value lies in Apple’s fundamental strengths and the untapped potential waiting to be unearthed.

Investing in Apple: A Strategic Move

When considering an investment in Apple, it’s crucial to focus on the company’s enduring qualities that transcend short-term market fluctuations. Whether buying and holding for the long term or capitalizing on temporary dips, Apple’s strong fundamentals and growth prospects position it as a strategic addition to any investment portfolio.

Should you invest $1,000 in Apple right now?

As investors weigh the decision to buy Apple stock, it’s worth noting that while Apple may not feature among the Motley Fool’s current top 10 stock recommendations, its strong foundation and potential for future growth should not be overlooked. The intrinsic value and long-term prospects of Apple make it a compelling investment option for those seeking stability and growth in their portfolio.

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Daniel Foelber has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Alphabet, Amazon, Apple, Berkshire Hathaway, Meta Platforms, and Microsoft. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.