Getting your feet wet in the expansive ocean of investing can feel like navigating uncharted waters. But fear not, you needn’t equip yourself with the financial equivalent of a sextant or astrolabe. Nope, when you’re dipping your toes into investments, simplicity reigns supreme.

If you’re treading into these unfamiliar waters, embarking on your maiden voyage, consider the tranquil simplicity of investing in Exchange-Traded Funds (ETFs). Picture them as the sturdy lifeboat that won’t leave you stranded at sea. And if you’re a novice looking for a buoy in the stormy seas of stock investment, cast your eyes upon the Vanguard S&P 500 ETF (NYSEMKT: VOO).

Decoding the S&P 500 Index

Imagine an index as a grand treasure chest, brimming with stocks meticulously curated by distinct criteria, akin to gems of a similar cut or color. The S&P 500 epitomizes such an index, tracking the mightiest 500 stocks adrift in the tumultuous seas of the U.S. stock market, gauged by their market capitalization.

Traversing Vast Terrains in a Single ETF

Behold the Vanguard S&P 500 ETF – a stalwart companion, offering a triumvirate of virtues: diversity, cost-effectiveness, and a time-tested track record. Any investor, whether green or seasoned, knows the value of spreading risks, much like planting your seeds in different soil.

The Vanguard S&P 500 ETF, akin to a well-diversified garden, nurtures 505 holdings sprawled across 11 sectors, each contributing to the tapestry of investment. No need for exhaustive searches through the stock market jungle; the S&P 500 serves as a loyal guide to the broader economic landscape.

Equipped with the Armor of Historical Returns

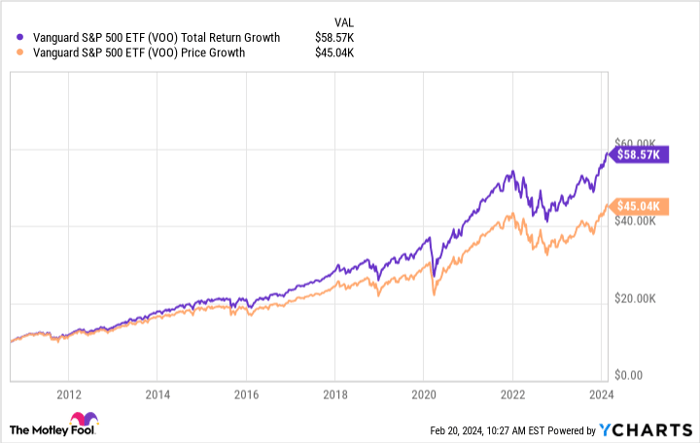

Since its inception in September 2009, the Vanguard S&P 500 ETF has fortified investors with total returns nearing 485%, cruising at an average annual return of approximately 14%. Visualize this journey as a thrilling roller coaster ride, its peaks and valleys a testament to the undulating stock market terrain.

Remember, investing is akin to a high-stakes poker game – a gambler’s paradise fraught with ups, downs, and hairpin turns. The Vanguard S&P 500 ETF, a reliable card in your deck, has shown a robust consistency in delivering value over time, a reassuring beacon in the mercurial waters of financial markets.

Unveiling the Veil of Fees

Amidst the sea of S&P 500 ETFs, the Vanguard S&P 500 ETF shines like a lighthouse, primarily due to its modest expense ratio – a fee so seemingly inconsequential, yet akin to the dripping of a faucet in the still of the night – a minor nuisance that accumulates into a considerable expense over time.

A mere 0.03% expense ratio embraced by the Vanguard vessel sets it apart from its competitors, such as the SPDR S&P 500 ETF Trust with a heftier 0.0945% expense ratio. These seemingly trivial differences transform into substantial financial deltas when compounded over time.

Oftentimes, the first step in investing resembles taking a leap off a diving board into murky waters, but remember, time is your most loyal companion in this voyage. Start early, start small, and don’t fret about knowing every nautical term; the experience will be worth its weight in gold in the long run.

Should you invest $1,000 in Vanguard S&P 500 ETF right now?

Before you dive headfirst into the Vanguard S&P 500 ETF, consider this sage advice:

The Motley Fool Stock Advisor analyst team has identified what they deem as the top 10 stocks to have in your treasure trove, each potentially yielding a bountiful return. While Vanguard S&P 500 ETF didn’t make their cut, these 10 stocks might just be the pearl in your oyster.

The Stock Advisor not only provides a roadmap for victory but also bestows upon you two new chests of stocks each month. Remember, their returns have blazed past the S&P 500 since 2002, an enticing offer for any intrepid investor.

*Stock Advisor returns as of February 20, 2024

Stefon Walters has positions in Vanguard S&P 500 ETF. The Motley Fool has positions in and recommends Vanguard S&P 500 ETF. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.