HSBC Boosts Labcorp Holdings Outlook to ‘Buy’

On October 30, 2024, HSBC raised Labcorp Holdings’ (NYSE:LH) stock outlook from Hold to Buy.

Analysts Predict Significant Price Growth

As of October 22, 2024, analysts project an average one-year price target for Labcorp Holdings at $259.08 per share. This estimate is based on a range that spans from a low of $232.30 to a high of $296.10. Notably, this average target suggests a potential increase of 12.36% from the stock’s most recent closing price of $230.59.

This price target places Labcorp among companies enjoying a substantial upside. Investors and analysts will be watching closely.

Labcorp’s Revenue and Earnings Outlook

Labcorp Holdings is projected to see an annual revenue of $16,214 million, marking a significant growth of 27.54%. The expected non-GAAP earnings per share (EPS) stands at 20.12.

Increased Institutional Interest

Reportedly, 1,566 funds and institutions currently hold positions in Labcorp Holdings, a notable increase of 306.75% as compared to the previous quarter. The average portfolio weight of these funds dedicated to Labcorp is 0.30%, up 33.01%. Over the last three months, total shares owned by institutions surged by 663.69%, reaching 88,534K shares.

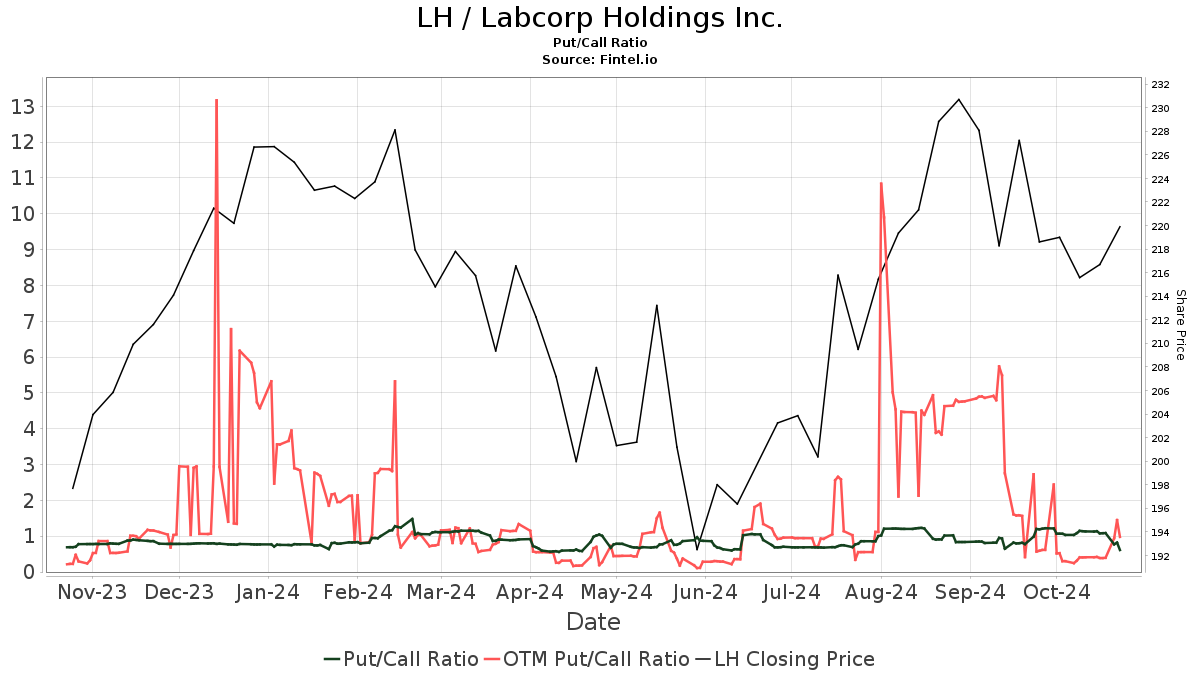

With a put/call ratio of 0.90, the outlook for Labcorp remains bullish among investors.

Major Shareholders’ Stakes

Key shareholders include:

- VTSMX – Vanguard Total Stock Market Index Fund Investor Shares with 2,652K shares, accounting for 3.16% ownership.

- Wellington Management Group Llp, holding 2,227K shares or 2.66% of the company.

- VFINX – Vanguard 500 Index Fund Investor Shares with 2,163K shares, which equals 2.58% ownership.

- Geode Capital Management, owning 1,951K shares or 2.33%.

- Diamond Hill Capital Management with 1,950K shares, also representing 2.33% ownership.

About Laboratory Corporation of America Holdings

(This description is provided by the company.) Labcorp is a leading global life sciences company that delivers critical information to assist doctors, hospitals, pharmaceutical companies, researchers, and patients in making informed decisions. With over 70,000 employees serving customers in more than 100 countries, Labcorp reported revenue of $14 billion in FY2020.

Fintel serves as a comprehensive investing research platform for individual investors, traders, financial advisors, and small hedge funds. Our extensive data covers global fundamentals, analyst reports, ownership data, fund sentiment, options sentiment, insider trading, options flow, and several other factors, aiming to enhance investment decisions and profits.

Click to Learn More

This story originally appeared on Fintel.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.