HP Inc. Faces Market Struggles Amid Modest Growth Expectations

Palo Alto, California-based HP Inc. (HPQ) stands as a prominent provider of PCs and other hardware devices, such as printers and hard drives. With a market capitalization of $24.5 billion, HP’s operations extend across the Americas, Indo-Pacific, and EMEA regions.

Recent Stock Performance

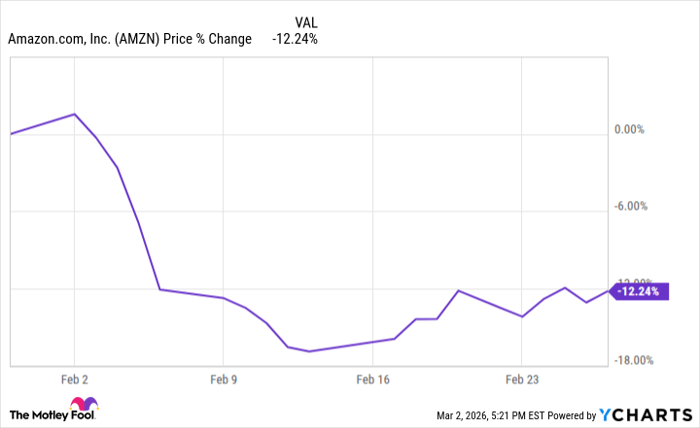

Over the past year, HP has significantly underperformed the overall market. HP’s stock has plunged 8.1% in the last 52 weeks and 20.6% year-to-date (YTD), contrasting sharply with the S&P 500 Index’s ($SPX) 10.2% gains over the same period and a modest 3.9% dip in 2025.

Focusing specifically on sector performance, HP has lagged behind the Technology Select Sector SPDR Fund’s (XLK) 6.4% gains over the past year and 7.3% decline YTD.

Q1 Results and Financial Overview

HP’s stock prices dropped 6.8% following the release of its Q1 results on February 27. The company reported modest growth in both products and services revenue, leading to an overall topline increase of 2.4% year-over-year, totaling $13.5 billion. Operating cash flows rose to $374 million, up from $121 million in the same quarter last year. However, rising costs—in terms of COGS and SG&A expenses—outpaced revenue growth, resulting in a 9.6% year-over-year decline in operating income, which reached $845 million, falling short of analysts’ earnings estimates.

Encouragingly, HP anticipates a notable improvement in cash flows. The company forecasts that its fiscal 2025 free cash flow will be between $3.2 billion and $3.6 billion, marking a projected 6.3% year-over-year growth at the midpoint when compared to fiscal 2024.

Analyst Outlook and Ratings

For fiscal 2025, which concludes in October, analysts predict a slight growth in earnings to $3.39 per share. While the company has exceeded analysts’ earnings expectations once in the past four quarters, it has missed projections on three occasions.

The stock currently holds a “Moderate Buy” rating. Of the 14 analysts covering HP, the ratings include four “Strong Buys,” nine “Holds,” and one “Strong Sell.”

This assessment has remained stable over recent months. On April 28, Evercore ISI analyst Amit Daryanani maintained an “Outperform” rating on HP but adjusted the price target down from $40 to $32.

HP’s mean price target stands at $33, suggesting a 27.4% premium to current prices, while its highest target of $44 indicates a potential upside of 69.9%.

On the date of publication, Aditya Sarawgi did not hold (either directly or indirectly) positions in any of the securities mentioned in this article. All information in this article is for informational purposes only. For further information, please view the Barchart Disclosure Policy here.

The opinions expressed herein are those of the author and do not necessarily reflect the views of Nasdaq, Inc.