“`html

IAMGOLD Gains Ground with Extended Mine Plans and Increased Gold Holdings

IAMGOLD IAG announced significant updates yesterday regarding its Mineral Resource and Mineral Reserve (“MRMR”) estimates and a refreshed life of mine (“LOM”) plan for its Westwood Complex in Quebec, Canada. Notably, the mine’s lifespan has been extended from 2025 to 2032.

On Monday, IAMGOLD revealed it has exercised its right to repurchase a 9.7% interest in the Côté Gold Mine from Sumitomo Metal Mining Co., Ltd., increasing its stake to 70% in this high-potential mine.

Let’s explore the implications of these developments for IAMGOLD’s future prospects.

IAG Extends Westwood Mine Life While Adjusting Reserve Estimates

The Westwood Project encompasses two main areas: Doyon-Westwood and Fayolle. Doyon-Westwood features the Westwood underground mine and the Grand Duc open pit. The Westwood mine has been operational since 2014, while the Grand Duc started in October 2019. Open pit operations at the Fayolle deposit began in February 2023, concluding in June 2024, with Grand Duc’s life projected to end in 2025.

IAMGOLD has revised the mine’s lifespan from 2025 to 2032, estimating an overall average gold production of 925,000 ounces over this extended period, a projection that fell short of market expectations. However, the first three years are expected to yield an accelerated average production of 146,000 ounces.

Estimated operating costs for the Westwood mine over its lifespan (2025-2032) are projected at $239.91 per ton processed. The total sustaining capital expenditures are estimated to be around $260.7 million, with expected recovery rates of 95% from the processing plant, which has an annual capacity of 1 million tons.

According to the MRMR statement, Westwood’s underground mineral reserves stand at 2.6 million tons (Mt), with an average of 11.45 grams of gold per ton, amounting to 955,400 ounces. This represents a decline from the previous estimate of 3.36 MT at an average of 10.62 grams per ton, containing 1,149,000 ounces. While total tonnage and contained gold have decreased by 23% and 17% respectively, the grade has seen a slight improvement. The adjustment stems from a redesigned mining strategy focused on safety and efficiency following seismic events in 2020.

Côté Gold Mine Projected to Drive IAMGOLD’s Growth

Beginning commercial production on August 2, 2024, Côté Gold mine briefly halted operations in September for enhancements. Despite this, IAG confirmed it is on track to achieve its goal of 90% throughput by the year’s end.

Managed as a joint venture between IAMGOLD (the operator) and Sumitomo Metal Mining Co., the Côté Gold mine’s total projected gold production (at 100%) is estimated at 220,000-290,000 ounces, improving as operational efficiencies ramp up.

For the first six years, Côté Gold is expected to produce around 495,000 ounces of gold, averaging 365,000 ounces per year over the mine’s life, solidifying its position as Canada’s third-largest gold mine after Agnico Eagle Mine’s AEM Detour Lake and Malartic.

This mine plans to leverage advanced technology, incorporating 23 autonomous haul trucks and six autonomous drills, to enhance both efficiency and safety while reducing costs. Additionally, IAG is considering exploration of the nearby Gosselin pit to enhance returns from the Côté Gold project.

Positive Production Forecast for 2024

For 2024, Essakane’s attributable production is anticipated to reach between 380,000 and 410,000 ounces, while Westwood is projected to produce 115,000-130,000 ounces.

IAMGOLD previously indicated that production from the Côté Gold mine in 2024 would likely sit at the lower end of 130,000-175,000 ounces. With an increase in its stake to 70%, this contribution is expected to surpass earlier forecasts.

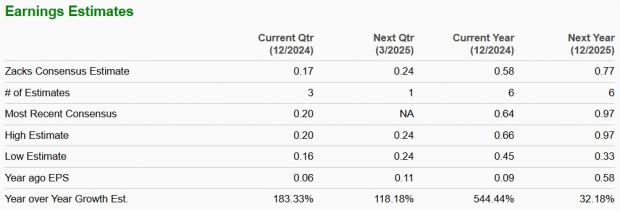

Upward Adjustments in Earnings Estimates Boost Confidence

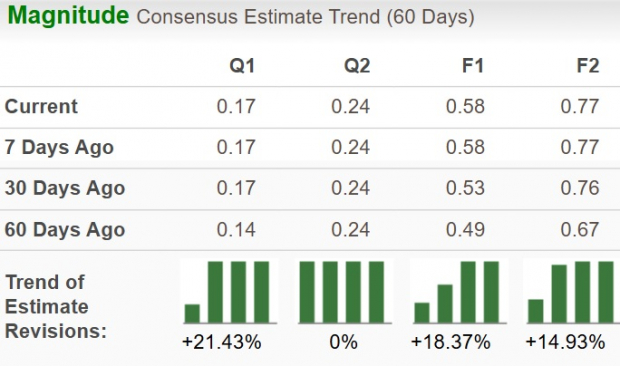

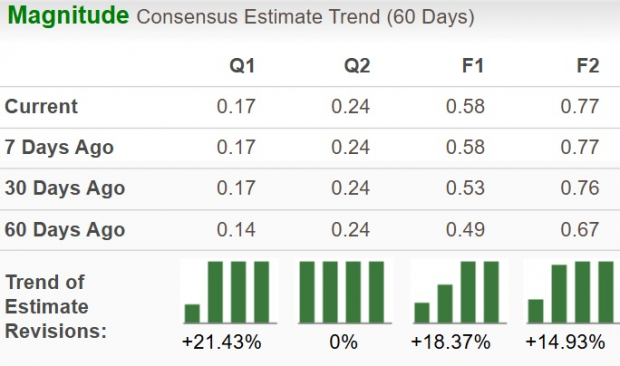

Over the past 60 days, the Zacks Consensus Estimate for IAMGOLD’s earnings in 2024 and 2025 has risen.

Image Source: Zacks Investment Research

For further updates on earnings estimates, visit Zacks Earnings Calendar.

The consensus forecast for 2024 and 2025 reflects anticipated year-over-year growth, showcasing analysts’ positive outlook towards IAMGOLD’s production capabilities and evolving gold prices.

IAMGOLD is committed to enhancing production levels, extending the life of its existing mines, and advancing new development and exploration initiatives.

Image Source: Zacks Investment Research

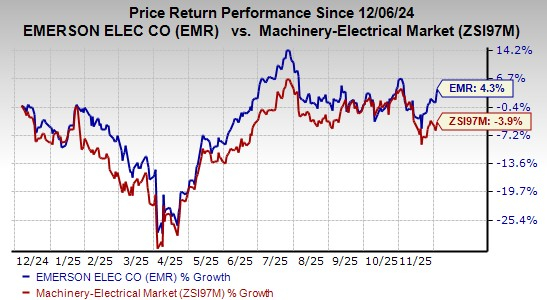

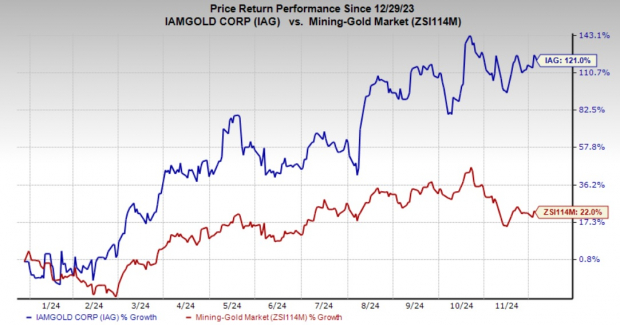

IAG Stock Price Shows Strong Year-to-Date Progress

Image Source: Zacks Investment Research

IAG shares have risen 121% year-to-date, significantly outperforming the gold mining industry, which has seen a growth of 22%.

The stock has benefitted from strong quarterly results throughout 2024, the launch of the Côté Gold mine, and a notable rise in gold prices, which have increased by 28% this year, proving to be one of the year’s standout assets.

Currently, IAG’s share price is approximately 12% below its 52-week high of $6.37, achieved on October 22, 2024.

Attractive Valuation for IAG Stock

IAMGOLD is trading at a forward 12-month price-to-sales ratio of 1.5X, which is lower than the industry’s 2.67X. Comparatively, it offers a more attractive price than Newmont NEM, Barrick Gold GOLD, and Agnico Eagle Mines, which have forward price/sales ratios of 2.54, 1.83, and 4.67, respectively.

Image Source: Zacks Investment Research

“““html

Image Source: Zacks Investment Research

IAMGOLD: Positioned for Future Growth Amid Gold Price Surge

Evaluating IAMGOLD’s Potential

IAMGOLD is on the brink of growth, largely due to rising gold prices, the ongoing development at Côté Gold, and a strong lineup of both early-stage and advanced exploration projects in promising mining regions. While the extension of the Westwood mine’s life looks encouraging, the mine’s production falling short of expectations was somewhat disappointing. However, with an appealing valuation and positive earnings forecasts, investors may find it worthwhile to hold onto this Zacks Rank #3 (Hold) stock.

Discover the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Top 7 Stocks to Watch Over the Next Month

Recently announced: Experts have identified 7 top-performing stocks from a current pool of 220 Zacks Rank #1 Strong Buys, labeling them as “Most Likely for Early Price Pops.”

This curated list has outperformed the market more than twice since 1988, averaging a remarkable gain of +24.1% each year. Don’t miss your chance to consider these selected stocks.

Newmont Corporation (NEM): Free Stock Analysis Report

Agnico Eagle Mines Limited (AEM): Free Stock Analysis Report

Sumitomo Corp. (SSUMY): Free Stock Analysis Report

Iamgold Corporation (IAG): Free Stock Analysis Report

Barrick Gold Corporation (GOLD): Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

“`