Co-authored by Treading Softly.

From the frosty rain of the north to the sultry showers of the south, the texture of life changes from place to place. This also holds true in the world of market investments, where the same event can yield distinct results depending on the company in question.

When it comes to investing for income, the market offers a unique alternative to the grind of the workforce. Rather than trading time for money, investors can stake their capital in quality companies and reap dividends or interest, bringing a downpour of financial gain without the need for additional toil.

Today, let’s cast a probing eye on two prime picks capable of showering investors with dividends.

Pick #1: GHI – Yield 8.8%

Greystone Housing Impact Investors (GHI) is a partnership that parades a dual strategy.

Its original core business revolves around owning “mortgage revenue bonds” or MRBs. These bonds, fostered by state housing agencies, aim to spur the growth of affordable housing. Notably, the interest from these bonds is federally tax-exempt, a boon that GHI extends to shareholders through its partnership structure.

Additionally, GHI has expanded its scope over the past 5 years by venturing into a Joint Venture (JV) that furnishes capital for the construction of new multi-family housing. The JV spearheads the construction, secures leases, and subsequently offloads the properties to other investors at a profit. This entails beefy yet sporadic returns for GHI.

In a rising interest rate environment, the MRB strategy grapples with slight hits to earnings, while a decline in interest rates would spell a welcome boost.

While MRB investments pose the risk of defaults, these occurrences are infrequent. In the event of a default, GHI can repossess the property, or more commonly, the borrower conveys the deed to GHI instead. For instance, GHI found itself in possession of Suites on Paseo, a 384-bed student housing property in San Diego, California, when the non-profit organization defaulted on a $35 million MRB.

During the global financial crisis, GHI witnessed a surge in defaults but managed to mitigate losses, only paring its distribution by 8%. Thus, despite operating in a real estate sector that was ravaged by the recession, GHI outshone the S&P 500.

The MRB strategy proved to be resilient even in the most challenging times.

Presently, GHI boasts a more diversified revenue stream, courtesy of the Vantage JV that has lately delivered hefty returns. Investors have savored several “special” and “supplemental” distributions. Although GHI had to trim its distribution during the COVID era, it is presently doling out $0.37/quarter, exceeding the 2019 payout. Furthermore, a $0.07 supplemental distribution, payable in units, is on the cards for January. The Q3 earnings report hinted at another $0.07 supplemental distribution earmarked for Q1 2024.

The bulk of these distributions emanate from their JV strategy, illustrated by the sales of properties in JVs during the initial 9 months of 2023.

It’s worth noting that the gains on the sale of $22.7 million vastly surpass the $47 million in proceeds. Nonetheless, this isn’t a swift process; the three properties sold in 2023 were originally embarked upon in 2018-2019.

While COVID threw a spanner in the works for these properties, an investment cycle of 3-5 years from the onset of construction to property sale seems to be the norm.

Per their 10-Q filing, GHI furnishes insights into its current construction pipeline:

Exploring Lucrative Real Estate Investment Picks: GHI and RQI

In the world of investment, GHI has been showing consistency by averaging the sale of three properties per year with its strategic approach. As of Q3 2023, three properties have completed construction, and these are anticipated to be on the market for sale in the upcoming year, with an additional eight projects at various stages of development.

The potential size of future supplemental distributions hinges on the number of properties sold and their corresponding gains, a factor that will significantly impact GHI’s financial outlook.

The allure of a $0.37/unit distribution from GHI is compounded by the prospect of heightened security as interest rates decline, potentially leading to amplified returns from GHI’s MRB strategy. Although supplemental distributions may exhibit variability, GHI’s business model supports the expectation of their frequent occurrence, akin to the proverbial cherry on top, with the tantalizing prospect of another cherry in Q1 2024.

A Closer Look at RQI

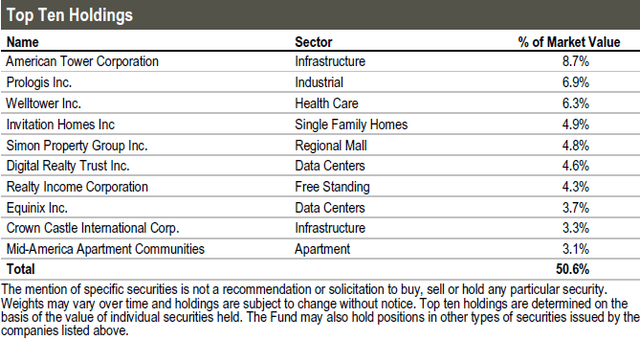

RQI – Yield 8.1%: Cohen & Steers Quality Income Realty Fund (RQI) is a Closed-End Fund (CEF) that directs investments towards U.S. REITs. RQI’s approach is straightforward and focuses on acquiring REITs deemed as the crème de la crème within their respective sectors. Its top 10 holdings bear substantial weight, accounting for over 50% of the portfolio allocation.

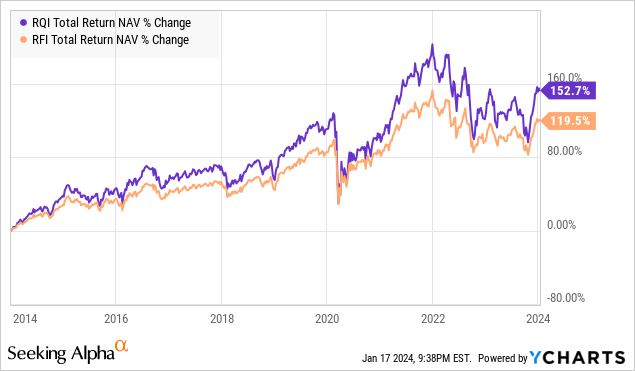

Additionally, RQI offers the advantage of cheaper leverage, with leverage standing at approximately 30% of assets. The fund’s strategic use of swaps enables it to maintain a weighted average interest rate as low as 2.6%, representing a more economical approach than conventional brokerage account leveraging. This leveraged approach, while inherently double-edged, has historically outperformed non-leveraged alternatives such as the similar RFIT fund.

Moreover, RQI is currently trading at a 6% discount to NAV, presenting an immediate opportunity for potential gains as REIT prices are expected to surge with anticipated market enthusiasm and a projected rise in interest rates. The fund’s higher dividends are another attractive feature, imparting the ability to follow an investment strategy for income while gaining exposure to high-quality REITs.

Conclusion: The Beauty of Income Investing

By considering GHI and RQI, investors can tap into the real estate market’s potential. GHI plays a central role in the critical affordable housing landscape through its investments in mortgage revenue bonds and the development of multi-family homes. On the other hand, RQI provides broad exposure to REITs positioned to benefit from potential declines in interest rates and holds real estate assets across the United States.

History has shown that long-term wealth is often derived from two primary sources: land ownership and stock market investments. Both have been proven to generate lasting wealth, and by investing in GHI and RQI, individuals can simultaneously access income streams and retain exposure to these wealth-generating mechanisms.

The allure of this investment strategy lies in the multifaceted wealth-building potential it offers. As we navigate the intricacies of the financial landscape, embracing the ethos of income investing not only provides a robust foundation for retirement income but also aligns with the enduring principles that have shaped generational prosperity.