As mentioned in the article from last Sunday, the anticipation for more selling in the recent week was evident. The selling on Friday signaled a continuation of the trend, attributed to tax-motivated profit-taking. Thus, while we braced for the selling, the intensity of the sell-off caught us off guard and has altered the outlook for this quarter.

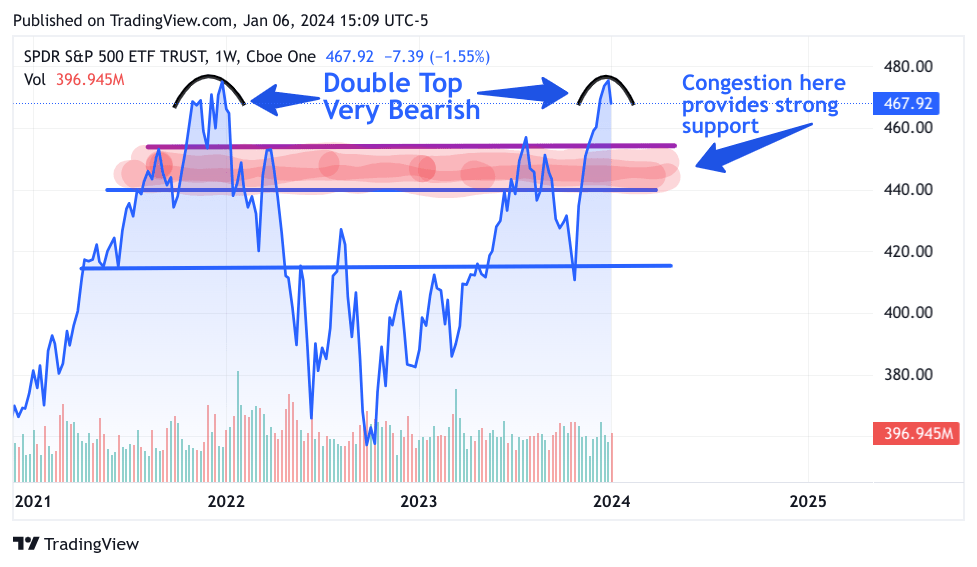

The unexpected fierceness of the sell-off has led to a shift in my stance. Contrary to my sentiment in the previous weeks, I am now more bullish. The market’s failure to break out to an all-time high, where it only reached, but did not surpass the 2021 high, has contributed to a bearish formation in the chart – a development likely to pose challenges for quick recovery. Foreseeing new highs in 2024, I anticipate this to occur in the latter half of the year. The commencement of the year with a sell-off was something our community keenly recognized and capitalized on. However, the extreme intensity of the sell-off and the notable shift in investor sentiment took me by surprise. Nonetheless, this change bears a hidden benefit for trading moving forward, as buyers seem to have been profoundly affected by the seemingly overwhelming selling spree. The euphoric buying that we observed has dissipated. While further selling may be on the horizon later in Q1, the scale of the retreat is expected to be less daunting, potentially leveling at a figure below 10%. Refer to the 3-year S&P 500 chart ETF (SPY), symbolizing the SPX.

Foreseeing a period of sideways trading at the current level, the positive earnings projected for Q4 are expected to be overshadowed by many CFOs adopting a cautious approach, thereby revising projections for Q1. The market’s susceptibility to such revisions is undetermined, but it appears that this time, there may be some justification. Projected economic growth is likely to plateau at approximately 2% GDP this year; thus, the critical question remains – can the consumer sustain their expenditure levels? Despite a robust employment number in December, the Bureau of Labor Statistics downwardly revised the previous 2 quarters, raising skepticism about consumer confidence. I anticipate further downward adjustments for the recent quarter by the BLS. However, despite these considerations, the positive earnings are likely to inject a renewed vitality into the market. I firmly believe in the resilience of the consumer and even if Powell exercises caution with rate cuts, the economy is poised to fare well. Consequently, stocks are expected to hold their ground, albeit encountering a somewhat challenging phase later in this quarter.

We still have cause for optimism

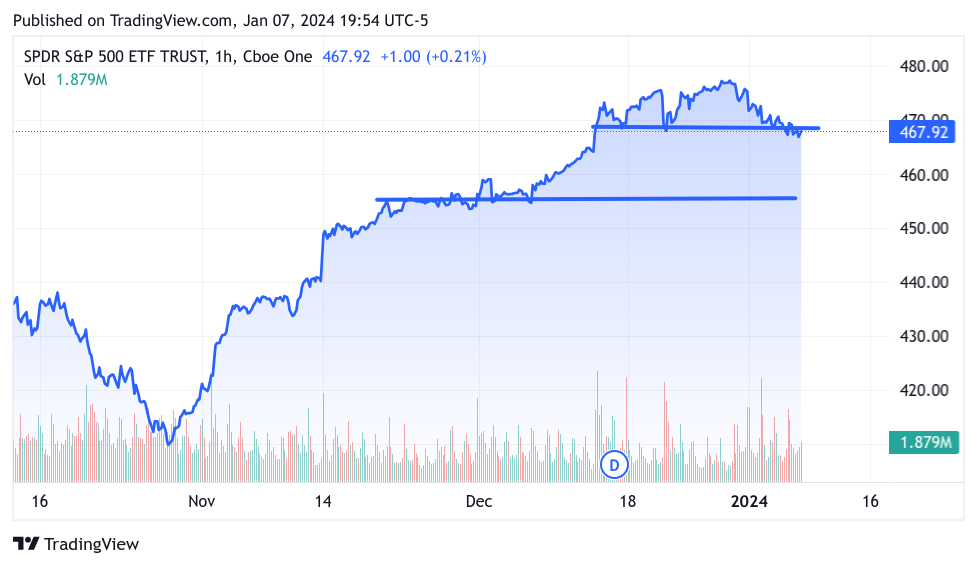

Despite the prevailing circumstances, there are several positive factors that merit our attention. With the Fed refraining from increasing rates, the discussion has now shifted to the timing and extent of the impending rate cuts. Personally, I lean towards an extended period of heightened rates. In fact, I believe this expectation prompted the considerable market upheaval. It appears that market participants are awakening to the notion that a rate cut by the Fed in March is unlikely. As the economy continues its upward trajectory and inflation growth moderates, the market is poised for an upward ascent once the realization dawns that the “dessert” will have to be postponed until later in the year. Additionally, with earnings season commencing imminently, starting with the reports from numerous major banks, I foresee a commendable performance on their part, effectively stemming the prevailing selling trend – at least momentarily. We will now zoom in on the S&P 500 via the ETF (SPY), this time focusing on the one month…

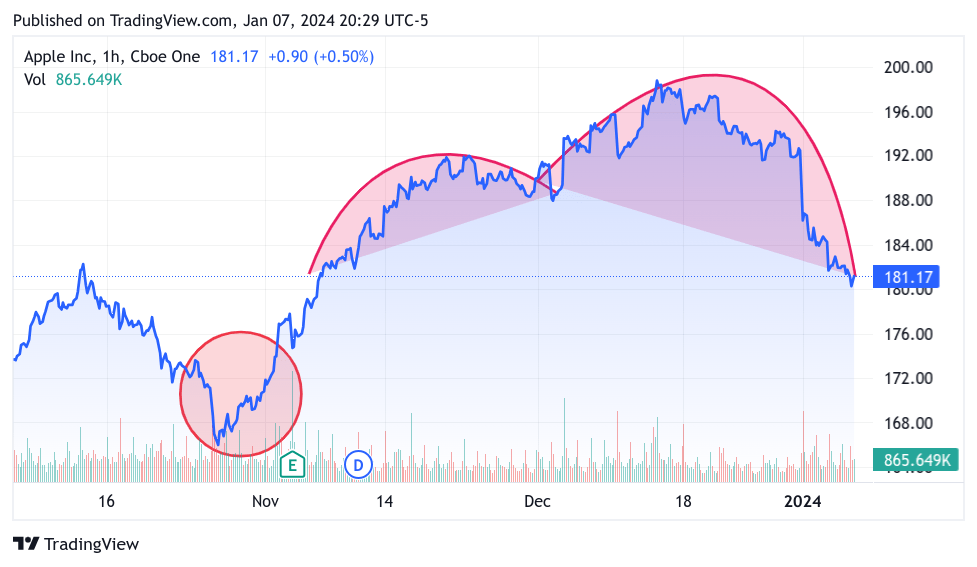

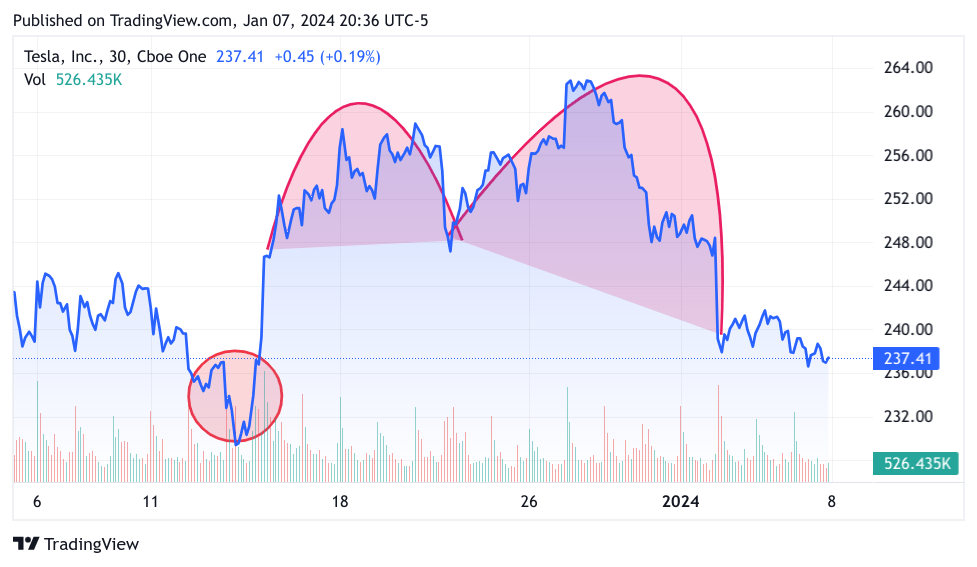

I don’t intend to dampen spirits, but it appears that a downward shift to approximately 4550 on the SPX is imminent, marking a subtle downturn of around 5% from the high of 2023. I forecast a period of consolidation at the current level, with the broader market potentially lending support to the indexes. Notably, the impending CES event represents a catalyst for the tech industry this week. The event will place a significant emphasis on AI, in addition to the accompanying hardware and software components. I envisage Advanced Micro Devices (AMD), Intel (INTC), and Micron (MU) reaping the rewards from the AI-PC frenzy. Furthermore, with a myriad of electronic devices vying for AI integration, Nvidia (NVDA) is projected to garner significant attention at CES. I will expound further on this within the trades and investment section towards the end. It is crucial to underscore that this is not a winner-takes-all scenario. While tech stands to benefit, so do the financial and biotech sectors. Personally, I anticipate favorable outcomes for small-cap biotech, medtech, fintech, and regional banks, whereas certain stocks such as Apple (AAPL) and Tesla (TSLA) are unlikely to enjoy unfaltering support. In the past, I faced criticism for expressing my reluctance to invest in AAPL, primarily due to the absence of revenue growth and innovation. It is my firm belief that AAPL will undergo a decline, exemplified by the lackluster response to the $3500 Vision Pro and the ongoing patent dispute with Masimo regarding their blood oxygen detector. Considering that AAPL constitutes 7% of the S&P 500’s weight, a surge in the index’s other components will be necessary to counterbalance its stock depreciation. As for TSLA, although it holds a smaller market cap weight, it nonetheless stirs significant enthusiasm for stocks. However, I am confident that NVDA will compensate for any setbacks endured by these stocks.

Let’s take a brief look at the AAPL chart…

The occurrence of an inverted cup-and-handle formation is a rare sight in my experience. While a standard cup-and-handle pattern denotes an optimistic chart formation, the inverse holds a negative connotation. I anticipate a downward trajectory for the stock, highlighting the area on the left-hand side as the focal point of its movement. Let’s now examine TSLA

Notably akin to each other, TSLA is also headed downwards. On a positive note, Meta Platforms (META), Microsoft (MSFT), Amazon (AMZN), and Alphabet (GOOGL), alongside NVDA, are expected to fare well this week, especially in light of CES, as previously mentioned.

Let’s summarize since I’m trying to impart a complicated message tonight

Prior to the Friday sell-off, we had already anticipated the possibility of Q1 witnessing a degree of selling. Once the selling ensued on Friday, there was little left to do, given that we had already retained 30% to 40% in cash, alongside several downside trades and a long position in the VIX using Calls. At that point, I advocated for the implementation of hedges. However, the deluge of selling surpassed my expectations. I had initially assumed that the selling would begin to wane by Wednesday morning. In my typical instinct, I acted prematurely, swiftly closing my short side trades and transitioning to a long position. The age-old adage from Mike Tyson, asserting that everyone has a strategy until they are met with adversity, rings true. This experience serves as a learning curve for me, compelling me to adopt a more astute approach going forward.

Assessing the Recent Market Sell-off and Asset Strategy for 2024

Interpreting the Market sell-off

Last week’s market sell-off, albeit unnerving, signals a necessary correction that prevents a buying frenzy. The dip buyers are likely to re-enter the market, buoying megacap tech names and offering support at a level beneath the previous peak. However, the selling vigor suggests a retraction of optimism about the possibility of a rate cut in March. Despite this, favorable factors such as lower interest rates, increased car sales projections, and a rise in railcar traffic provide reasons for optimism amidst the current volatility. Reflecting on these factors, it becomes apparent that the recent market sell-off is an opportunity for investors and traders alike to recalibrate their positions and outlook.

Implications of the Sell-off

The recent sell-off has prompted a shift in the market sentiment regarding a potential rate cut in March. However, positive developments such as lower interest rates, increased car sales projections, and improved railcar traffic indicate underlying resilience amidst the current market turbulence.

Investment Insights

Amidst the market fluctuations, a strategic emphasis on long-term investments is prudent. The evolving landscape presents compelling opportunities across various sectors, such as the bond market. Stocks like Tradeweb (TW) and Moelis (MC) stand out as potential investment candidates due to their involvement in facilitating institutional trading and boutique merger and acquisition advisories. These developments underscore the importance of informed investment decisions amidst market volatility.

Exploring Investment Avenues

The current market environment presents opportunities for strategic investments, particularly in the bond market and boutique merger and acquisition advisory firms. Stocks like Tradeweb (TW) and Moelis (MC) are poised to capitalize on these opportunities, reflecting the potential for growth and resilience amidst market fluctuations.

Assessing Trading Strategies

Despite the prevailing uncertainties, strategic trading opportunities exist in consumer-centric growth stocks. By positioning call options in companies such as Affirm (AFRM), AMD, Dutch Bros (BROS), Celsius (CELH), DraftKings (DKNG), and Monster (MNST), investors can capitalize on the anticipated resurgence of consumer-oriented equities. Furthermore, the potential diversification of portfolios indicates a favorable outlook for these trading positions in the upcoming market dynamics.

Evaluating Market Resilience

Amidst the prevailing market volatility, sound trading strategies can leverage the anticipated resurgence in consumer-oriented equities. By strategically positioning call options in companies such as Affirm (AFRM), AMD, Dutch Bros (BROS), Celsius (CELH), DraftKings (DKNG), and Monster (MNST), investors can potentially capitalize on the expected market dynamics and portfolio diversification.