“`html

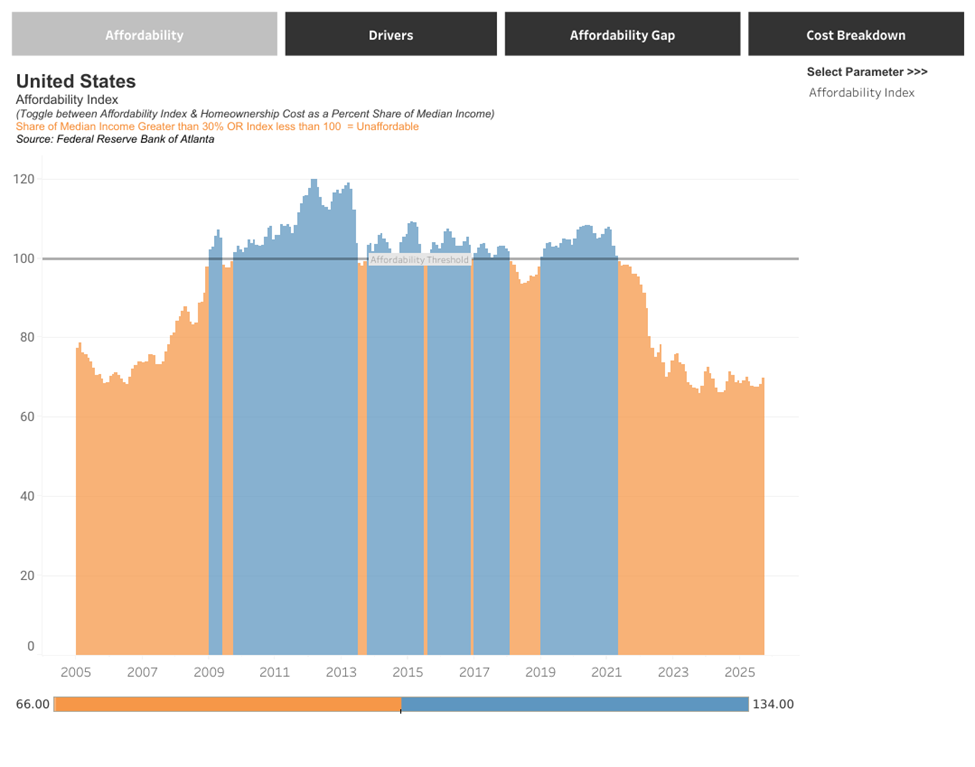

The U.S. housing market is facing a crisis, with a shortage of 4.7 million homes as of July 2025, according to Zillow. The affordability crisis is extreme, with average households now spending over 35% of their annual income on mortgage payments, compared to less than 25% in previous years. Currently, about 120,000 in annual income is required to afford the average home, while the median U.S. household income is approximately $80,000.

The Biden administration may declare a National Housing Emergency, as hinted by Treasury Secretary Scott Bessent in September. The administration is considering several interventions, including tariff relief on building materials, first-time buyer grants, expedited permitting processes, and potential use of federal land for housing development, to improve both supply and demand within the housing market.

Analysts suggest that if these measures are enacted, housing stocks could see significant gains, especially for homebuilders and housing-tech companies. Investors are advised to position themselves now as housing affordability continues to decline and potential policy shifts loom.

“`