Understanding the Crucial Impact of Trend on Portfolio Returns with Luke Lango

Imagine stumbling upon a captivating article about XYZ Stock that ignites your investment fervor.

After thorough research revealing a robust balance sheet, burgeoning earnings, and an attractive valuation, you take the plunge…

Only to find yourself staring at a 20% loss a month down the line.

Why the setback? What went wrong?

Your meticulously accurate analysis may have missed a critical aspect of investing…

The trend.

In this scenario, while your insights could be flawless, you might have overlooked the stock’s downward trajectory at the time of purchase.

Attempting to swim against the current often leads to financial detriment, a timeless truth in the realm of investing.

Forget the conventional wisdom, abstract models, and pundit advice for a moment.

Let’s focus on a straightforward query that could redefine your wealth: Are you aligning your investments with the prevailing trend or vainly resisting it?

Unlocking the Mysteries of Past Portfolio Disappointments

Newton’s First Law of Motion parallels investing, asserting that a stock in motion tends to maintain its trajectory until an external force intervenes.

The concept of “trend” is akin to this principle.

A stock often continues in the same direction until an external catalyst prompts a change. However, a “trend” isn’t inherently upward; it can oscillate in any direction, with sideways trends being the most prevalent.

According to Investopedia, markets trend upward or downward roughly 25% of the time, remaining within sideways trading ranges for the remaining 75%.

In essence, comprehending the prevailing trend remarkably simplifies the stock market landscape.

Given stocks trend upward merely 15% of the time, it elucidates why bullish analyses may falter in flat or declining markets.

Chances are, a retrospective of your losses would reveal a recurring theme – investing during flat, downward trends, or the twilight of an upward trend.

Simplifying Investment Strategies through Trend Analysis

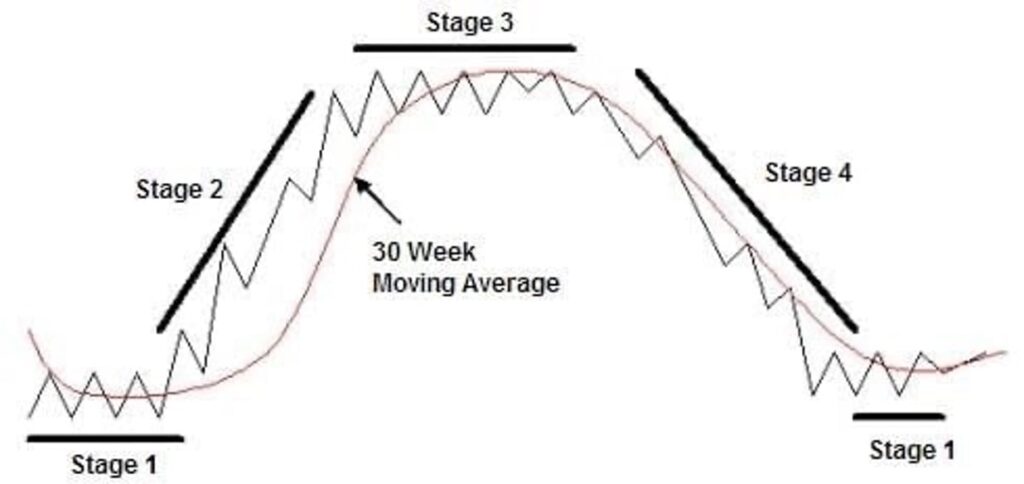

The awareness of trend dynamics has given rise to a strategic market philosophy – “stage analysis.”

Essentially, every stock is perpetually in one of four distinct stages: consolidation at a bottom, upward trajectory, consolidation at a peak, or a downtrend.

Stage analysis involves the meticulous identification of a stock’s current stage at any given juncture.

The crux of consistent substantial gains lies in pinpointing stocks on the brink of or already breaking out in Stage 2.

Conversely, evading substantial losses hinges on evading stocks transitioning to or entrenched in Stage 4 or meandering in Stages 1 or 3.

In essence, the quest is to minimize exposure to the 15% of the time when stocks trend positively.

The Bedrock of Luke Lango’s High Velocity Stocks Trading Strategy

Luke espouses this approach:

As a tech and quantitative analysis virtuoso, I’ve devised a proprietary quantitative model to unearth high-flying stocks in their nascent stages of ascent.

Our system leverages a core quantitative stage analysis technique to identify market’s most explosive stocks, capable of catapulting by hundreds of percentage points within weeks.

Adhering to stage analysis as the guiding light for lucrative trades significantly streamlines the process. Yet, there are instances where simplicity enhances even further…

Occasionally, a groundbreaking event, legislation, or avant-garde technology propels an entire sector into Stage 2, a monumental development. It’s one thing for an individual stock to flourish in a Stage-2 breakout, defying prevailing sectoral trends…

Unlocking the Fortunes of a Sector on the Rise

The Sector Riding a Wave of Momentum

Today, amidst the tumultuous sea of investments, there lies a sector basking in the warm, inviting breeze of prosperity. Luke beckons our attention to an industry brimming with the promise of monumental successes, standing tall alongside artificial intelligence and other notable sectors.

As the economic tides surge, propelling corporate profits to new heights, this high-growth sector finds itself at the pinnacle of progress. What powers this sector’s ascent, one may wonder? The surprising force behind its rise is none other than the U.S. government.

A significant legislative shift, as highlighted by Luke, has emerged as a game-changer, possibly one of the most pivotal in recent memory. This change, heralded by Section 3209, has the potential to unlock a treasure trove of wealth within a specific subset of artificial intelligence.

By overturning a long-standing federal law denounced as archaic and misguided, Section 3209 liberates this industry, paving the way for unprecedented growth and innovation. This transformation is monumental, marking a new dawn for the sector.

Maximizing Returns Through Market Awareness

When navigating the market’s winding paths, should investors align themselves with prevailing trends? For steadfast buy-and-hold enthusiasts with a long-term outlook, the answer may lean towards indifference. Patiently invested in blue-chip stocks, these individuals await the distant fruits of a perpetually rising tide, allowing time to outweigh temporary setbacks and sideways movements.

Conversely, those operating with shorter investment horizons, whether medium or short-term, stand to benefit greatly from trend analysis. The timing of market entries and exits, and consequently, one’s wealth, can be significantly influenced by the ebb and flow of trends.

A golden rule emerges: the briefer the investment duration expected, the more imperative it becomes to factor in prevailing trends prior to purchasing. While fundamental analysis holds merit, the ultimate truth lies in the price movement. A stock in continual decline signals danger for the short run, regardless of its fundamental robustness.

Conversely, a stock on a steadfast upward trajectory warrants attention. Ultimately, the only metric that concerns wealth accumulation is a sale price surpassing the purchase cost. Remember, in the realm of investments, a bullish trend serves as a faithful companion.

As Luke suggests, a particular sector currently boasts an overwhelmingly friendly and bullish trend. Don’t miss out on tonight’s opportunity to delve into the specifics.