The market rebounded Monday following the significant and much-needed pullback to start 2024. Stocks were more mixed on Tuesday as Wall Street waits for the start of fourth quarter earnings season later this week and the release of potentially key December inflation data.

The quick rebound helped both the S&P 500 and the Nasdaq climb right back above their 21-day moving averages. More investors are trying to get on the right side of a potential rally to new highs this year and no one wants to get left behind after many missed out on a large chunk of the 2023 run.

Finding Profitable Momentum Stocks

The screen we explore today aims to find Zacks Rank #1 (Strong Buy) stocks that boast strong upward price momentum to help investors buy potential winners in January and throughout 2024.

Unveiling the Screen Basics

The screen we are looking into today comes loaded with the Research Wizard. The screen helps investors dig through all of the Zacks Rank #1 (Strong Buy) stocks, of which there are over 200 at any given time, to find some of the top momentum names.

The screen narrows down the list of Zacks Rank #1 (Strong Buy) stocksto those with upward price momentum that are also trading within 20% of their 52-week highs. The screen then uses the PEG ratio and the Price to Sales ratio to help make sure investors are getting value as well. The screen then makes your life a little easier and narrows it down to just seven stock picks.

The screen basics are listed below…

· Zacks Rank = #1 (Strong Buy)

· Current Price/52-week High >= 0.8

· PEG Ratio: P/E F(1)/EPS Growth <= 1

· Price/Sales <= 3

· Percentage Change Price -12 Weeks = Top # 7

This strategy comes loaded with the Research Wizard and it is called bt_sow_momentum_method1 It can be found in the SoW (Screen of the Week) folder.

One of the Top Seven Stocks

The screen is pretty simple, yet powerful. Here is one of the seven stocks that made it through this week’s screen… Outside of DaVita, some of the other stocks that made the list were Stride (LRN) and Shift4 Payments (FOUR).

DaVita Inc. (DVA)

DaVita Inc. is one of the top providers of dialysis services in the U.S. The firm aims to serve patients suffering from chronic kidney disease and beyond. DaVita served approximately 200k patients at roughly 2,707 outpatient dialysis centers around the country, while also running around 350 outpatient dialysis centers in around 10 countries outside of the U.S. DVA’s services include outpatient dialysis services, hospital inpatient dialysis services, and ancillary services.

Analyzing DaVita’s Performance

Roughly 15% of U.S. adults are estimated to have chronic kidney disease, according to the CDC. DaVita is expanding its reach both within and outside of the U.S. The firm, like many healthcare companies, stands to benefit over the long haul from an aging population in the U.S. and elsewhere. DVA crushed our Q3 earnings estimates by 48%, marking its fourth-straight big bottom line beat.

Image Source: Zacks Investment Research

Zacks estimates call for its adjusted earnings to climb 22% in FY23 and another 5% in FY24 on the back of around 3% revenue expansion in both periods. DaVita’s adjusted earnings outlook has continued to improve over the last six-plus months to help it grab a Zacks Rank #1 (Strong Buy). DaVita’s Medical – Outpatient and Home Healthcare segment is in the top 16% of over 250 Zacks industries and it lands “A” grades for Value and Growth in our Style Scores system.

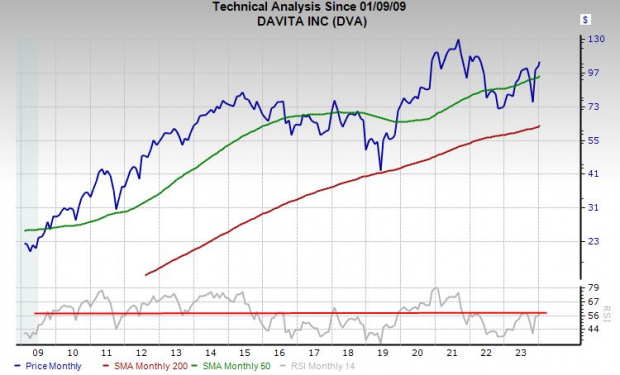

Diving into DaVita’s Financials and Stock Performance

DVA shares have climbed by 710% in the last 20 years to blow away the S&P 500’s 325%, including a 96% run during the past five years to outpace the benchmark. DaVita has soared 50% since the middle of October and it recently completed the golden cross, where the shorter-dated 50-day moving average climbs above the longer-dated trendline.

Image Source: Zacks Investment Research

DVA is currently trading solidly above its 50-month moving average again. Despite the rebound, DVA still trades nearly 20% below its 2021 records. Valuation-wise, DVA trades at a nearly 45% discount to its 10-year highs and the Zacks Medical sector at 12.8X forward 12-month earnings.

Click here to sign up for a free trial to the Research Wizard today.

Want more articles from this author? Scroll up to the top of this article and click the FOLLOW AUTHOR button to get an email each time a new article is published.

Zacks Investment Research: Propelling Portfolios Since 2000

Discover Exclusive Stock Picks

Starting today, you can get instant access to the latest picks from Zacks Investment Research’s time-proven screens. These screens have soared far above the market benchmark since 2000. While the S&P 500 averaged +6.2% per year, Zacks saw results like Small-Cap Growth +46.4%, Filtered Zacks Rank5 +49.5%, and Big Money Zacks +55.2%.

You’re invited to screen the latest stocks in seconds by trying Zacks’ Research Wizard stock-picking program. Or use the Wizard to create your own market-beating strategies. No credit card needed, no cost or obligation.

Download 7 Best Stocks for the Next 30 Days today to receive the latest recommendations from Zacks Investment Research.

Get your Free Stock Analysis Report on DaVita Inc. (DVA)

Read the full article on Zacks.com here.

Learn more about Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.