HSBC Lowers Align Technology Outlook to Hold Amid Shareholder Adjustments

On April 25, 2025, HSBC revised its outlook for Align Technology (BMV: ALGN) from Buy to Hold.

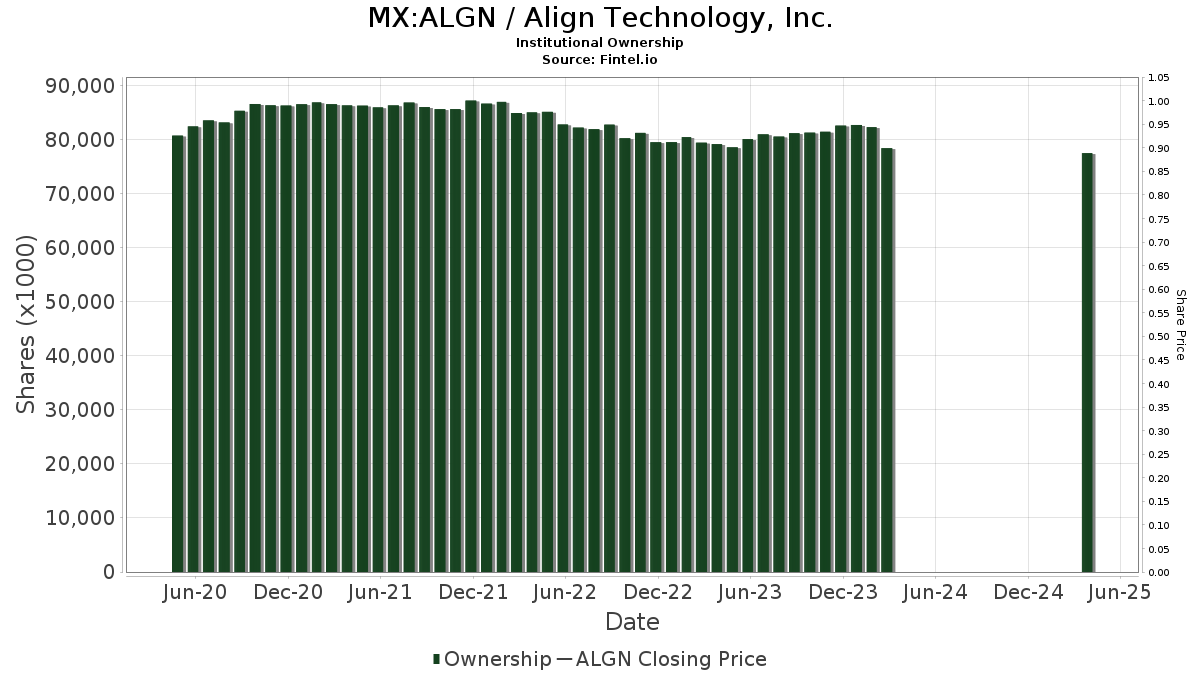

What are Other Shareholders Doing?

Wellington Management Group LLP holds 2,385K shares, accounting for 3.26% ownership in the company. Previously, it reported owning 2,635K shares, indicating a decrease of 10.47%. The firm has reduced its portfolio allocation in ALGN by 22.40% over the last quarter.

The Vanguard Total Stock Market Index Fund Investor Shares (VTSMX) holds 2,215K shares, reflecting 3.03% ownership. In its last filing, the fund reported owning 2,250K shares, a decrease of 1.59%. Its portfolio allocation in ALGN decreased by 20.47% in the last quarter.

T. Rowe Price Investment Management oversees 1,972K shares or 2.69% ownership. In the preceding filing, it reported 1,982K shares, indicating a decrease of 0.51%. Its portfolio allocation in ALGN has declined by 16.55% over the last quarter.

The Vanguard 500 Index Fund Investor Shares (VFINX) holds 1,900K shares, representing 2.59% ownership. Its prior filing indicated ownership of 1,839K shares, which shows an increase of 3.19%. However, its portfolio allocation in ALGN decreased by 19.88% over the last quarter.

Geode Capital Management retains 1,790K shares, translating to 2.45% ownership. Previously, it reported owning 1,751K shares, reflecting an increase of 2.19%. Its portfolio allocation in ALGN has seen a significant decline of 57.74% over the last quarter.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.