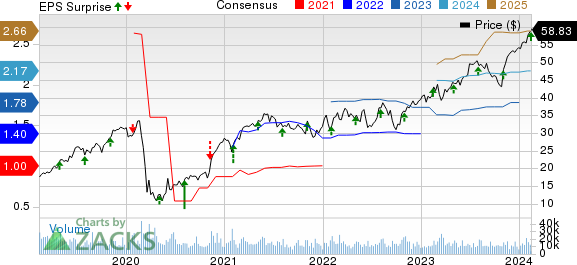

Howmet Aerospace Inc.’s (HWM) fourth-quarter 2023 financial report has sparked enthusiasm, beating expectations and showing significant growth. The aerospace giant’s adjusted earnings of 53 cents per share surpassed the Zacks Consensus Estimate of 46 cents, marking a 39.5% improvement compared to the previous year.

Moreover, Howmet’s total revenues of $1.73 billion outperformed the consensus estimate of $1.65 billion, reflecting a remarkable 14.4% increase year over year. The surge in revenues was propelled by an upturn in the commercial aerospace market, signifying a strong resurgence in the industry.

Positive Performance in Key Segments

The Engine Products segment recorded a revenue increase of 16%, attributing to growth across commercial aerospace, defense aerospace, industrial gas turbine, and oil and gas markets. Likewise, revenues from the Fastening Systems segment skyrocketed by 26% due to the expansion in the commercial aerospace market, including the recovery of emerging wide-body aircraft and the commercial transportation sector.

Additionally, the Engineered Structures segment observed a 6% revenue surge, driven by growth in the commercial aerospace market. The Forged Wheels segment experienced a 3% increase in revenues, largely due to the upswing in the commercial transportation market.

Stable Margin Profile and Financial Position

Despite increased costs of goods sold and selling, general, administrative, and other expenses, Howmet’s adjusted EBITDA surged by 23.6% year over year, demonstrating a robust margin increase of 170 basis points to 23.6%. The company’s operating income also witnessed a substantial rise of 48.2% compared to the previous year. Furthermore, a decline in net interest expenses indicated a favorable financial position.

Robust Cash Flow & Optimistic Outlook

Howmet’s strong cash flow from operating activities in 2023, totaling $901 million, exemplifies the company’s financial resilience and efficient capital management. The company has forecasted a positive outlook for the first quarter of 2024, with anticipated revenues of $1.73-$1.75 billion and a mid-point adjusted earnings per share above the consensus estimate.

For the entire year of 2024, Howmet predicts revenues of $7.0-$7.2 billion, adjusted EBITDA of $1.60-$1.67 billion, and a free cash flow ranging from $700-$770 million, highlighting its bullish long-term prospects.

Comparison with Other Industry Players

Amid a vibrant market environment, Howmet’s stellar performance is further accentuated when compared to other industry peers. The company’s robust financial results exhibit its robust position in the aerospace and engineering sector, contributing to overall industry growth and stability.

The Meteoric Rise of Semiconductor Stocks: A Financial Perspective

Semiconductors, the unsung heroes of the tech world, are on a trajectory that should make investors sit up and take notice. Recent projections suggest that the global semiconductor industry is set to skyrocket from $452 billion in 2021 to a whopping $803 billion by 2028. The rise of semiconductor stocks has been nothing short of breathtaking, offering a promising outlook for investors seeking growth opportunities in the tech sector.

The Growth Trajectory

Over the years, the semiconductor industry has carved out a pivotal role in powering the digital revolution. As technological advancements continue to unfold at a rapid pace, semiconductors have become indispensable across a spectrum of applications, from consumer electronics to industrial automation. This relentless march of innovation has been a key driver behind the industry’s remarkable growth trajectory.

According to industry analysts at Nasdaq, Inc., the surge in demand for semiconductors is underpinned by a confluence of factors, including the proliferation of IoT devices, the transition to 5G networks, and the burgeoning deployment of artificial intelligence. This robust demand landscape has been a boon for semiconductor stocks, propelling them into the investment spotlight.

Investment Potential and Opportunities

With the semiconductor industry poised for substantial expansion, investors are understandably keen to capitalize on this trend. Prominent companies such as Illinois Tool Works Inc. (ITW), Tetra Tech, Inc. (TTEK), A. O. Smith Corporation (AOS), and Howmet Aerospace Inc. (HWM) are garnering attention as prime candidates for investors seeking exposure to the burgeoning semiconductor sector. These companies are positioned to leverage the industry’s growth momentum, offering compelling investment potential as they navigate the technological landscape with innovative solutions.

The ascent of semiconductor stocks is drawing widespread interest, with market players closely monitoring the latest developments and earnings reports for opportunities to seize favorable positions. Notably, Howmet Aerospace Inc. recently reported fourth-quarter earnings that surpassed estimates, accompanied by a substantial year-over-year increase in revenues, reflecting the underlying strength of semiconductor-related activities. The implications of such trends are not lost on investors seeking to align their portfolios with the evolving dynamics of the tech sector.

Key Takeaways for Investors

As the semiconductor industry hurtles toward unprecedented expansion, it behooves investors to stay attuned to the burgeoning vistas of opportunity. The current climate is replete with potential for astute investors to ride the wave of semiconductor growth and position themselves advantageously in the market. While the past has shown us the remarkable capacity of the semiconductor industry to adapt and thrive, the future offers an even more compelling narrative.

In conclusion, the meteoric rise of semiconductor stocks presents an enticing tableau for investors, brimming with potential and promise. Seizing the opportunities that lie ahead, investors can chart a course for success in the ever-evolving landscape of technology and innovation. As the semiconductor industry gears up for an era of unparalleled growth, investors have a front-row seat to witness the unfolding of a transformative narrative in the realm of high-tech investments.