Hyatt Hotels divulged on February 15, 2024, that its board of directors authorized a unchanging quarterly dividend of $0.15 per share ($0.60 annually). Previously, the company disbursed $0.15 per share. Share acquisition should transpire before the ex-dividend date of February 27, 2024, to warrant eligibility for the dividend. Shareholders of record as of February 28, 2024, will receive the payment on March 12, 2024.

At the ongoing share price of $132.83 per share, the stock’s dividend yield stands at 0.45%. Going back five years and sampling weekly, the average dividend yield recorded was 0.94%, with the lowest at 0.45% and the highest at 1.72%. The stand deviation of yields is 0.36 (n=104). The current dividend yield hovers 1.35 standard deviations below the historical average. Furthermore, the company’s dividend payout ratio is 0.13 which signifies the percentage of the company’s income paid out in dividends. A payout ratio beyond unity indicates the company delving into reserves to sustain dividends – a precarious scenario. Companies with meager growth prospects are expected to allot a majority of their earnings in dividends, usually resulting in a payout ratio ranging from 0.5 to 1.0.

What is the Fund Sentiment?

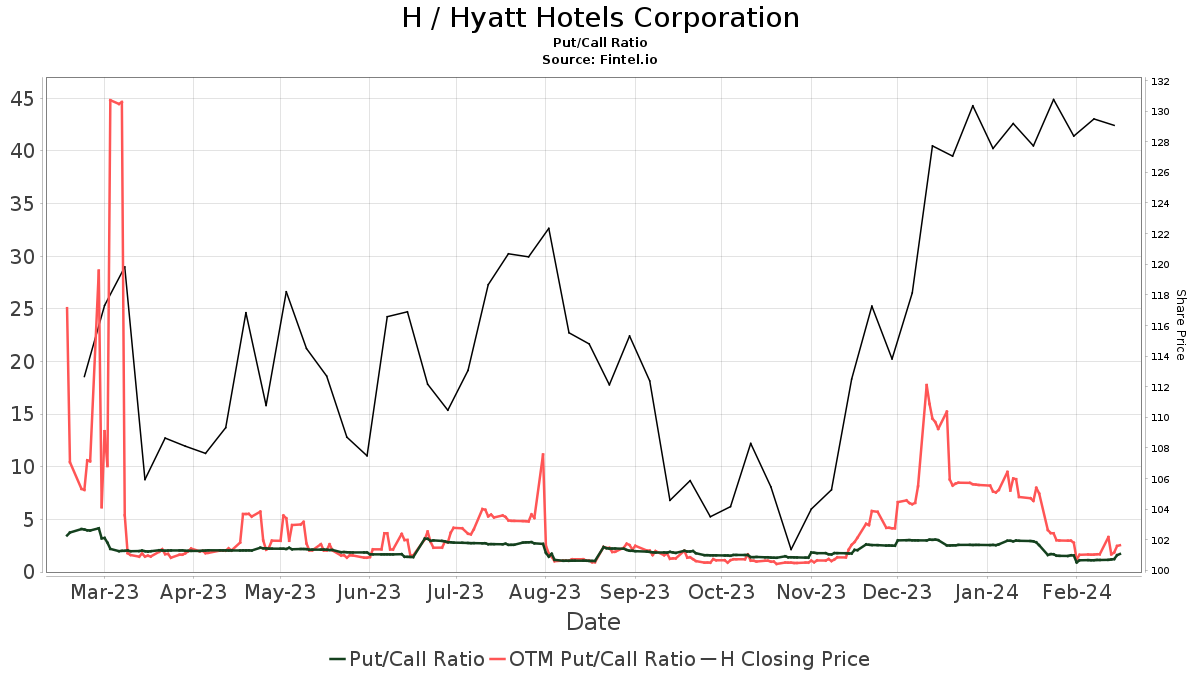

Reports indicate that 743 funds or institutions documented positions in Hyatt Hotels, denoting an upsurge of 46 owners or 6.60% in the last quarter. The average portfolio weight dedicated to H is 0.21%, reflecting an 8.20% decrease. The total shares owned by institutions have increased in the past three months by 3.66%, totaling 63,664K shares. The put/call ratio of H is 1.71, indicating a bearish outlook.

The put/call ratio of H is 1.71, indicating a bearish outlook.

Analyst Price Forecast Suggests 0.57% Upside

As of January 18, 2024, the average one-year price target for Hyatt Hotels rests at 133.59. The forecasts range from a low of 112.11 to a high of $159.60. This signifies an average price target boost of 0.57% from its latest reported closing price of 132.83. The projected annual revenue for Hyatt Hotels stands at 6,715MM, representing a significant escalation of 86.89%. The projected annual non-GAAP EPS is 3.39.

What are Other Shareholders Doing?

Bamco currently holds 5,405K shares, signifying 5.24% ownership of the company. In its prior filing, the firm reported owning 5,327K shares, reflecting an increase of 1.44%. The firm augmented its portfolio allocation in H by 14.33% over the last quarter. BPTRX – Baron Partners Fund upholds 3,325K shares, representing 3.22% ownership of the company, with no alteration in the last quarter.

Massachusetts Financial Services retains 3,046K shares, indicating 2.95% ownership of the company. In its earlier filing, the firm reported owning 3,046K shares, showing an increase of 0.01%. However, the firm decreased its portfolio allocation in H by 82.53% over the last quarter. Wellington Management Group Llp clinches 2,547K shares, accounting for 2.47% ownership of the company. Contrarily, they revealed the possession of 2,918K shares in their prior filing, signifying a decrease of 14.55%. The firm has downsized its portfolio allocation in H by 85.62% over the last quarter. Principal Financial Group secures 2,405K shares, manifesting 2.33% ownership of the company. In the previous filing, the firm reported owning 2,256K shares, demonstrating an increase of 6.19%. Nevertheless, the firm downsized its portfolio allocation in H by 35.84% over the last quarter.

Hyatt Hotels Background Information

(This description is provided by the company.)

Headquartered in Chicago, Hyatt Hotels Corporation is a leading global hospitality proposition, offering 20 premier brands. As of September 30, 2020, the company’s portfolio encompassed more than 950 hotel, all-inclusive, and wellness resort properties in 67 countries across six continents. The company’s firm intent to care for individuals so they can achieve their utmost potential informs its business decisions and growth strategy, designed to allure and retain top talent, build rapport with guests, and generate value for shareholders. The company’s subsidiaries are involved in developing, owning, leasing, operating, managing, franchising, licensing, or offering services to hotels, resorts, branded residences, and vacation ownership properties, including under esteemed brand names such as Park Hyatt®,Miraval®,Grand Hyatt®,Alila®,Andaz®,The Unbound Collection by Hyatt®,Destination®,Hyatt Regency®,Hyatt®,Hyatt Ziva™,Hyatt Zilara™,Thompson Hotels®,Hyatt Centric®,Caption by Hyatt,Joie de Vivre®,Hyatt House®,Hyatt Place®,tommie™,UrCove, and Hyatt Residence Club®. The company also operates the World of Hyatt® loyalty program, furnishing exclusive benefits and experiences to its esteemed members.

Additional reading:

Fintel is one of the most comprehensive investing research platforms available to individual investors, traders, financial advisors, and small hedge funds.

Our data covers the world, including fundamentals, analyst reports, ownership data and fund sentiment, options sentiment, insider trading, options flow, unusual options trades, and much more. Additionally, our exclusive stock picks are powered by advanced, backtested quantitative models for improved profits.

Click to Learn More

This story originally appeared on Fintel.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.