The stock market is scaling new heights every day, with the Nasdaq Composite soaring 33.8% in the last 12 months. However, the electric vehicle (EV) sector has been languishing in the red, with Tesla down 4% and Rivian Automotive plummeting more than 19% over the same period. Year-to-date, the Nasdaq is up 5.1%, while Tesla is down 19.5% and Rivian is down 30.5%.

Amidst this downturn, it is imperative to scrutinize the challenges being faced by these companies and explore the critical changes necessary for a reversal in fortune.

Image source: Getty Images.

Tesla’s Uphill Battle

The downward trajectory of Tesla’s stock is understandable given its decelerating top- and bottom-line growth, and pessimistic 2024 guidance. The company’s operating margins are being squeezed by price cuts and sustained investments in manufacturing expansions and R&D. There’s also the unresolved issue of monetizing artificial intelligence and achieving the advanced level required for autonomous driving and robotaxi operations, which could revolutionize ride-sharing and food delivery.

As a growth stock with a lofty valuation, Tesla must maintain rapid growth to justify its standing, a tough feat in the cyclical automotive industry. Moreover, the intensifying competition from established and emerging players poses additional challenges.

Rivian’s Race Against Time

Rivian’s uphill battle involves the urgent need to achieve positive free cash flow to reduce its reliance on cash reserves for operations. While the company has made strides in narrowing its losses and boasts impressive technology and a strong brand, it faces the risk of cash depletion within two years. The success of its second-generation platform, the R2 line, is crucial in reaching a broader customer base by reducing the sales price of its vehicles.

Despite its potential, Rivian is encumbered by risks. If it fails to achieve positive cash flow, resorting to stock dilution or debt financing would be inevitable, both undesirable options given its battered stock price and high interest rates.

Auto Industry Dynamics

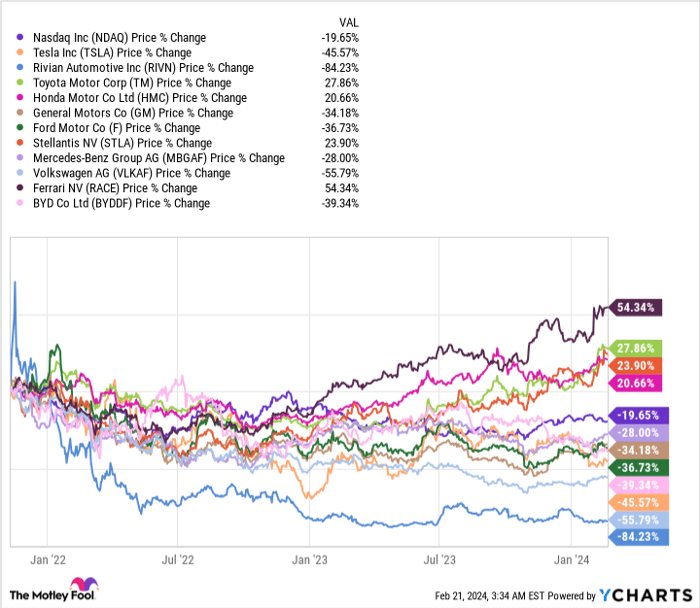

The underperformance of the entire auto industry, with a few exceptions, highlights a context that’s often overlooked. Established players such as Ferrari, Toyota, Honda, and Stellantis have outperformed the Nasdaq Composite in the last three years, shattering the prevalent notion of conventional automakers struggling amidst the EV renaissance.

NDAQ data by YCharts

Toyota, in particular, stands out as a prime example of successful adaptation in the rapidly evolving automotive landscape.

Toyota’s Winning Strategy

Toyota’s remarkable surge to a $300 billion market cap heralds a significant departure from its traditionally conservative image. Its strategy revolves around robust growth in both revenue and bottom line, driven by a substantial investment in hybrids as opposed to solely focusing on battery-powered EVs.

During the first nine months of its fiscal year 2024, Toyota registered a 23.9% sales hike and more than doubled its operating income, culminating in a surge in operating margins from 7.6% to 12.5%. In stark contrast, Tesla’s 2023 operating margin stood at a modest 9.2%, plummeting from a lofty 17% in 2022. Toyota’s emphasis on hybrid EVs, comprising 33.5% of its sales volume, has underscored its unprecedented success.

Toyota’s success can be attributed to its diverse offerings, leveraging a range of solutions to cater to consumer demand. While committed to harnessing the potential of battery EVs, the company’s pragmatic approach demonstrates that a hybrid-centric strategy is currently outperforming the one-dimensional focus on EVs, casting a shadow of doubt on the efficacy of a pure-play EV business model.

Grasping the Future

The multi-decade potential of EVs remains undisputed. However, the inflection point for sustained demand envisaged by investors is yet to materialize.

Amidst the current landscape, Toyota’s resilient dual approach projects a model for success, putting pressure on Tesla and Rivian to exhibit similar adaptability. While Tesla remains a profitable business with towering valuations, the erosion of its pricing power and heightened competition in the EV space warrant prudence. Rivian, being a lower-volume, nascent player in the high-end market, is particularly susceptible to industry slowdowns.

For Tesla and Rivian to regain their lost luster, they must demonstrate a superior product that resonates with consumers at an appealing price point. While both companies might argue their product excellence, the shifting market dynamics necessitate a critical assessment of the evolving competitive landscape. The efficacy of pure-play EV makers against hybrid-centric stalwarts like Toyota remains to be seen amidst escalating uncertainty.

As investors navigate these turbulent waters, the prudent course of action would be to approach these stocks with caution. While the long-term growth prospects of the EV sector are promising, the prevailing challenges could trigger a volatile period for both Tesla and Rivian. This demands a high risk tolerance and an unwavering belief in the enduring allure of EVs.

Where to invest $1,000 right now

When our analyst team has a stock tip, it can pay to listen. After all, the newsletter they have run for two decades, Motley Fool Stock Advisor, has more than tripled the market.*

They just revealed what they believe are the 10 best stocks for investors to buy right now… and Tesla made the list — but there are 9 other stocks you may be overlooking.

See the 10 stocks

*Stock Advisor returns as of February 20, 2024

Daniel Foelber has positions in Rivian Automotive and has the following options: short March 2024 $15 puts on Rivian Automotive and short March 2024 $17.50 calls on Rivian Automotive. The Motley Fool has positions in and recommends BYD, Tesla, and Volkswagen Ag. The Motley Fool recommends General Motors and Stellantis and recommends the following options: long January 2025 $25 calls on General Motors. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.