Hewlett Packard Enterprise Faces Significant Stock Decline Amid Market Challenges

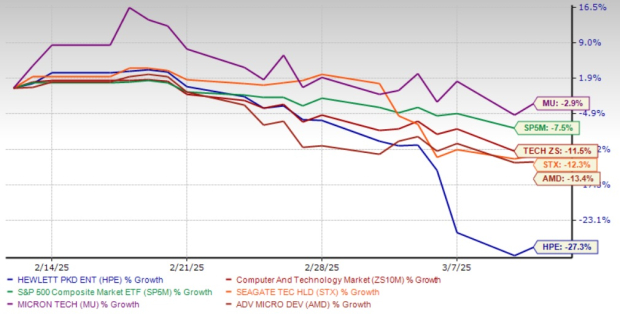

Hewlett Packard Enterprise (HPE) has experienced a steep decline of 27.3% in the past month, significantly underperforming compared to the Zacks Computer and Technology sector’s drop of 11.5% and the S&P 500 index’s decrease of 7.5%. Additionally, HPE’s decline exceeds that of industry competitors such as Micron Technology (MU), Seagate Technology (STX), and Advanced Micro Devices (AMD). This sharp downturn has raised investor concerns, leading many to question whether they should retain their positions in HPE or cut their losses.

Recent Price Performance Overview

Image Source: Zacks Investment Research

Factors Contributing to HPE’s Stock Decline

HPE’s recent stock drop is largely a consequence of overall market weakness, driven by heightened concerns surrounding the trade war. Increasing tariffs have raised worries about potential cost escalations for companies like HPE, which operates manufacturing facilities across numerous countries, notably China and Mexico.

The U.S. government has raised tariff rates to 25% on all goods imported from China and Mexico, which could have adverse effects on HPE products and components such as servers, storage devices, and networking equipment manufactured or sourced from these countries.

Further compounding investor anxiety, HPE’s fiscal first-quarter earnings fell short of expectations due to unexpected pricing pressures stemming from aggressive discounting on traditional servers. Additionally, the normalization of post-pandemic demand in its high-margin Intelligent Edge business has created a more pessimistic outlook for HPE stock.

Regulatory Challenges Impacting HPE’s Growth

Another significant issue has arisen from the U.S. Department of Justice (DOJ), which is hindering HPE’s efforts to acquire Juniper Networks. This acquisition is critical for HPE as it aims to enhance its networking capabilities and provide next-generation AI-driven networking solutions.

The DOJ’s lawsuit is based on concerns that combining HPE and Juniper would reduce competition in the networking market by limiting the number of market players. As the acquisition faces ongoing delays due to regulatory challenges, the associated costs are expected to rise. In its annual filing for fiscal 2024, HPE indicated that charges related to acquisitions increased by $135 million, primarily attributed to the costs connected to the pending Juniper acquisition. Such rising costs are likely to affect HPE’s earnings potential going forward. The Zacks Consensus Estimate forecasts HPE’s fiscal 2025 earnings at $2.04 per share, representing a modest 2.6% growth year-over-year.

Notably, HPE managed to surpass the Zacks Consensus Estimate for earnings in three of the last four quarters, missing on one occasion with an average surprise of 5.7%.

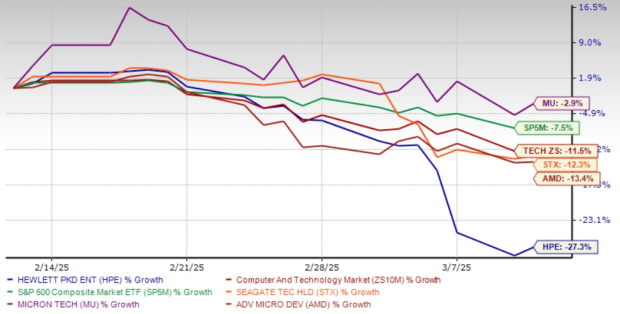

Hewlett Packard Enterprise Price Trend Analysis

Hewlett Packard Enterprise Company price-consensus-eps-surprise-chart | Hewlett Packard Enterprise Company Quote

Technical Indicators Signal Bearish Outlook

Currently, HPE shares are trading below both the 50-day and 200-day moving averages, which suggests a bearish trend in the stock’s performance.

Image Source: Zacks Investment Research

Conclusion: Current Recommendation for HPE Stock

HPE continues to contend with pressures from tariffs, rising operational costs, and reduced revenue in its high-margin divisions. Additionally, ongoing regulatory hurdles from the DOJ are complicating the integration of Juniper Networks and increasing acquisition expenses.

Taking these factors into account, investors are advised to reconsider their positions. With a Zacks Rank of #4 (Sell), it is currently advisable to avoid HPE stock.

For further insights, you can view the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Five Stocks with High Growth Potential

These stocks were carefully selected by a Zacks expert as the top picks with the potential to double in value in 2024. Past recommendations have generated impressive returns, ranging from +143.0% to an astonishing +673.0%.

Many of the stocks in this report remain under the radar of Wall Street, providing an excellent opportunity for early investment.

Today, explore These 5 Potential High Performers >>

Looking for the latest recommendations from Zacks Investment Research? You can download the 7 Best Stocks for the Next 30 Days. Click to access this free report.

Advanced Micro Devices, Inc. (AMD): Free Stock Analysis report.

Seagate Technology Holdings PLC (STX): Free Stock Analysis report.

Micron Technology, Inc. (MU): Free Stock Analysis report.

Hewlett Packard Enterprise Company (HPE): Free Stock Analysis report.

This article originally appeared on Zacks Investment Research (zacks.com).

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.