When it comes to HP Inc. (HPQ), forget the quirkier HP Enterprises (HPE) siblings. The hardware giant recently set tongues wagging by revealing robust guidance on February 28. The FY free cash flow forecast for this fiscal year, set to conclude on Oct. 31, sparked a wave of optimism. As a result, the value of HPQ stock is poised to climb between 14% to 19.5%. Such a promising outlook has piqued interest, particularly for existing shareholders eyeing it as an income play.

These revelations were penned and predicted in a recent Barchart article on Feb. 28. Its title? “Unusual Put Options Activity Today for HP Inc Ahead of Its Earnings Highlights Its Value.” With HPQ at $28.96 then, the proposal came to sell short the April 19 expiration $25.00 strike put options. At the time, these puts were trading at a modest 22 cents, yielding a mere 0.88% for short-term speculators.

Fast forward to today, with HPQ comfortably perched at $29.82 per share. Those once-coveted puts now trade at a meager 4 cents midprice. This signals a successful trade already for savvy investors looking to capitalize on the wave of success.

As HP’s recent earnings report and free cash flow (FCF) guidance dance in investors’ minds, the allure of shorting near-term expiry puts grows. The narrative surrounding HP’s Free Cash Flow Guidance takes center stage.

A Dive into HP’s Free Cash Flow Guidance

The latest quarterly report ending Jan. 31 painted a conservative picture, with HP claiming a meager $25 million in FCF. However, the fiscal year climaxing on Oct. 31 holds more optimistic promises. The company foresees a wholesome $3.1 billion to $3.6 billion in free cash flow.

With analysts predicting $53.66 billion, a mid estimaion hovers around $3.4 billion, culminating in an FCF margin of approximately 6.33%. If the market mirrors a 10% FCF yield, HPQ’s market cap could soar to $34 billion ($3.4b/0.10), marking a tantalizing 14% increase above its current market cap of $29.77 billion.

The future forecasts are equally rosy. Next year’s revenue projects a mighty $55.6 billion. Extrapolating a 6.4% FCF margin, FCF could elevate to $3.558 billion. Following a 10% FCF yield, HPQ stock’s potential ascension to a value of $35.58 billion looms large, clocking a 19.5% growth surge beyond the current market cap.

Thus emerges a range in the stock’s valuation, beckoning between 14% to 19.5% higher, equating to $34.00 to $35.64 per share. The clarion call to short near-term expiry out-of-the-money (OTM) put options for additional income grows louder.

Delving into Shorting OTM Puts for Income

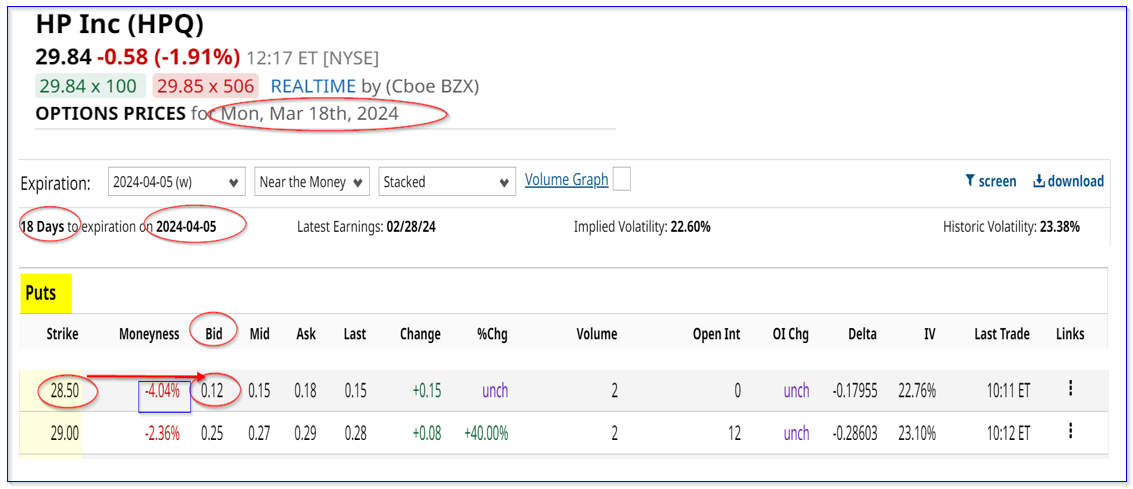

As an illustration, the expiration cycle culminating on April 5, a mere three weeks away, paints an intriguing picture. The $28.50 strike price, currently trading 4.00% under today’s price, fetches 12 cents on the bid side, offering a yield of 0.60% ($0.17/$28.50).

For the risk-takers, the $29.00 strike price puts sell for 25 cents. Positioned 2.36% below today’s price, they boast a yield of 0.86%.

This strategy is not without its perils. Investors should tread cautiously, as the cash secured to fund these shorts may be exercised should the stock slide to $29 or $28.50 over the next 3 weeks. In such an eventuality, they would be compelled to acquire shares at the strike prices they had shorted.

One workaround could involve vending further out expiration strike prices. For instance, as per the April 19 expiration, the $27.50 strike price puts command an 11-cent bid. Despite being 7.84% under today’s price, they still wield a yield of 0.40%.

The takeaway? HPQ sports an air of undervaluation, a sentiment amplified by the resonant free cash flow guidance. Thus, it stands to reason that shorting out-of-the-money put options seems a prudent move for extra income, especially for those already in the HPQ fold.

Feast on More Stock Market News from Barchart

As of the date of publication, Mark R. Hake, CFA had no positions directly or indirectly related to the securities discussed in this piece. The information and data presented herein are meant solely for informative purposes. Find Barchart’s Disclosure Policy here for further details.

Opinions expressed in this piece solely belong to the author and may not necessarily mirror those held by Nasdaq, Inc.