As we delve into the components underpinning the ETFs in our purview at ETF Channel, a compelling narrative unfolds. We juxtapose the trading price of each holding against the average analyst 12-month forward target price, culminating in the weighted average implied analyst target price for the ETF. For the Invesco S&P SmallCap 600 Revenue ETF (Symbol: RWJ), our analysis reveals an intriguing revelation – the implied analyst target price for the ETF stands solid at $45.96 per unit.

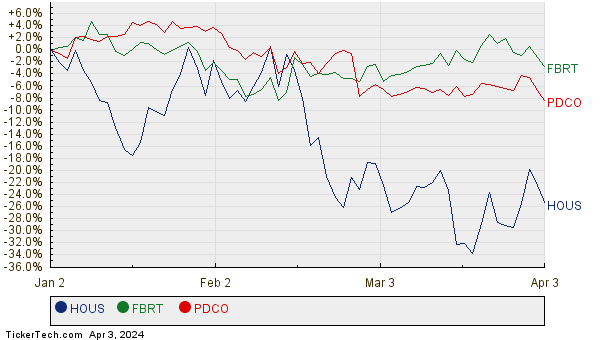

Against the backdrop of RWJ exchanging hands at approximately $41.51 per unit in recent trading sessions, analysts are pointing towards a promising 10.72% upside for this ETF against the backdrop of the average analyst targets of the underlying holdings. Among RWJ’s constituent holdings, Anywhere Real Estate Inc (Symbol: HOUS), Franklin BSP Realty Trust Inc (Symbol: FBRT), and Patterson Companies Inc (Symbol: PDCO) stand out with substantial upside potential to their respective analyst target prices. HOUS, currently priced at $5.70/share, basks in an optimistic glare with the average analyst target hovering 18.42% higher at $6.75/share. Similarly, FBRT boasts a notable 16.73% upside from its recent share price of $12.85, should the average analyst target price of $15.00/share be attained. PDCO, on the other hand, is expected by analysts to ascend to a target price of $30.60/share, representing a 15.87% premium over the recent price of $26.41. A glance at a twelve-month price history chart tracking the stock performance of HOUS, FBRT, and PDCO adds depth to this compelling narrative:

Here’s a concise table summarizing the current analyst target prices discussed above:

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| Invesco S&P SmallCap 600 Revenue ETF | RWJ | $41.51 | $45.96 | 10.72% |

| Anywhere Real Estate Inc | HOUS | $5.70 | $6.75 | 18.42% |

| Franklin BSP Realty Trust Inc | FBRT | $12.85 | $15.00 | 16.73% |

| Patterson Companies Inc | PDCO | $26.41 | $30.60 | 15.87% |

Are these analyst targets well-founded, or are they unduly sanguine about the future prospects of these stocks a year down the line? Do the analysts have a cogent rationale for their targets, or do they risk trailing behind the curve when it comes to recent industry developments? While a lofty price target vis-a-vis a stock’s prevailing trading price may signal optimism towards the future, it could also serve as a harbinger of impending downgrades if the targets are rooted in outdated assumptions. These queries beckon for further scrutiny and due diligence from investors.

![]() Explore 10 ETFs Showing the Most Potential Upside According to Analyst Targets »

Explore 10 ETFs Showing the Most Potential Upside According to Analyst Targets »

Dive Deeper:

• Delving Into Bargain Finds in the Stock Market

• Exploring Impact of JOEZ Holdings on Funds

• A Broader Look at WFC Options Trading

The insights articulated are solely the perspective of the author and do not necessarily mirror the views of Nasdaq, Inc.