This article was coproduced with Chuck Walston.

With a market cap of $62 billion, Humana (NYSE:HUM) is the fifth-largest player in the healthcare plans industry.

As November drew to a close, an announcement that Cigna (CI) was seeking to acquire Humana tanked the shares of both companies. Although Humana’s stock has recovered a bit, it still sits near a 52-week low.

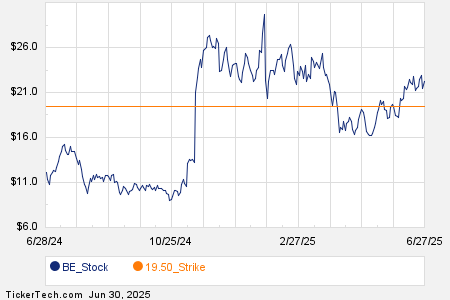

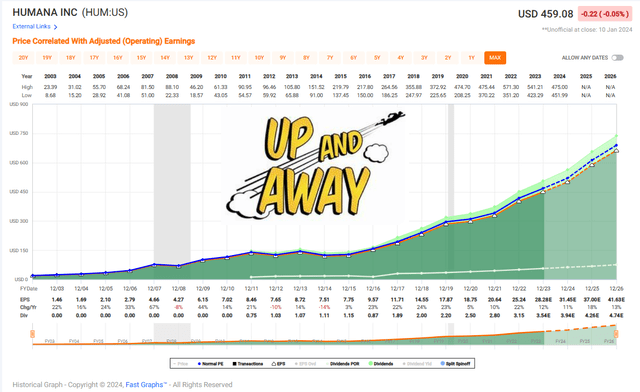

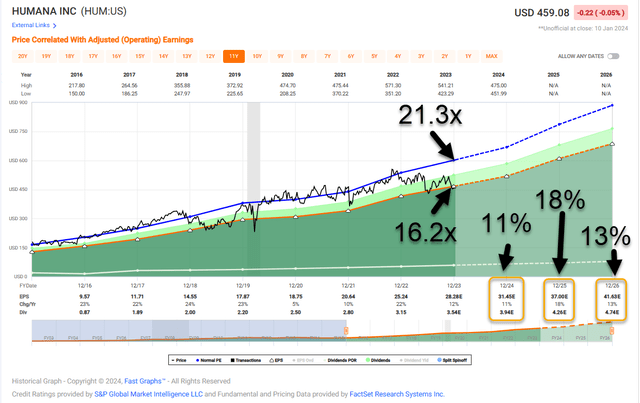

Graph showing years of consistent profits are just a false instinct. Humana was consistently performing as a moneymaker and was showing growth in memberships.

Fast-forward. Humana was posting a 13% increase in revenue, along with a staggering 15.9% revenue increase, each a clear embodiment of financial success.

But much to the dismay of investors, a rise in medical costs brought a storm of criticism directed at Humana.

Despite these rocky waters, Humana reaffirmed its growth guidance and projected a significant increase in annual membership. A beacon of hope, amidst the turmoil.

Recent Results Reveal Strong Growth

For the second quarter, HUM posted revenue of $26.8 billion, a 13% increase year over year, along with EPS of $7.66, up $5.48 from the comparable quarter.

That was followed on the first day of November by Q3 2023 results. Humana posted a double beat with adjusted EPS of $7.78 surpassing consensus of $0.61.

Revenue also increased year over year by 15.9%, hitting $26.42 billion. That metric also beat analysts’ estimates by $840 million.

However, increased utilization affected HUM’s insurance segment. The firm’s benefit-expense ratio, which measures the percentage of payouts on claims compared to its premiums, increased to 87.4% from 85.5% in the comparable quarter.

Following management’s revelation that Humana expected higher medical costs in its Medicare Advantage business, the shares fell by 6%. This also led to revised guidance for growth at the lower end of the prior targeted long-term range of 11% to 15% in 2024.

Recognizing the increased utilization we have now seen in 2023 and prudently assuming this level of utilization continues into 2024, we currently anticipate growth at the low end of this range.

CFO Susan Diamond

However, for the full year, management reaffirmed adjusted EPS guidance of at least $28.25 which reflects a 12% increase over 2022.

The company also projects annual membership growth of 850,000, a 19% increase that significantly outpaces the industry.

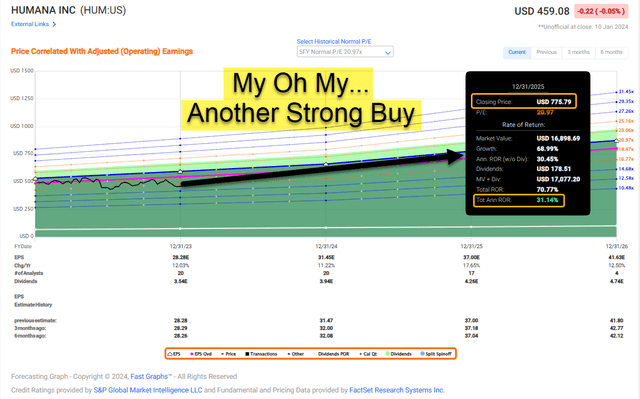

Management targets 2025 adjusted EPS of $37.

Where Humana Shines

From 2017 through 2021, Humana’s Medicare Advantage memberships increased at a CAGR of 11.4% versus 9.1% for competitors.

A study by Forrester ranked HUM #1 among health insurance providers in Customer Satisfaction with Dental Plans, #1 in Communication, #1 in Plan Cost, and #1 in Customer Service Experience.

JD Power ranked Humana as #2 among Mail-Order Pharmacies in the US in 2022, and once again, the company has been named the best overall Medicare Advantage insurance company by U.S. News and World Report.

Clinical excellence is not just lip service—Humana walks the talk. It has consistently ranked high in star ratings, reaping the rewards with a substantial bonus. A true testament to its quality.

With medical visits and hospital stays trending down, Humana’s value-based care programs have not only reduced costs but also improved patient outcomes, making them stand out in the healthcare sector.

Moreover, Humana’s scale and local networking advantages have enabled the company to offer competitive pricing and superior services to its members, gaining an edge over its rivals.

Add to that the fact that once a client joins Humana’s Medicare Advantage, they typically stick around for quite some time, creating a sizable and loyal customer base.

Humana’s stronghold in pharmacy benefit management, along with its growing presence in the provider space, is also bolstering its cost management efforts.

An In-depth Look at Humana’s Financial Outlook

A Positive Sector Perspective

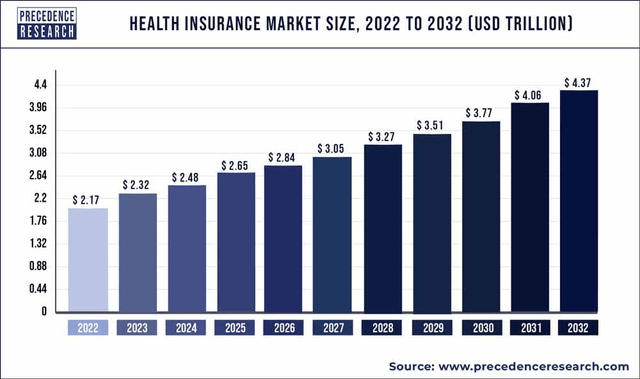

Precedence Research forecasts an impressive 7.3% CAGR for the global health insurance market from 2023 to 2032. With 64.3 million Medicare-eligible individuals in the US today, it is worth noting that one in five US residents will reach retirement age by 2030.

Humana predicts the Medicare Advantage sector to experience high single-digit growth through 2025, including membership growth at or above the industry average. These trends signify sustained demand for Humana’s products in the foreseeable future. As the aging population continues to expand, there will be a notable surge in the demand for home health care. Humana estimates a robust 6% CAGR for the home health care sector.

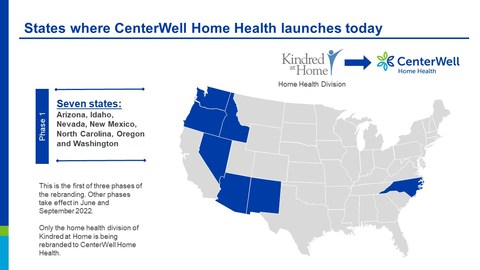

The home health care market, characterized by significant fragmentation, is growing rapidly. Notably, Humana’s subsidiary, CenterWell Home Health, holds a remarkable 6% market share, operating 296 centers and serving nearly 285,000 patients, representing impressive year-over-year growth rates of 33% and 17%, respectively.

Financial Position and Market Evaluation

Humana’s debt is rated investment grade by various rating agencies, including BBB+ by S&P, Baa2 by Moody’s, and BBB by Fitch. The company offers a .77% yield, with a low payout ratio of 12.42% and a 5-year dividend growth rate of 12.1%. Trading at $456.61 per share, Humana’s forward P/E of 17.36x is notably below its 5-year average P/E of 19.08x. Furthermore, the company’s 5-year PEG ratio of 0.99x is considerably lower than its average PEG ratio over the same period of 1.34x.

In 2022, Humana repurchased $2 billion in shares and has already repurchased approximately $1 billion in shares as of the end of Q3 of the current fiscal year, with an anticipated share repurchase of approximately $1.5 billion in 2023. The company’s current market capitalization stands at roughly $56.5 billion.

Evaluating the Investment Potential

Humana’s strategic focus on Medicare Advantage plans places it at the forefront of one of the fastest-growing segments in the US medical insurance landscape. The company is set to benefit from compelling demographic trends in the US, offering a strong foundation for future growth. Management projects earnings growth within a robust long-term target range of 11%-15% for 2024 and anticipates adjusted EPS of $37 in 2025, representing a notable 14% CAGR from 2022 to 2025.

Given its strong balance sheet, share repurchase plan, growing dividend, promising growth prospects, and appealing valuation, Humana emerges as a Strong Buy. It is important to note that this rating is based on holding the stock for an extended period, and even as a dividend-focused investor, the decision to increase positions in Humana remains challenging. Nonetheless, the stock’s investment appeal is undeniably attractive, especially for those with a long-term investment horizon.

It is interesting to note that the initial expectation of the evaluation did not qualify Humana as a Strong Buy, underscoring the changing dynamics within the company and the sector as a whole.

Note: Brad Thomas is a Wall Street writer, which means he’s not always right with his predictions or recommendations. Since that also applies to his grammar, please excuse any typos you may find. Also, this article is free: Written and distributed only to assist in research while providing a forum for second-level thinking.