IBM Expands Partnership With Microsoft to Boost AI and Cloud Solutions

International Business Machines Corporation (IBM) has reinforced its multi-year partnership with Microsoft Corporation (MSFT) by launching a new Microsoft Practice within IBM Consulting. This collaboration aims to harness the strengths of both companies to create innovative offerings and solutions tailored to various industries, including retail, consumer packaged goods, government, financial services, and supply chain management.

With initiatives like IBM Copilot Runway and IBM Consulting Azure OpenAI Services, the partnership seeks to provide customized solutions that enable businesses to uncover growth opportunities, transition smoothly to the cloud, and expedite their digital transformation journeys. This integrated approach merges IBM’s expertise in industry and transformation with Microsoft’s technology suite, which includes Copilot, Azure OpenAI, Azure Cloud, Fabric, and Sentinel. The goal is to drive growth, minimize costs, and establish a sustainable competitive edge.

Furthermore, the Microsoft Practice will seamlessly incorporate Microsoft’s technology ecosystem into IBM Consulting’s AI-powered delivery platform known as IBM Consulting Advantage. This integration enables clients to implement optimal AI solutions tailored to their specific business requirements while ensuring enterprise governance and security.

IBM Capitalizes on Demand for Hybrid Cloud and AI

IBM stands to gain from robust demand for hybrid cloud and AI solutions, which are driving its Software and Consulting segments. The long-term growth of the company is expected to be supported by ventures in analytics, cloud computing, and security. A shift toward a more favorable business mix, improved operating leverage due to productivity gains, and increased investment in growth initiatives are likely to enhance profitability.

The company’s watsonx platform is anticipated to serve as the cornerstone for its AI capabilities. This platform offers foundational models to enterprises, boosting their productivity. watsonx includes three major components: the watsonx.ai studio for foundation models and generative AI, the watsonx.data data store built on an open lake house architecture, and the watsonx.governance toolkit designed to facilitate responsible and transparent AI workflows.

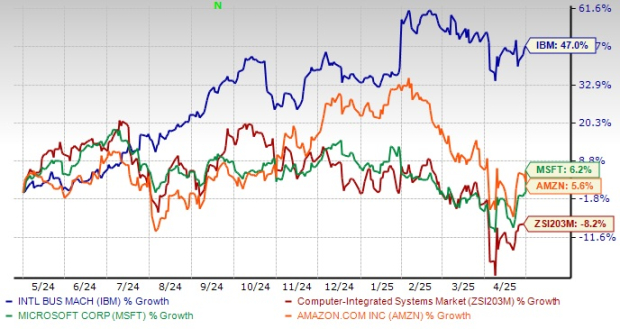

Price Performance Overview

Over the past year, IBM has realized a remarkable 47% increase in stock value, significantly outperforming the industry average decline of 8.2%. This performance eclipses tech giants like Microsoft and Amazon.com, Inc. (AMZN), which saw modest gains of 6.2% and 5.6%, respectively, during the same period.

One-Year IBM Stock Price Performance

Image Source: Zacks Investment Research

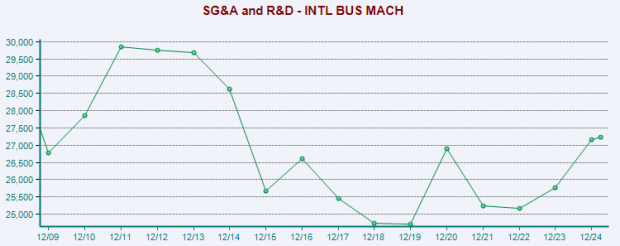

Challenges with Margin Pressures

Despite strong traction in hybrid cloud and AI, IBM faces intense competition from Amazon Web Services and Microsoft Azure. Increasing pricing pressures are squeezing margins, leading to a downward trend in profitability, aside from occasional spikes. The company is struggling with its lengthy transition to a cloud-focused business model. Additional challenges include weaknesses in its traditional sectors and foreign exchange volatility.

This year, IBM plans to cut approximately 9,000 jobs in the United States to streamline operating costs. A portion of these positions is expected to be relocated to India as part of a “resource action” plan aimed at leveraging the region’s talent pool at reduced costs. While the company has not provided specific details about the layoffs, reports indicate that the reductions are already in progress.

Job cuts have been confirmed in locations including Raleigh, NC, New York City, NY, Dallas, TX, and CA, affecting various teams including consulting, corporate social responsibility, cloud infrastructure, sales, and internal systems. The Cloud Classic division is expected to face the most significant impact, as IBM seeks to enhance roles in India for experts in cloud computing, infrastructure, sales, and consulting.

Image Source: Zacks Investment Research

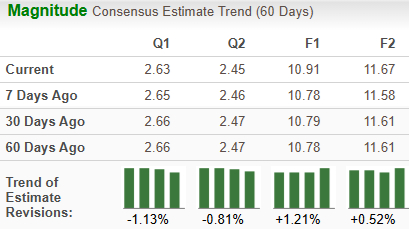

Positive Trend in Earnings Estimates

IBM is currently experiencing an upward trend in earnings estimate revisions. Estimates for 2025 have risen by 1.2% to $10.91 over the past 60 days, while 2026 estimates have increased by 0.5% to $11.67. These positive revisions signal optimistic outlooks for the Stock’s growth potential.

Image Source: Zacks Investment Research

Conclusion

IBM is poised to prosper from businesses increasingly favoring cloud-agnostic approaches for effective multi-cloud management while focusing on hybrid cloud and AI solutions. The rise in traditional cloud-native workloads coupled with generative AI and quantum computing advancements has radically increased the complexity of enterprise cloud strategies, driving significant demand.

Despite improving earnings estimates contributing to a favorable investor perception, IBM’s growth is hampered by high operating costs and intense competitive pressures that limit profitability. With a Zacks Rank #3 (Hold), the company seems to be navigating cautiously, suggesting that new investors should proceed with care.