In the ever-evolving realm of stock markets, the S&P 500 is soaring to new heights, poised to bid farewell to February. With Q4 earnings behind us, the market exudes unwavering confidence in a soft landing scenario for the U.S. economy. The past week has seen Wall Street taking a well-deserved breather, awaiting the Fed’s crucial inflation data before charting its next move.

Irrespective of the PCE data’s verdict, it’s prudent to remember that a healthy market correction is lurking around the corner. When the downturn knocks, expect quick Wall Street rebounds as enthusiasts rally behind S&P 500 earnings, anticipated Fed rate cuts, and the growth and efficiency gains driven by revolutionary Artificial Intelligence.

Today, let’s delve into leveraging the Filtered Zacks Rank 5 Stock Screen to unearth potential gems for purchasing in March and embracing the promising landscape of 2024.

Discovering Zacks Rank #1 (Strong Buy) Stocks

Boasting superior performance during market ups and downs, Zacks Rank #1 stocks are a coveted lot. Yet, with over 200 stocks securing a Zacks Rank #1 at any given time, it’s essential to master the art of applying filters to zero in on a refined and actionable stock selection.

Key Parameters to Consider

Although this screen comprises only three criteria, collectively, they have the potential to deliver remarkable returns.

• Selection of Zacks Rank 1

Initiating with a Zacks Rank #1 can be a robust starting point, historically offering an average annual return exceeding 24.4% since 1988.

• Positive % Change (Q1) Est. over 4 Weeks

Reflecting recent upward revisions in the current quarter estimates over the past four weeks.

• Top # 5 in % Broker Rating Change over 4 Weeks

Identifying the top 5 stocks with the most favorable average broker rating adjustments over the recent four-week period.

Embark on this journey with the Research Wizard-equipped strategy known as bt_sow_filtered zacks rank5, nestled within the Screen of the Week (SoW) collection.

Dive into a Top Performing Stock: Cardinal Health

Positioned at the intersection of healthcare products distribution, Cardinal Health (CAH) rides the growth waves of pharmaceuticals, biotech, medical products, and the broader healthcare terrain. It navigates alongside a resilient industry spectrum, steering clear of the tumultuous boom-bust trajectory faced by niche innovators.

Recently eclipsing Q2 FY24 EPS estimates, Cardinal Health is painting a rosy picture for its future. The company is slated to record an 11% revenue upsurge this year, followed by an additional 8% sales spike next year, propelling it to a $245 billion revenue milestone. Furthermore, its adjusted earnings are forecasted to surge by 26% and 10% for the next two consecutive years.

Image Source: Zacks Investment Research

Offering a 1.8% dividend yield, Cardinal Health comes from the vibrant Medical – Dental Supplies sector, ranking among the top 30% within the pool of over 250 Zacks industries. The company is basking in renewed investor confidence post an activist investor push.

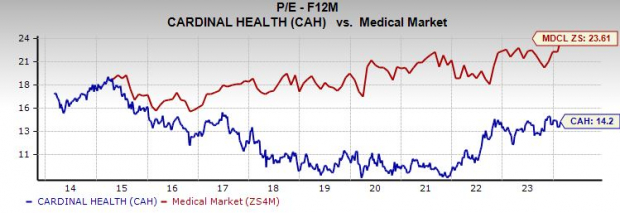

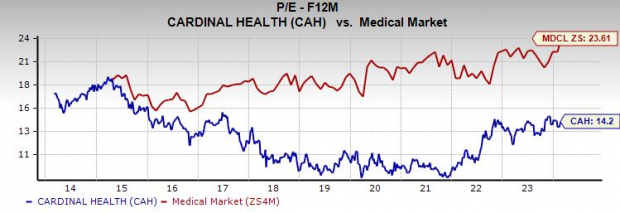

Over the last five years, CAH shares have surged by an astounding 100%, while its sector witnessed a staggering 5% decline, including a remarkable 45% spike in the past year, outflanking the S&P 500’s growth rate of 28%. Despite scaling all-time highs and outperforming its sector, Cardinal Health offers a tempting 40% discount against the Zacks Medical sector and trades at a 14% markdown compared to its peak over the past five years.

Entice your investment journey by exploring the remaining stocks on this list and seek out budding enterprises that align with these robust criteria. Simple yet effective, this screening process might unveil your next jackpot. Commence your quest for these potential winners today by availing a free trial to the Research Wizard. The future could hold your next profitable move.

Ready to embark on this promising journey? Sign up now for a free trial to the Research Wizard.

Eager for more insightful articles from this author? Give the FOLLOW AUTHOR button at the top of this article a click to stay informed about fresh publications.

Legal Disclaimer: Officers, directors, or employees of Zacks Investment Research may possess, sell short, or hold long/short positions in securities or options mentioned in this content. An affiliated investment advisory firm might also engage in similar transactions.

Legal Disclaimer: Detailed performance data concerning Zacks’ portfolios and strategies are accessible at: www.zacks.com/performance_disclosure

Zacks’ Super Screen

The performance of our top stock-picking screens may sound too good to be true, even to us at Zacks. Since 2000, while the market saw a yearly gain of +7.0%, one of our premier screens boasted an average annual return of +55.2%.

In fact, our top 10 screens significantly outperformed the market, delivering an average gain of +35.6%.

Unlock the Stocks Attracting Attention Today >> for Free

To continue reading this article on Zacks.com, click here.

The perspectives and expressions articulated herein represent the author’s stance, not necessarily reflecting those of Nasdaq, Inc.