Earlier this year, Payload Research unveiled details about SpaceX’s robust revenue and profits in 2023, sparking intrigue among investors. The space market analyst’s insights suggested that SpaceX likely saw a remarkable surge, with revenue potentially nearing $8.7 billion in 2023. Though the precise profit figure remained elusive, previous reports hinted at profitability reaching $3 billion, excluding one-time items.

Image source: Getty Images.

Optimistic Predictions for SpaceX in 2024

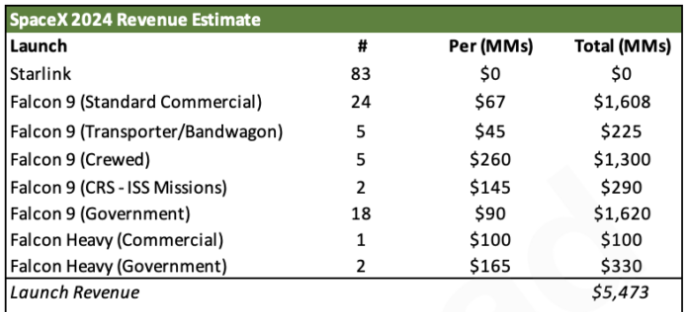

Undeterred by the challenges of peering into the future, Payload Research recently attempted the daring task of predicting SpaceX’s financial performance for 2024. Their analysis was based on SpaceX’s forecast of launching 148 missions this year, a number curtailed to a more conservative 140 missions anticipating potential setbacks. Payload meticulously dissected these missions, estimating probable revenues from each type, ultimately projecting a total of $5.5 billion revenue from rocket launches in 2024.

Data source: Payload Research.

Yet, rocket launches are now just a fraction of SpaceX’s multifaceted business. The burgeoning Starlink satellite internet venture has emerged as the primary revenue source, poised to contribute approximately $6.8 billion in 2024, collectively with terminal sales and service provision. Additional revenue streams from various SpaceX projects, such as in-orbit refueling demonstrations and military communication services, are anticipated to generate another $1 billion. Combined, these avenues are predicted to propel SpaceX’s revenue beyond $13.3 billion this year, surpassing traditional industry behemoths like Lockheed Martin in space business revenue generated last year.

Navigating the Financial Galaxy: SpaceX’s Valuation in 2024

The meteoric rise of Starlink, from non-existence to becoming SpaceX’s primary revenue generator within a mere four years, is undeniably impressive. Surpassing rocket launches, Starlink is projected to grow revenue by 63% in 2024, outpacing the trajectory of SpaceX’s launch business, estimated to grow by 56%.

Even more striking is the profitability SpaceX has achieved, with a significant profit margin of nearly 35% in 2023, setting it apart from competitors like Lockheed Martin. Assuming a similar profit margin in 2024, SpaceX’s anticipated revenue of $13.3 billion could translate to operating profits exceeding $4.5 billion, marking a substantial 50% year-over-year increase. This robust performance has led to a rich valuation, indicating SpaceX stock is trading at 40 times forward earnings.

Key Takeaways for Potential Investors

Amidst these staggering figures, the question arises – is SpaceX a wise investment? The data suggests a compelling case. Paying a premium for a company growing at a robust 50% rate seems reasonable, especially considering SpaceX’s distinctive profitability in the space sector. With innovative projects like Starship, Starlink, and military-focused Starshield, SpaceX continues to fortify its competitive advantage, making it a formidable force in the market.

This “top dog and first mover” stance bodes well for SpaceX’s future, with potential opportunities like the much-anticipated Starlink IPO on the horizon. Investors eagerly await the chance to be part of this rapid and dynamic enterprise’s journey.

Where to invest $1,000 right now

When our analyst team has a stock tip, it can pay to listen. After all, the newsletter they have run for over a decade, Motley Fool Stock Advisor, has nearly tripled the market.*

They just revealed what they believe are the 10 best stocks for investors to buy right now…

See the 10 stocks

*Stock Advisor returns as of March 11, 2024

Rich Smith has no position in any of the stocks mentioned. The Motley Fool recommends Lockheed Martin. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.