Investors Anticipate Growth: AI Powers Promising Returns in 2025

Analysts on Wall Street believe that 2025 will be a year of strong gains for the stock market. The S&P 500 is projected to rise by 9%, meaning investors could see a total return of 10.2% when dividends are included.

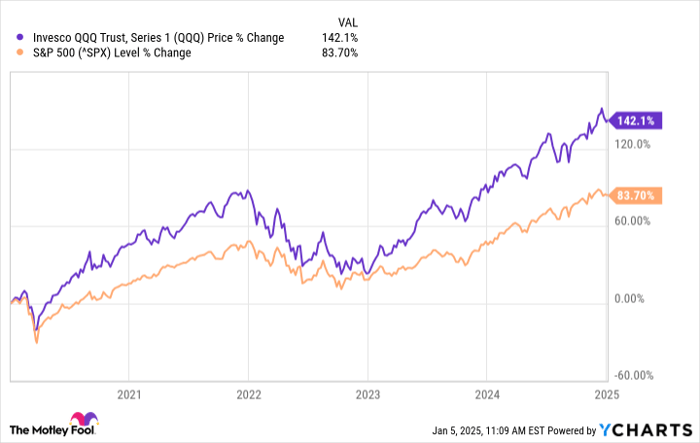

However, investments in artificial intelligence (AI) may yield even higher returns this year. According to forecasts from Wall Street, the Invesco QQQ Trust (NASDAQ: QQQ), which focuses on technology stocks, is expected to deliver a substantial 15.5% increase. When dividends and the ETF’s low expense ratio of 0.20% are taken into account, total returns could be close to 16%.

Stay Informed Every Morning! Get Breakfast news delivered to your inbox every market day. Sign Up For Free »

Image Source: Getty Images.

Let’s explore three major catalysts that could help the Invesco QQQ outperform the S&P 500 in 2025.

1. The Great Data Center Expansion

Leading technology companies are significantly increasing their computing capabilities. For example, Microsoft plans to invest $80 billion in AI-enabled data centers in fiscal year 2025, with more than half allocated for projects in the United States. This massive capital investment illustrates the considerable infrastructure needed to support advanced AI systems and reflects the ongoing tech competition between the U.S. and China.

According to industry projections, AI-ready data center capacity is expected to grow at an impressive annual rate of 33% until 2030. This growth will create persistent demand for hardware, software, and services from major players in the Invesco QQQ Trust, including Nvidia (NASDAQ: NVDA) and Microsoft.

The ongoing expansion of AI data centers is expected to be a significant trend for years to come, positioning the Invesco QQQ for continued outperformance compared to the broader market, like the S&P 500, in 2025.

QQQ data by YCharts

2. The Emergence of Agentic AI

The next phase of AI involves much more than just faster computers. Nvidia CEO Jensen Huang forecasts that 2025 will usher in a pivotal shift for AI in business, with new AI agents capable of automating nearly 50% of tasks across various roles, from customer service to supply chain management. This transformation from experimental to widely adopted technology could boost business spending on AI solutions.

Competition in this area is already intense. Salesforce has rolled out its Agentforce platform for automating business operations, while many other tech giants invest heavily in similar solutions. This rapid evolution promises strong revenue growth for the fund’s enterprise software leaders throughout 2025 and beyond.

3. The Rise of Physical AI

Humanoid robots are becoming reality rather than fantasy. Nvidia is set to launch Jetson Thor in early 2025—a new line of compact computers for advanced robots. The company is gearing up to support robot manufacturers globally, which will provide a new revenue channel alongside its core AI chip business.

What’s the importance for investors? The move into physical AI broadens the potential market for many of the fund’s leading companies. The robotics revolution can lead to diverse revenue opportunities for the Invesco QQQ Trust’s top tech stocks, from the components that drive these machines to the software that directs them.

Transforming Technology, Transforming Returns

The Invesco QQQ Trust gives investors focused exposure to companies at the forefront of these three significant trends. Though the technology sector can be volatile at times, the combination of substantial investments in data centers, the rise of agentic AI, and advancements in robotics are expected to create strong growth opportunities for 2025.

The major firms within this fund are investing billions in AI to preserve their competitive positions. With consensus predictions suggesting superior returns from these key trends, the Invesco QQQ Trust provides an efficient way for investors to benefit from this rapidly evolving landscape without the need to pick individual stocks.

Is Invesco QQQ Trust a Good Investment for You?

Before you decide to invest in the Invesco QQQ Trust, consider the following:

The Motley Fool Stock Advisor analyst team recently identified what they believe are the 10 best stocks currently available… and Invesco QQQ Trust was not included. The chosen stocks have the potential to deliver exceptional returns in the future.

Reflect on when Nvidia was included on this list on April 15, 2005… investing $1,000 then would have grown to $885,388!*

The Stock Advisor service provides an easy-to-follow path for investment success, including portfolio-building advice, timely updates from analysts, and two new stock picks each month. The Stock Advisor program has produced returns over four times that of the S&P 500 since 2002*.

See the 10 stocks »

*Stock Advisor returns as of December 30, 2024

George Budwell is invested in Microsoft and Nvidia. The Motley Fool holds positions in and recommends Microsoft, Nvidia, and Salesforce. The Motley Fool also endorses long January 2026 $395 calls and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are solely those of the author and do not necessarily represent those of Nasdaq, Inc.