“`html

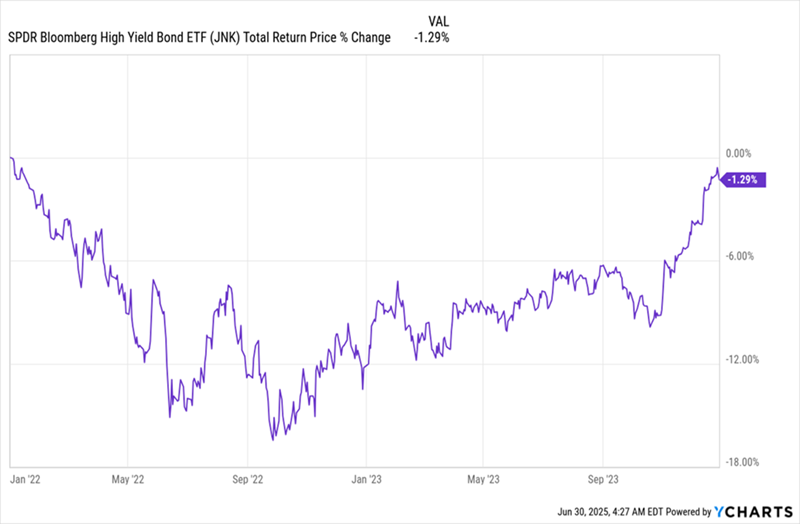

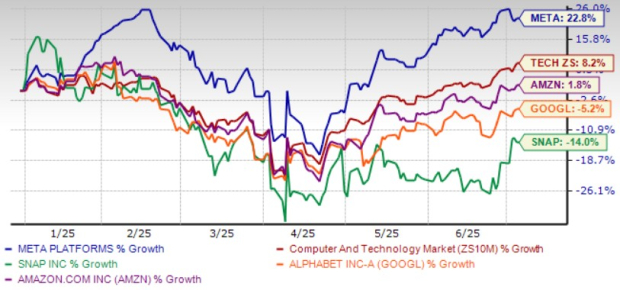

The fear of a wave of corporate defaults in the U.S. has been widespread; however, defaults have remained low, particularly in the high-yield corporate bond sector. The default rate for speculative-grade bonds has been declining, driven by solid corporate profits and a resilient economy. As of late 2023, key indices showed high-yield corporate bonds significantly outperforming the S&P 500, marking a departure from earlier fears.

According to the New York Federal Reserve’s Corporate Bond Market Distress Index, risk in the corporate-bond market is at a historic low. Corporate bonds have seen increased buying activity, pushing CEF discounts to an average of 4.1%, down from their typical 7.5%. One notable fund, the Western Asset Inflation-Linked Opportunities & Income Fund (WIW), offers an 8.6% yield and is positioned primarily in TIPS, minimizing exposure to corporate bond risks.

Since the COVID-19 pandemic, business-loan delinquencies have risen slightly to about 1.3% but remain historically insignificant. Economists expect further declines in default rates for the remainder of the year, enhancing the attractiveness of high-yield bonds as they have shown strong performance during 2025.

“`