Co-authored with “Hidden Opportunities”

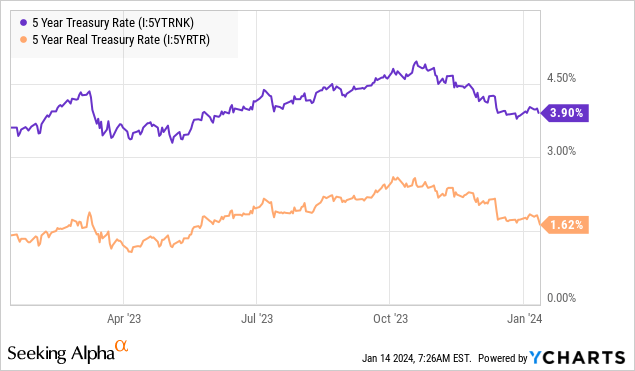

As interest rates stay north of 5%, money market funds continue to see record inflows from retail investors. Investment Company Institute data shows total money market assets at $5.87 trillion. There are early signs of institutional capital moving out while retail investors continued piling on into these guaranteed instruments.

There is no doubt that money market funds and CDs offer low-risk and steady interest income, and retail investors are rushing into these to lock in the yields before the Fed begins rate cuts. CDs are beating inflation for the first time in recent memory and producing positive adjusted returns; what could go wrong?

Saving for near-term needs, emergencies, and unexpected expenses is one thing, but CDs aren’t real investments. Despite higher yields, CDs barely beat inflation in the practical sense of rising costs around us. Moreover, these instruments come with significant renewal risk. Locking in high CD yields now will limit your exit options, and almost guarantee a reduction in your income stream upon maturity.

As retail investors are rushing to lock what they can in CD rates, we are looking elsewhere for near-low-risk qualified dividend income with significant capital upside. In that spirit, let us review our top picks.

Exploring JPM Preferreds – Offering Up To 5.5% Yields

JPMorgan Chase & Co. (JPM) is the largest bank in the U.S. with over $2.2 trillion in assets under management. JPM is known for its prudent risk management, and continues to grow in an environment that is seen as tough for smaller players in the industry. Under the leadership of Jamie Dimon, the bank has demonstrated readiness for the next catastrophe, being in a position of strength to benefit if one were to strike. JPM successfully acquired First Republic’s deposits and most of its assets at 87 cents on the dollar for around $10 billion and boosted its wealth division’s AUM by 10%.

Despite rate uncertainties, JPM made a 5% dividend raise in September, a sign of continued dividend stewardship. The bank’s current dividend comes at a modest 22% payout ratio, indicating that the bank is well-positioned to maintain and grow the payments in the coming years.

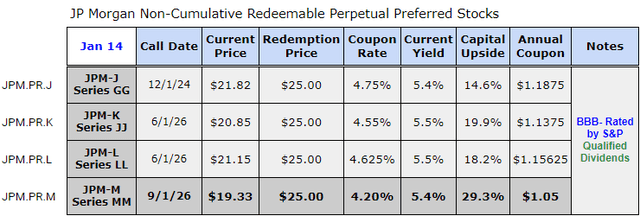

Among the different preferred securities for JPM, we note the following to be the best income opportunities with significant upside when rates come down.

JPM-M offers a 5.4% qualified yield and 29% capital upside to par value, and its Yield-To-Call calculates to an impressive 14.7%. During the 9 months of FY 2023, the bank spent $10 billion in dividends paid (including ~$9 billion on common stock dividends and $1.2 billion on preferred dividends), which is adequately covered by the $40.2 billion net income for

the period. The preferred enjoys 33.5x coverage for its dividends from the company’s operations. In addition, JPM repurchased $7.6 billion of its shares YTD 2023, under the authorized $30 billion repurchase program indicating its strong liquidity and profitability position.

Assessing BAC Preferreds with Yields Up To 5.7%

Bank of America (BAC) is the second largest U.S. bank by AUM. With operations in more than 35 countries, BAC is one of the largest and most globally diversified financial institutions in the world.

Despite rising interest rates, BAC stock has been the worst performer among its big bank peers in 2023 since the lender piled into low-yielding, long-dated securities during the pandemic. Those securities lost value as interest rates climbed at record pace, leaving the bank with $131.6 billion in unrealized losses and weighing down its ability to benefit from higher rates.

BAC maintains the best level of insured deposits in the banking sector, and the bank came ahead of its guidance Net Interest Income for Q3, delivered 10% higher YoY net income, and reported lesser than expected provision for credit losses and maintains net charge-offs below the pre-pandemic period.

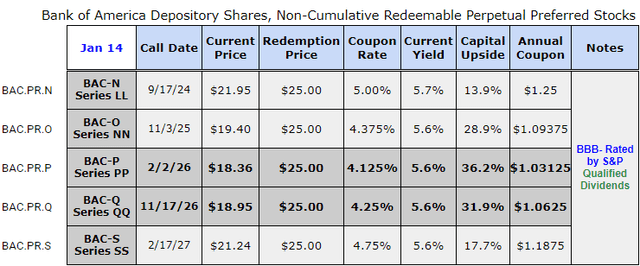

Despite turmoil in the banking sector, BAC made a 9% YoY dividend increase. This common stock dividend comes at a modest 29% payout ratio.

During the 9 months of FY 2023, BAC spent $1.3 billion on preferred and $6.8 billion on common stock dividends. These shareholder commitments enjoyed excellent coverage from the bank’s $23.3 billion net income. In addition, BAC repurchased $3.7 billion of its common stock YTD 2023 indicating overall comfort with its liquidity position.

Among BAC preferreds, we specifically see BAC-P and BAC-Q offering steady dividends to wait for significant upside. BAC-Q comes with an impressive YTC of 15%, yielding 5.6% and presenting ~32% upside to par.

Unearthing WFC Preferreds with Up To 5.9% Yields

Wells Fargo & Company (WFC) is the third largest bank in the U.S. with $1.8 trillion in AUM.

For over 150 years, WFC has played a pivotal role in the nation’s banking landscape, offering a wide range of financial services to millions of customers. Despite the historical significance, the bank has faced notable controversies in recent years, impacting its reputation and leading to significant fines and penalties and notable changes in leadership and corporate strategy.

WFC has the biggest dependence on consumer banking and lending vs. peers and stands to be a significant beneficiary of higher interest rates. In Q3 2023, WFC reported a 6.5% YoY increase in revenues and an 8%

The Soaring Future of WFC: A Closer Look Beyond The Numbers

In a world where shifts in the financial landscape have become as unpredictable as the weather, Wells Fargo & Company (WFC) has managed to harness the winds of change, reporting a substantial increase in net income to $5.7 billion. This impressive feat was supported by higher interest rates, effectively offsetting a slower lending environment.

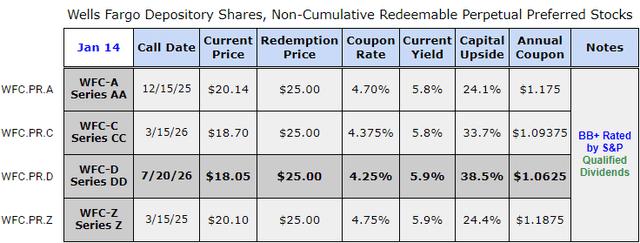

July brought the exciting announcement of a 16.7% raise in their common stock dividend by WFC. This payment comes at a 22% payout ratio, a clear indication of the company’s dedication to rewarding its investors.

With an impressive 17% year to call (YTC), the WFC-D offers a compelling 5.9% yield and an enticing 38% upside to par. During the first nine months of 2023, the bank demonstrated its confidence by repurchasing 220 million shares of common stock at a cost of $9.6 billion from its $30 billion share repurchase program. Moreover, the bank paid $874 million in preferred stock dividends and $3.5 billion in common stock dividends. Both shareholder commitments were adequately covered by the bank’s $15.7 billion net income, reflecting an 18x coverage for the preferreds.

Looking Beyond the Numbers

It’s easy to get caught up in the tempting proposition of locking in a high interest rate with a 5-year CD. However, it’s crucial to consider the real returns, which include the inflation-adjusted total return and the sacrifice of liquidity until maturity. While CDs may provide a secure harbor for savings, they often fall short when it comes to generating substantial income and offering a clear path to achieving financial independence or building wealth.

“A savings account is not an investment. It’s a cushion for those times when life deals you an unfair blow. You’re never going to get rich off them” – Dave Ramsey

Building a portfolio that delivers a lifestyle-sustaining income stream through dividends is crucial. A portfolio including over 45 carefully selected fixed-income options, featuring preferred stocks and baby bonds, all aimed at achieving an inflation-beating +9% overall yield, serves as a much more promising route.

As buyers of quality income-producing assets, it’s paramount to view volatility as a strategic ally in turbocharging income generation. Currently, high-quality fixed-income securities like investment-grade baby bonds and preferred stocks are trading at rock-bottom prices, offering historic high yields. This presents an opportunity that should be seized before any potential moves by the Fed. Delving into three investment-grade preferreds from leading global financial institutions, boasting robust dividend coverage and a potential double-digit capital upside to par value is a strategic move worth considering. What strategic moves are you making in anticipation of the Fed’s potential rate cuts?