HSBC Upgrades Waste Management Outlook to Buy with Promising Growth Forecast

Fintel reports that on April 25, 2025, HSBC upgraded their outlook for Waste Management (XTRA:UWS) from Hold to Buy.

Analyst Price Forecast Indicates Potential Growth

As of April 24, 2025, the average one-year price target for Waste Management is €214.90 per share. Projections vary, with a low of €171.19 and a high of €241.05. This average target represents a 6.62% increase from its latest closing price of €201.55 per share.

Revenue and Earnings Projections

The projected annual revenue for Waste Management is €23.923 billion, indicating an increase of 8.43%. Additionally, the projected annual non-GAAP EPS is €7.86.

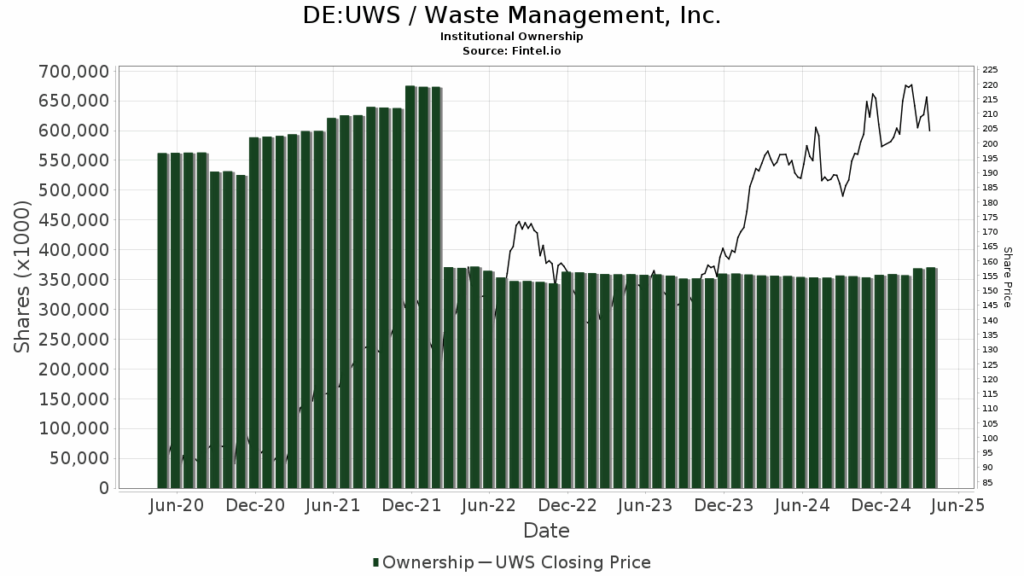

Fund Sentiment Overview

Currently, 3,021 funds or institutions hold positions in Waste Management. This marks an increase of 167 funds, or 5.85%, over the last quarter. The average portfolio weight of all funds dedicated to UWS is 0.38%, reflecting an increase of 0.64%. In the past three months, total shares owned by institutions grew by 3.00%, reaching 368.072 million shares.

Shareholder Movements

The Bill & Melinda Gates Foundation Trust maintains 32.234 million shares, representing 8.01% ownership. There has been no change in this position over the last quarter.

Vanguard Total Stock Market Index Fund (VTSMX) holds 12.570 million shares, accounting for 3.12% ownership. This is a decrease from the previous 12.717 million shares, reflecting a drop of 1.17%. The firm’s portfolio allocation to UWS decreased by 5.32% this quarter.

Vanguard 500 Index Fund (VFINX) reports 9.887 million shares, or 2.46% ownership, up from 9.565 million shares, indicating a 3.26% increase. However, the firm’s allocation in UWS has dropped by 4.94% over the last quarter.

Geode Capital Management holds 8.210 million shares, representing 2.04% ownership, an increase from 8.146 million shares, marking a growth of 0.78%. Still, the firm’s portfolio allocation to UWS fell significantly by 50.58% in the last quarter.

Parnassus Investments increased its holdings to 6.272 million shares, representing 1.56% ownership. This marks an 18.36% increase from the prior 5.121 million shares, with a portfolio allocation boost in UWS of 24.66% over the last quarter.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.