HSBC Elevates TechnipFMC to ‘Buy’ as Institutional Interest Grows

On October 29, 2024, HSBC made a significant decision, upgrading their rating for TechnipFMC (BRSE: FTI) from Hold to Buy.

Fund Sentiment on the Rise

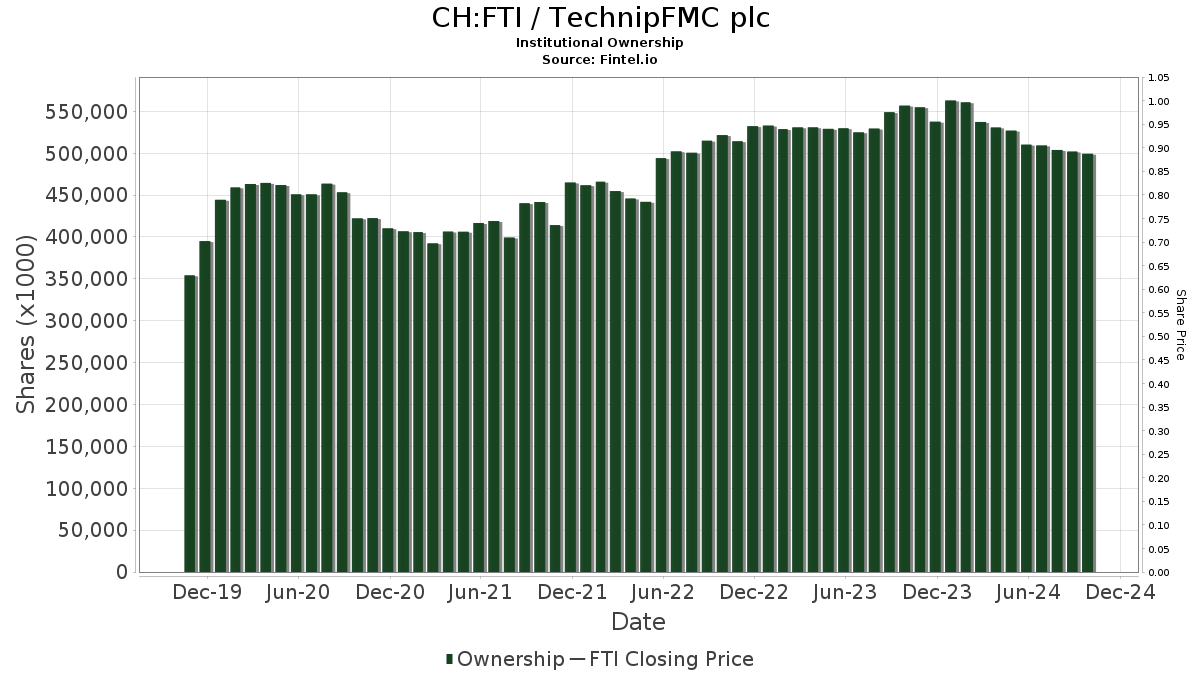

A total of 961 funds or institutions are currently invested in TechnipFMC, marking an increase of 35 owners or 3.78% in the last quarter. The average portfolio allocation to FTI across these funds stands at 0.43%, which is up by 5.21%. However, total shares held by institutions have seen a decline over the last three months, decreasing by 1.49% to 496,154K shares.

Insights from Other Shareholders

Price T Rowe Associates now owns 49,640K shares, accounting for 11.67% of TechnipFMC. Previously, the firm reported ownership of 40,595K shares, indicating an 18.22% increase. Additionally, its portfolio allocation in FTI rose by 24.33% last quarter.

T. Rowe Price Investment Management holds 39,988K shares, which is 9.40% ownership. Their previous reporting showed ownership of 40,496K shares, representing a slight decline of 1.27%. Nevertheless, this firm increased its portfolio allocation in FTI by 6.08% over the last quarter.

Meanwhile, J.P. Morgan Chase owns 23,262K shares, which means a 5.47% stake. Previously, they reported holding 24,511K shares, which is a decrease of 5.37%. Their portfolio allocation in FTI saw a drastic reduction of 84.97% last quarter.

The T. Rowe Price New Horizons Fund (PRNHX) increased its holdings to 17,921K shares, equating to 4.21% ownership, up from 13,426K shares, or a 25.08% increase. Their portfolio allocation in FTI surged by 61.76% over the last quarter.

Ameriprise Financial also slightly increased its stake, owning 14,657K shares, which is 3.45% of the company. They previously reported holdings of 14,087K shares, reflecting a small rise of 3.89%. However, their overall allocation in FTI decreased by 80.72% over the past quarter.

Fintel provides comprehensive investing research for individual investors, traders, financial advisors, and small hedge funds. Their extensive data set covers fundamentals, analyst reports, ownership data, fund sentiment, and more, offering tools for enhanced investment decisions.

This report originally appeared on Fintel.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.