Investing Monthly: The Path to a Million-Dollar Portfolio

Establishing a monthly investment habit can significantly benefit your financial journey. Consistently investing removes the stress of trying to time the market, allowing you to stick to a planned budget and build wealth over time.

If you allocate $350 each month to an exchange-traded fund (ETF), it could potentially grow your portfolio to over $1 million in the long run. I will illustrate how this can happen even with a conservative annual growth rate.

A Reliable ETF for Your Monthly Investments

Choosing the right stocks or ETFs to invest in each month is essential. This way, you can simplify the decision-making process, making investing feel routine and increasing your chances of sticking with it.

The Invesco QQQ Trust (NASDAQ: QQQ) is a strong option for long-term investors. This fund tracks the top 100 nonfinancial stocks on the Nasdaq, removing some of the uncertainty around which growth stocks to buy. By investing in well-established companies, you reduce the risks associated with unprofitable businesses or shaky business models that smaller growth stocks may pose.

Well-known holdings in this ETF include Tesla, Nvidia, Meta Platforms, and other prominent tech stocks. Moreover, the fund charges a relatively low annual expense ratio of just 0.20%.

Projecting Your Portfolio’s Growth Over Time

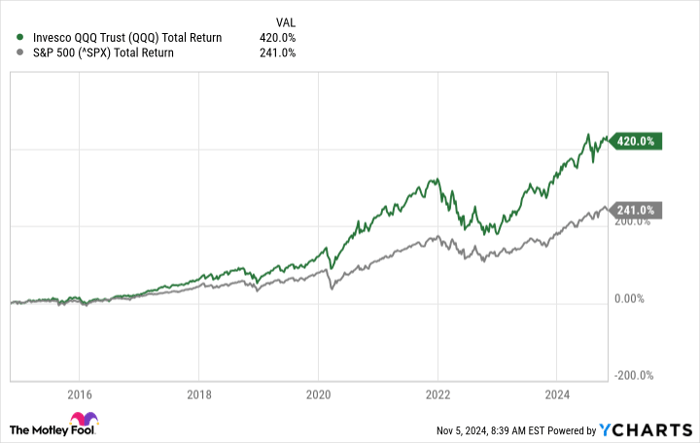

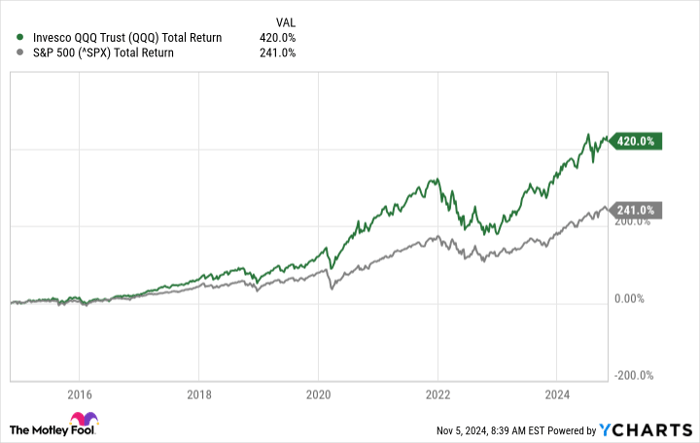

Over the last decade, the Invesco QQQ Trust has achieved total returns (including reinvested dividends) of 420%, compared to the S&P 500 index’s 241%. This equates to a compounded annual growth rate (CAGR) of 17.9%.

QQQ Total Return Level data by YCharts

Sustaining such high growth rates may be challenging, especially in today’s bullish market. Historically, the S&P 500 has returned about 10% annually. To set more realistic expectations, let’s estimate a more conservative growth rate of 9%. This approach allows you to create attainable benchmarks.

Here’s what investing $350 monthly might yield with a 9% annual growth rate:

| Year |

Portfolio Balance |

|---|---|

| 5 | $26,398 |

| 10 | $67,730 |

| 15 | $132,442 |

| 20 | $233,760 |

| 25 | $392,393 |

| 30 | $640,760 |

| 35 | $1,029,625 |

Calculations by author.

Under these conditions, it would take roughly 35 years for a monthly investment of $350 to exceed $1 million in value. Higher returns or increased contributions can shorten this timeline, but these figures provide a baseline for understanding potential growth.

Setting Realistic Goals for Investment Success

Moderating your growth rate assumptions enhances the chances of achieving your investment goals. If you meet your targets based on conservative growth expectations, you can exceed them if the actual returns are higher. More importantly, this method reduces the risk of disappointment stemming from overly optimistic projections.

By committing to a consistent investment strategy and placing funds into solid options like the Invesco QQQ Trust, you are likely to see tangible progress compared to not following a structured approach.

Is Now the Right Time to Invest $1,000 in Invesco QQQ Trust?

Before purchasing shares in Invesco QQQ Trust, keep this in mind:

The Motley Fool Stock Advisor team has recently highlighted what they consider the 10 best stocks to buy now, and Invesco QQQ Trust is not on that list. The recommended stocks could lead to exceptional returns in the coming years.

For instance, if Nvidia made this list on April 15, 2005, and you invested $1,000 then, that investment would be worth approximately $892,313 today!*

Stock Advisor offers a straightforward roadmap for investors, providing guidance on portfolio building, regular analyst updates, and two new stock recommendations each month. Since 2002, the Stock Advisor service’s performance has significantly outpaced the S&P 500’s return.*

Discover the 10 stocks »

*Stock Advisor returns as of November 4, 2024

Randi Zuckerberg, former director of market development at Facebook and sister of Meta Platforms CEO Mark Zuckerberg, serves on The Motley Fool’s board. David Jagielski does not hold positions in any mentioned stocks. The Motley Fool holds positions in and recommends Meta Platforms, Nvidia, and Tesla. Additionally, The Motley Fool recommends Nasdaq. For more details, please refer to their disclosure policy.

The views and opinions expressed herein reflect the author’s perspective and do not necessarily represent those of Nasdaq, Inc.